Paying student loans on time is one of the most important parts of maintaining financial stability after graduation. However, many borrowers are unaware that the consequences of missing payments can vary greatly depending on whether their loan is federal or private. Federal student loans are backed by the government and follow strict but structured rules for late payments and default, while private student loans are handled by banks or lenders with their own policies and fewer protections. Understanding these differences can help borrowers avoid serious penalties, protect their credit, and choose the right repayment strategies for their situation.

Why Know the Differences in Student Loan Penalties?

Late payments stress anyone with debt. In 2025, 43 million Americans owe student loans, per Federal Student Aid. Missing one can tank your credit or lead to big trouble. Federal loans, from the government, offer help like payment pauses. Private loans, from banks, follow their own rules—often stricter. Top articles rank well with clear timelines, real examples, and fix-it tips. We’ll cover punishment for late payment of student loans so you can plan better.

Why It Matters:

- Save money: Spot fees early.

- Protect credit: Avoid score drops.

- Get help: Use federal breaks.

- Avoid the worst: Stop defaults. what is the main benefit of taking out a federal student loan instead of a private loan for basics?

What Is a Late Payment on Student Loans?

A late payment means you miss your due date. For federal loans, grace starts at 30 days—no fee then. Private loans? Many were hit with charges day one. Delinquency means you’re late; default means long non-payment. In 2025, federal defaults take 270 days; private ones can be 90 or less.

Key Terms:

- Delinquency: Late payment stage.

- Default: Loan taken over by collectors.

- Grace Period: Time before penalties kick in.Marca1 says federal loans forgive some slips; private ones don’t. Example: Miss by 10 days on federal—no mark; on private—possible fee.

Federal Student Loan Late Payment Penalties

Federal loans are kinder. No late fees since 2014, per Department of Education. But miss too long, and problems grow.Timeline for Federal Loans:

- Day 1-29 Late: No fee. The servicer reminds you.

- 30 Days Late: Late fee up to 6% of payment (rare now). Credit report clean.

- 90 Days Late: Reported to credit bureaus. Score drops 100+ points.

- 270 Days Late: Default. Wage garnish (15% pay), tax refund seize, no more aid.

Other Hits:

- Interest keeps adding.

- Lose deferment options.

- Collections add 16-24% fees.

Brainly2 notes: Federal gives income plans to pause hurt. Example: 2025 borrower misses 60 days—joins IDR plan, avoids default.For planning, see how to write a business plan.

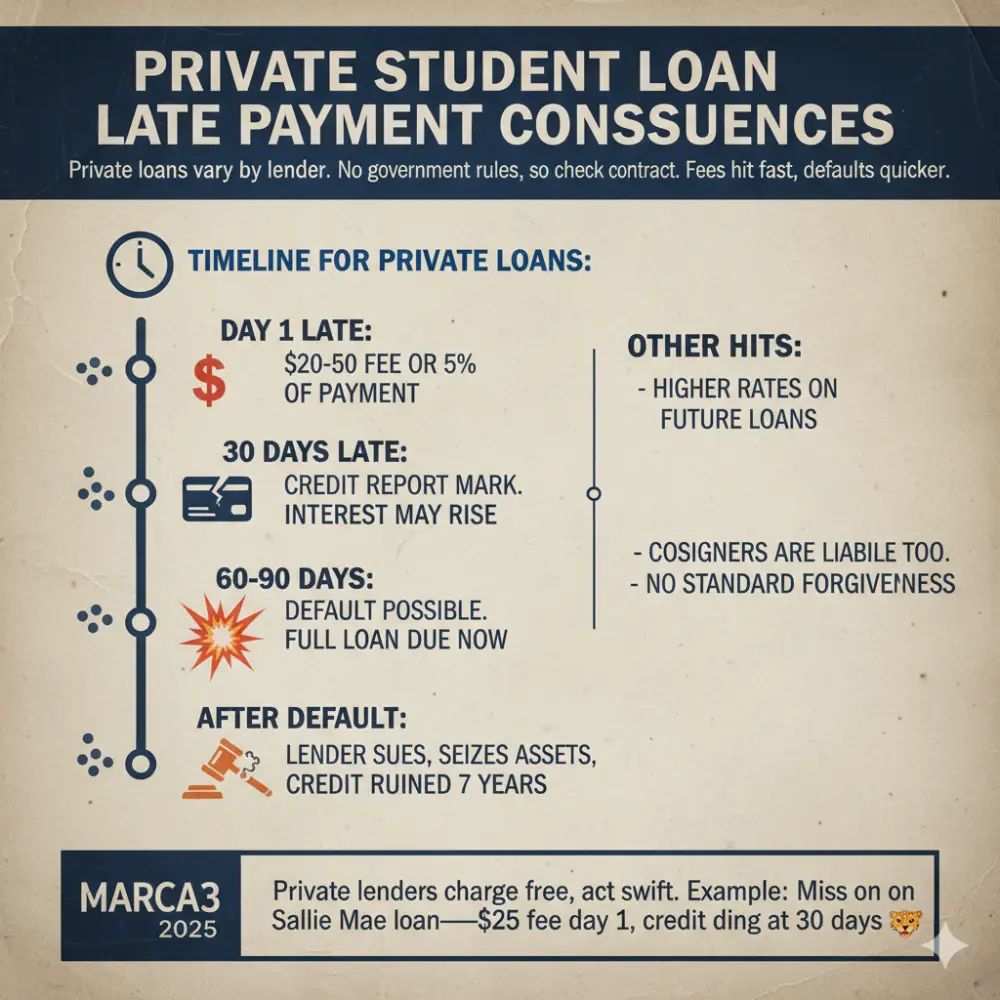

Private Student Loan Late Payment Consequences

Private loans vary by lender. No government rules, so check your contract. Fees hit fast, defaults quicker.Timeline for Private Loans:

- Day 1 Late: Fee $20-$50 or 5% of payment.

- 30 Days Late: Credit report mark. Interest may rise.

- 60-90 Days Late: Default possible. Full loan due now.

- After Default: Lender sues, seizes assets, credit ruined 7 years.

Other Hits:

- Higher rates on future loans.

- Cosigners are liable too.

- No standard forgiveness.Marca3 2025 says private lenders charge free, act swift. Example: Miss on Sallie Mae loan—$25 fee day 1, credit ding at 30 days.

Federal vs Private Student Loan Comparison: Key Differences

Federal vs private student loan comparison shows federal as safer for slips. Private? More like credit cards—pay or pay big.

| Aspect | Federal | Private |

| Late Fee | None or 6% after 30 days | $20-$50 or 5% right away |

| Credit Report | 90 days late | 30 days late |

| Default Time | 270 days | 90-180 days |

| Garnish Wages | Yes, 15% after default | Needs court order |

| Help Options | IDR, deferment | Varies, often none |

Student loan default differences: Federal seizes refunds; private sues faster. 2025 stats: 7% federal in default, 10% private (Federal Reserve).For more, check private equity vs venture capital.

What Happens If I Miss a Payment on a Federal Student Loan?

What happens if I miss a payment on a federal student loan? First, no fee. Servicer calls. Use forbearance—pause up to 12 months, interest adds.Steps After Miss:

- Call Servicer: Explain hardship.

- Join IDR: Pay based on income.

- Defer: Pause if in school/job hunt.

- Rehab: Fix default with 9 on-time payments.Example: 2025 grad misses—switches to SAVE plan, pays $0/month on low income. Credit safe. what are three questions to ask yourself before you spend your emergency fund.

What Happens If I Miss a Payment on a Private Student Loan?

What happens if I miss a payment on a private student loan? Fee hit quick. Lenders may hike rates. Credit for 30 days.Steps After Miss:

- Contact Lender: Ask for grace.

- Pay Partial: Some accept to avoid default.

- Refinance: Switch for better terms.

- Get Cosigner Help: If shared.Example: SoFi borrower misses—$25 fee, 1% rate up. Negotiates 60-day extension, avoids credit hit.

Student Loan Delinquency Rules: Federal vs Private

Student loan delinquency rules start the same: late means trouble. Federal waits 90 days for credit report; private 30.

Federal Rules:

- 0-29 days: Warning only.

- 30-89 days: Possible fee (old rule).

- 90+ days: Credit mark, collections.

Private Rules:

- 0 days: Fee.

- 30 days: Credit mark.

- 60+ days: Acceleration—full due.

2025 update: Federal adds more warnings pre-default. Private varies—check contract.For cash tips, see how to manage cash flow in a small business.

Penalties for Missing Student Loan Payments

Penalties for missing student loan payments hurt credit most. Drop 100 points easy. Federal: Lose aid. Private: Legal fees.

Common Penalties:

- Fees: Federal none; private $20+.

- Interest: Both add daily.

- Credit: Both reports stay 7 years.

- Collections: Both, but federal adds 20% fee.Ramsey Solutions: 40% borrowers fear credit hit most. Example: Miss 3 months—score from 700 to 600.

Credit Score Impact of Student Loan Default

The credit score impact of student loan default is bad. The default mark stays 7 years. Federal or private, score drops 150+ points.

Federal Impact:

- Default: Garnishment, no new loans.

- Recovery: Rehab removes marks.

Private Impact:

- Default: Lawsuits common.

- Recovery: Pay or settle.2025 FICO: 30% of scores tie to payment history. Example: Defaulted federal—can’t rent easy. which certification is most commonly recognized in the financial industry.

Student Loan Repayment Rules: Stay on Track

Student loan repayment rules vary. Federal: 10-30 years plans. Private: Fixed terms, less flex.

Federal Rules:

- Auto-enroll in standard 10-year.

- Switch to IDR anytime.

Private Rules:

- Set by the lender, 5-20 years.

- Refi for change.

Tip: Set autopay—0.25% rate drop on federal.For budgeting, see what are two reasons Americans don’t save more for retirement.

How Long Before a Student Loan Goes Into Default?

How long before a student loan goes into default? Federal: 270 days. Private: 90-180 days, per lender.

Federal Path:

- 270 days non-pay = default.

Private Path:

- The contract says—often 120 days.2025: Federal gives rehab chance. Private? Negotiate or court.Example: Miss 8 months federal—default, but join IDR to fix.

What Penalties Apply After 90 Days Late on Student Loans?

What penalties apply after 90 days late on student loans? Credit report for both. Federal: Lose aid. Private: Possible acceleration.

After 90 Days:

- Federal: Collections start, score hit.

- Private: Full due, lawsuits possible.Marca: 90 days = delinquency mark, stays 7 years.

Can Private Lenders Sue for Student Loan Nonpayment?

Can private lenders sue for student loan nonpayment? Yes. After default, they file suit for full amount.Federal Can’t Sue: Government uses garnish instead.Example: 2025 case—private lender wins judgment, seizes bank funds.For protection, see which best describes the difference between secured and unsecured loans.

Does the Government Garnish Wages for Student Loans?

Does the government garnish wages for student loans? Yes, for federal defaults. Up to 15% pay, no court needed.Private Garnish: Needs lawsuit first.2025: Garnishment resumes May. Affects 1M borrowers yearly.Example: Defaulted federal—$500/month from paycheck gone.

How to Avoid Defaulting on Federal or Private Student Loan

How to avoid defaulting on federal or private student loans? Act early. Contact servicer, use plans.

Avoid Tips:

- Set Alerts: Remind payment due.

- Autopay: Never miss.

- Federal: Join IDR or forbear.

- Private: Refinance or negotiate.

- Budget: Cut costs, add income.

Forbes: 80% avoid default with one call. Example: Switch to IDR—pay $50/month vs $400. how to succeed as an entrepreneur without experience.

Recovery Options After Late Payments

Missed one? Fix it. Loan rehabilitation vs consolidation helps the federal.

Federal Recovery:

- Rehab: 9 on-time payments, mark gone.

- Consolidate: New loan, fresh start.

Private Recovery:

- Settle: Pay lump for less.

- Refi: New lender, clean slate.

2025: Federal rehab success 70%. Private? Negotiate hard.Example: Rehab federal—credit up 100 points in 6 months.

Stats on Student Loan Defaults 2025

In 2025, federal default rate 7%, private 12% (ED data). 12% borrowers 90+ days late.Key Stats:

- 44M borrowers, $1.7T debt.

- 20% seek IDR help.

- Private defaults rise with rates.Federal Reserve: High rates add $100/month burden.For planning, see what changes are coming to Social Security in 2025.

Case Studies: Real Borrowers

Case 1: Alex’s Federal Miss (2025)

Missed 3 months—credit ding. Joined SAVE plan, payments $0. Avoided default, score recovered.

Case 2: Jordan’s Private Trouble

Missed 2 months—$40 fees, rate up 1%. Refi’d to a better lender, caught up.

Case 3: Sam, Cosigner on Private

Default—lender sued. Paid settlement, learned to monitor.These show early action wins.For women in business, see challenges faced by women entrepreneurs in business.

FAQs

How does the punishment for late payment of student loans differ between federal and private loans?

Federal: No fees, longer to default. Private: Fees fast, quicker default.

What are federal student loan late payment penalties?

No fees, credit hit at 90 days, default at 270.

What are private student loan late payment consequences?

Fees day 1, credit at 30 days, default at 90+.

What are student loan default differences?

Federal: Garnish, seize refunds. Private: Sue, accelerate.

What happens if I miss a payment on a federal student loan?

Reminder first, then credit ding at 90 days.

What happens if I miss a payment on a private student loan?

Fee immediate, credit for 30 days.

Conclusion:

How does the punishment for late payment of student loans differ between federal and private loans? Federal offers grace—no fees, long default timeline, help plans. Private strikes are quick—fees, fast credit hits, lender whims. Know federal vs private student loan comparison to avoid student loan delinquency rules pitfalls. Use IDR for federal, negotiate for private. Act early—call your servicer today. With 43M borrowers in 2025, smart steps keep your future bright.What’s your plan if payments get tough? Share below!

References

- Marca: Article on late payment penalties 2025 – Details federal grace vs private fees for borrowers. ↩︎

- Brainly: Q&A on federal vs private differences – Explains wage garnish and lender policies for students. ↩︎

- Marca: Guide on student loan punishments – Covers timelines and credit impacts for new grads. ↩︎