Jump into a rewarding path with CFP certification. As a Certified Financial Planner, you help everyday people reach dreams like buying homes or retiring early. College students eyeing finance, pros switching from insurance or accounting, and advisors wanting more trust all pick CFP. It builds real skills in retirement planning, taxes, and investment planning.

The CFP Board leads the way. Over 230,000 CFP professionals serve globally with fiduciary duty – always putting clients first. U.S. News ranks financial advisor #2 best business job. CFP pros enjoy high pay and deep impact.

Why CFP Fits Aspiring Planners Perfectly

CFP designation sets you apart as a personal finance advisor. Clients seek wealth management certification for peace of mind.

- Job satisfaction: 82% of CFP holders love their work.

- Growth: Advisory firms hire more CFP pros yearly.

- Global reach: Recognized in 26 countries via FPSB.

Is CFP worth it for financial advisors? Yes – clients pay more for certified help. Income rises 20-50%. Referrals grow fast.

Difference between CFP and CFA: CFP covers full life plans (insurance, estate). CFA dives deep into markets. Many combine both. Explore retirement challenges – CFP solves them daily.

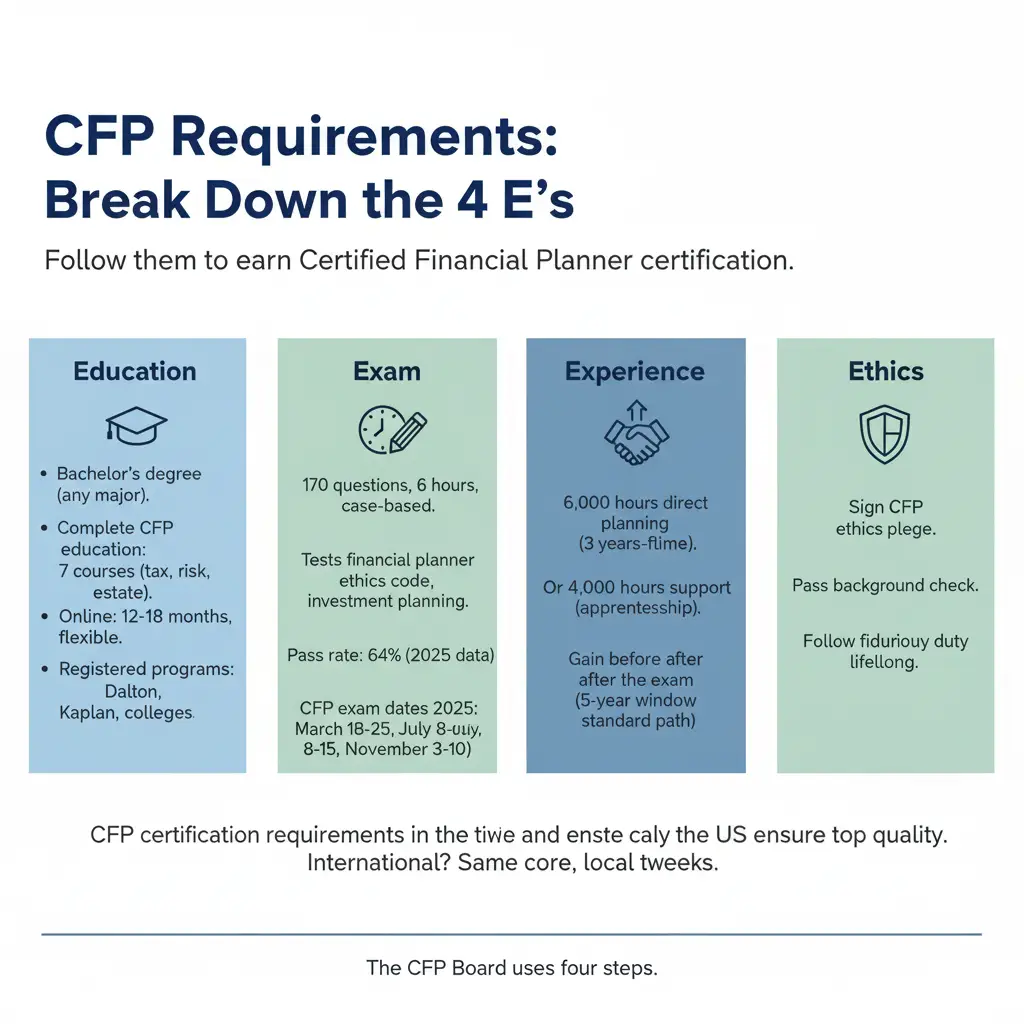

CFP Requirements: Break Down the 4 E’s

The CFP Board uses four steps. Follow them to earn Certified Financial Planner certification.

- Education

- Bachelor’s degree (any major).

- Complete CFP education requirement: 7 courses on CFP exam syllabus (tax, risk, estate).

- Online courses to prepare for CFP: 12-18 months, flexible.

- Registered programs: Dalton, Kaplan, colleges.

- Exam

- 170 questions, 6 hours, case-based.

- Tests financial planner ethics code, investment planning.

- Pass rate: 64% (2025 data).

- CFP exam dates 2025: March 18-25, July 8-15, November 3-10.

- Experience

- 6,000 hours direct planning (3 years full-time).

- Or 4,000 hours support (apprenticeship).

- Gain before or after the exam (5-year window standard path).

- Ethics

- Sign CFP ethics pledge.

- Pass background check.

- Follow fiduciary duty lifelong.

CFP certification requirements in the US ensure top quality. International? Same core, local tweaks.

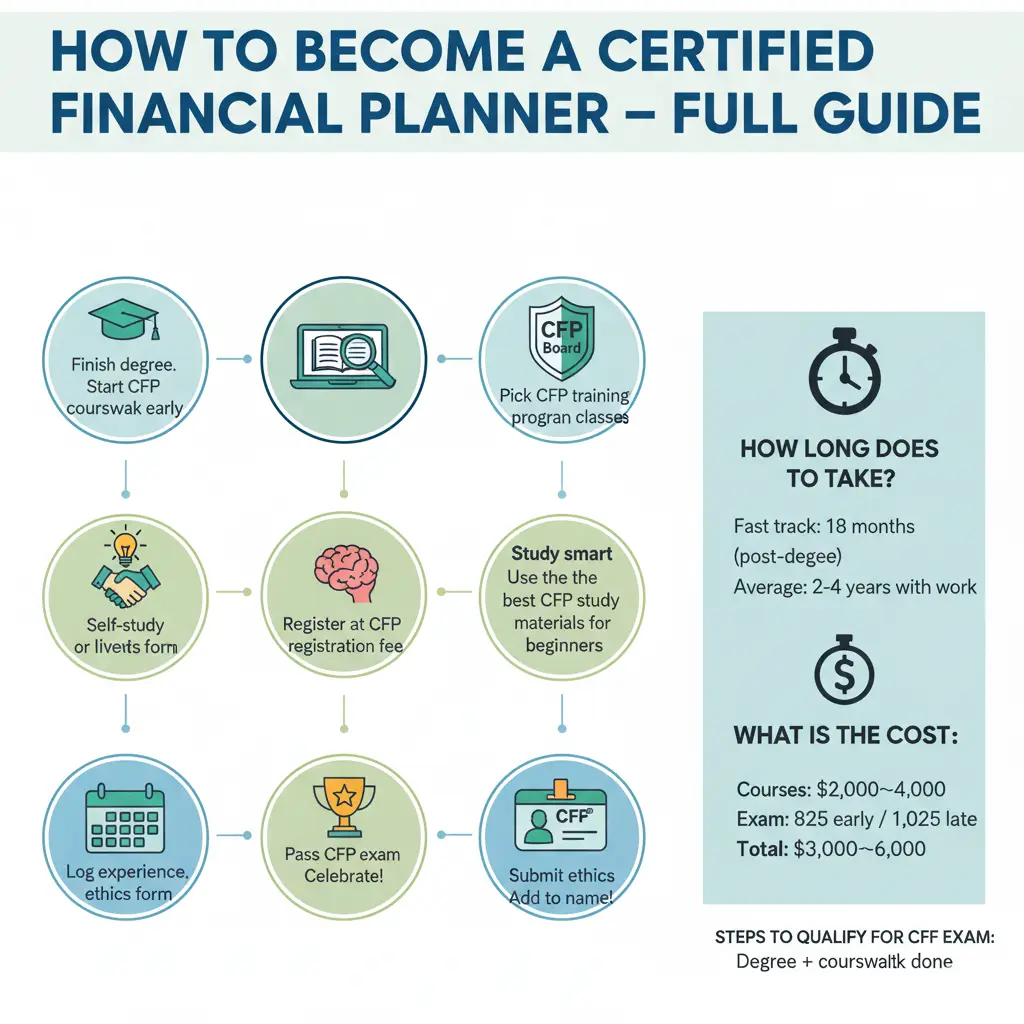

How to Become a Certified Financial Planner – Full Guide

How to become a CFP? Action plan:

- Step 1: Finish degree. Start CFP coursework early – CFP certification after graduation is ideal.

- Step 2: Pick CFP training program. Self-study or live classes.

- Step 3: Register at CFP Board. Pay CFP registration fee.

- Step 4: Study smart. Use the best CFP study materials for beginners.

- Step 5: Pass CFP exam. Celebrate!

- Step 6: Log experience. Submit ethics form.

- Step 7: Get a CFP professional mark. Add to name!

How long does it take to become a CFP?

- Fast track: 18 months (post-degree).

- Average: 2-4 years with work.

What is the cost of CFP certification?

- Courses: $2,000-$4,000

- Exam: $825 early / $1,025 late

- Total: $3,000-$6,000

Steps to qualify for CFP exam: Degree + coursework done.

Ace the CFP Exam: Proven Prep Strategies

CFP study guide tips:

- Hours needed: 250-300 total.

- Daily plan: 2 hours weekdays, 6 weekends.

- Practice: 1,000+ questions. Focus case studies.

- Tools:

- CFP Board practice exams.

- Kaplan QBank.

- Flashcards for CFP ethics.

Best CFP study materials for beginners:

- Official CFP Board textbook.

- Dalton Review videos.

- Mock exams (aim 70%+).

CFP course formats:

- Live online: Interactive.

- On-demand: Fit your job.

Schedule CFP exam early – spots fill fast.

Launch Your CFP Career

CFP career paths explode post-cert:

- Independent advisor: Build your firm.

- Bank/wealth firm: JP Morgan, Merrill seek CFP pros.

- Insurance: Boost sales with planning.

Job opportunities for CFP holders:

- Financial planner (median $95K).

- Wealth manager ($120K+).

- Advisor in RIA firms.

CFP salary expectations and career growth:

- Entry: $70K-$90K.

- 5 years: $120K+.

- Top: $250K with clients.

How to add CFP designation to your profile:

- LinkedIn: “Jane Doe, CFP®”

- Email signature.

- Business cards.

How to market yourself as a CFP professional:

- Create a website: “Your Trusted CFP Advisor”.

- Network at FPA events.

- Share financial literacy education on social media.

- Offer free reviews – convert to clients.

Firms gain from benefits of hiring CFP professionals for clients:

- Higher retention (95% stay).

- Compliance benefits of CFP credentialed staff.

Why firms should hire certified financial planners:

- Meet financial planning standards board rules.

- Win client trust.

- How to support employees earning CFP certification: Pay fees, give study time.

Maintain and Grow as a CFP Professional

Continuing education for CFP professionals:

- 30 hours every 2 years.

- 2 hours CFP ethics.

- Topics: Taxes, behavioral finance.

How to maintain CFP certification:

- Report CE online.

- Renew biennially ($325 fee).

- CFP renewal requirements keep you sharp.

Professional certification in finance demands growth. CFP continuing education offers webinars, conferences.

CFP for Career Changers

Switching fields? CFP welcomes you.

- From accounting: Use tax skills.

- From sales: Build client bonds.

Global CFP certification: Work in Canada, Australia. Same fiduciary duty.

Clients Love CFP Pros

How to find a certified financial planner near me: CFP Board tool1.

Why work with a CFP professional: Best-interest plans.

What does a certified financial planner do:

- Budgets.

- Retirement planning specialist strategies.

- Estate docs.

Questions to ask your CFP advisor:

- How do you charge?

- Experience with my goals?

- Fiduciary duty proof?

How CFP professionals manage retirement planning:

- Run projections.

- Pick investments.

- Adjust for life changes.

CFP vs Other Credentials

CFP certification vs other finance credentials:

- CFP: Holistic, client-first.

- ChFC: Insurance focus.

- CPA: Taxes.

Best financial advisor credentials? CFP for planning.

CFP FAQs

What is a CFP?

Certified Financial Planner – top financial planning certification.

How to become a CFP?

Follow 4 E’s above.

CFP certification requirements in the US?

Education, exam, experience, ethics.

Best CFP study materials for beginners?

CFP Board guides + mocks.

Is CFP worth it for financial advisors?

Absolutely – higher pay, satisfaction.

Difference between CFP and CFA?

CFP: Client-focused planning; CFA: Investments.

Continuing education for CFP professionals?

30 hours every 2 years.

How to maintain CFP certification?

CE + ethics renewal.

CFP ethics and professional conduct?

Fiduciary standard.

How to market yourself as a CFP professional?

Use designations everywhere.

Job opportunities for CFP holders?

Advisors, planners, wealth roles.

CFP salary expectations and career growth?

$100K+ average.

How to add CFP designation to your profile?

Update LinkedIn, bios.

Why should firms hire certified financial planners?

Client trust, compliance.

Benefits of hiring CFP professionals for clients?

Holistic advice.

Compliance benefits of CFP credentialed staff?

Ethical standards.

How to find a certified financial planner near me?

Why work with a CFP professional?

Best-interest advice.

What does a certified financial planner do?

Plans retirement, taxes, estates.

Questions to ask your CFP advisor?

Fees, experience, strategy.

How CFP professionals manage retirement planning?

Customized portfolios.

Where is the CFP national championship 2025?

Atlanta (Mercedes-Benz Stadium) – football fun!

When is the CFP selection show?

Mid-December.

When is CFP selection show?

December 8, 2025 (est.).

Where is CFP national championship 2025?

Atlanta.

When does CFP start?

Playoffs Dec. 2025.

Conclusion

CFP powers your future. Nail CFP requirements, crush the CFP exam, and shine as a CFP professional. Students, changers, firms – all win with fiduciary duty and skills. Visit CFP Board or Wikipedia2 today.

Your move: Which Certification is Most Commonly Recognized in the Financial Industry?

References

- CFP Board – 4 E’s, exam dates, CE, careers for students/changers. ↩︎

- Wikipedia: Certified Financial Planner – 230K+ pros, global, ethics history. Targets aspiring CFP candidates: how to become a certified financial planner, CFP study guide, CFP career paths. ↩︎