If you are an early-career finance pro or a student eyeing investment roles, CFA certification stands out as a top choice. It builds deep skills in analysis and opens doors to better jobs. Many pros chase this credential to stand out and grow fast.

Why Pursue CFA Certification Today?

CFA certification helps you gain trust in the investment world. It shows you know ethics, analysis, and portfolio rules well. Over 200,000 people hold the charter globally. This number grows each year as firms seek skilled workers.1

Early pros with 0-5 years in banking or management use it to move up. Students in finance or business start exams early to build a strong base. Even pros from other fields pivot to asset management with this help.

Who Benefits Most from CFA Certification?

- Early-career finance professionals: You work in research or risk. CFA certification adds credibility and skills for senior spots.

- Students and recent graduates: Finish your degree and start Level 1. Gain knowledge while you build experience.

- Career changers: Come from consulting or corporate finance? Learn investment tools to switch smoothly.

Senior pros also join for global recognition. In places like India or the Middle East, it boosts mobility.2

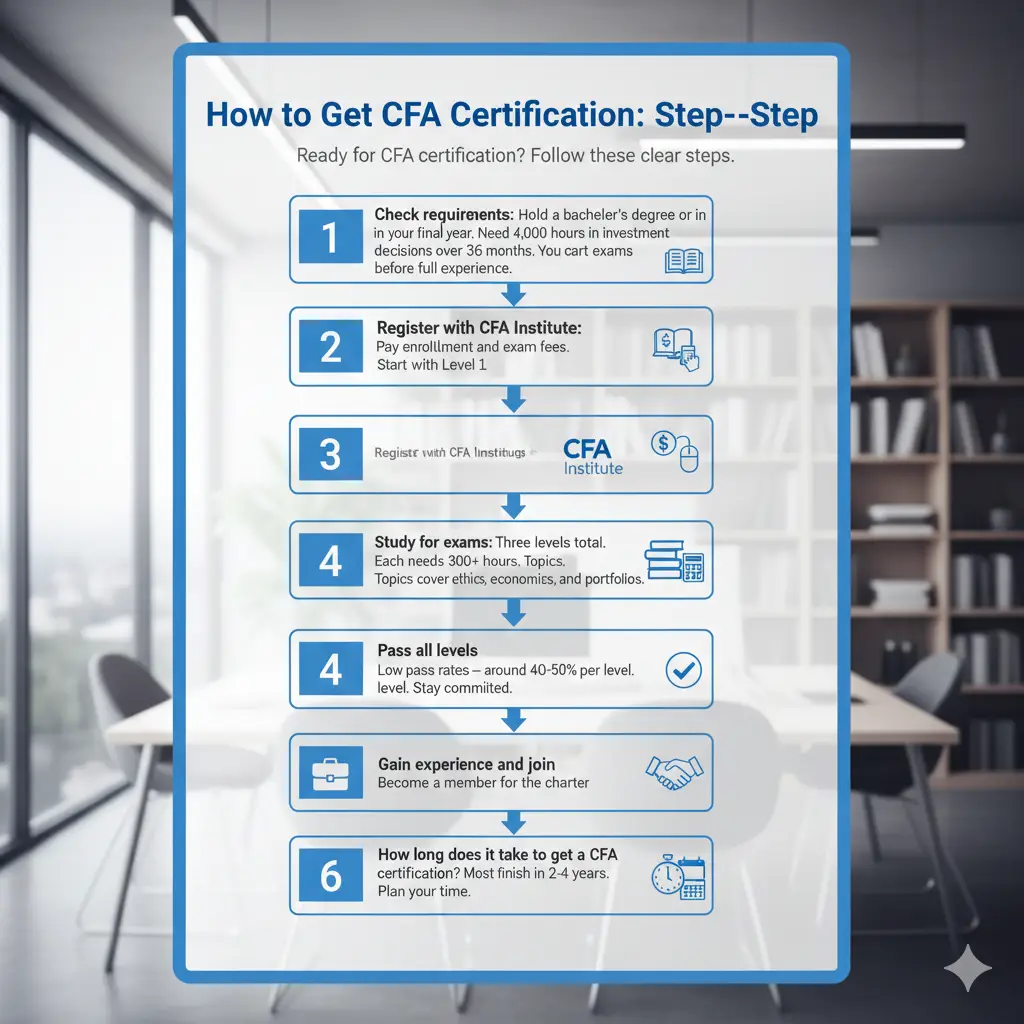

How to Get CFA Certification: Step-by-Step

Ready for CFA certification? Follow these clear steps.

- Check requirements: Hold a bachelor’s degree or be in your final year. Need 4,000 hours of work in investment decisions over 36 months. You can start exams before full experience.1

- Register with CFA Institute2: Pay enrollment and exam fees. Start with Level 1.

- Study for exams: Three levels total. Each needs 300+ hours. Topics cover ethics, economics, and portfolios.

- Pass all levels: Low pass rates – around 40-50% per level. Stay committed.

- Gain experience and join: Submit work details. Become a member for the charter.

How long does it take to get a CFA certification? Most finish in 2-4 years. Plan your time well.

CFA Certification Requirements in Detail

- Education: Bachelor’s or equivalent.

- Exams: Computer-based. Level 1 four times a year; others twice.

- Experience: Relevant investment work. Can build after exams.

- Ethics: Follow strict code.

Meet these for chartered financial analyst CFA certification.3

CFA Certification Cost Breakdown

Budget matters for CFA certification. Here’s what to expect in 2025:

- One-time enrollment: $350.

- Per exam: $1,000-$1,500 (early bird saves).

- Study materials: $500+ extra if needed.

Total for all levels: $3,000-$5,000. CFA certification cost 20254 stays similar, but check for updates.5

Save by registering early. Some employers pay fees – ask yours!

Jobs and Salary with CFA Certification

Jobs with CFA certification shine in key areas:

- Portfolio management (25% of charterholders).

- Research analysis.

- Risk management.

- Wealth advising.

CFA certification salary? Entry-level boosts 20-30%. Seniors earn $100,000+ in the US; more in global hubs. In emerging markets, it lifts pay and options.6

What can you do with a CFA certification? Lead funds, advise clients, or consult. It fits what is the CFA certification – a gold standard for pros.

Top Paths After CFA Certification

| Role | Why It Fits | Average Boost |

| Portfolio Manager | Deep analysis skills | High seniority |

| Investment Analyst | Research focus | Better firms |

| Risk Specialist | Ethics and tools | Stable growth |

CFA Certification Process: What to Expect

The CFA certification process tests you hard. Level 1: Basics and multiple choice. Level 2: Cases and vignettes. Level 3: Essays on portfolios.

How long to get CFA certification? Average 4 years with work. Start early if you’re a student.

Tips:

- Study 10-15 hours weekly.

- Join study groups.

- Practice exams often.

Is CFA certification worth it? Yes, for investment goals. It pays off in credibility and pay.

Career Benefits of CFA Certification

CFA certification career benefits include:

- Global respect: Work anywhere.

- Skill upgrade: Master analysis.

- Network: Join 170,000+ members.

- Higher pay: Proven in surveys.

For how to obtain CFA certification in India or Pakistan, same global process. Local study providers help.

What is CFA certification exactly? A rigorous path to charterholder status.7

How to Get a CFA Certification Successfully

- Plan a schedule around work.

- Use official books.

- Track progress.

- Retake if needed – many do.

CFA certification overview: Ethics-heavy, practical, respected.

FAQs About CFA Certification

What is a CFA certification?

It’s the Chartered Financial Analyst credential for investment experts.

CFA certification fees?

Vary by timing; plan $4,000 total.

How to verify CFA certification?

Check the CFA Institute5 directory.

Who needs CFA certification?

Pros in investments, research, or management.

CFA certification course options?

Self-study or prep providers.

Conclusion

CFA certification empowers early pros, students, and changers to excel in investments. Meet CFA certification requirements, budget for CFA certification cost, and follow the CFA certification process. Gain jobs, salary boosts, and global options. It demands time but delivers big.

What step will you take first toward your CFA certification?

References

- Investopedia – Exam structure, pass rates (40-50%), study hours (300+ per level), and rigor of the process. CFA Charter ↩︎

- CFA Institute – Eligibility criteria, work experience rules, and target audience segments like students and career changers. All Programs ↩︎

- Wikipedia – Historical background, job distribution among charterholders (e.g., 25% in portfolio management), and international recognition. Chartered Financial Analyst ↩︎

- Corporate Finance Institute – Cost breakdowns, salary impacts, and career paths post-certification. Chartered Financial Analyst ↩︎

- CFA Institute – Detailed program overview, candidate statistics (over 200,000 charterholders), and global mobility benefits. CFA Program ↩︎