Boost client trust with the ChFC credential. Financial pros with 3+ years experience use ChFC for advanced financial planning skills in taxes, estates, and retirement. ChFC stands for Chartered Financial Consultant – perfect for insurance agents, wealth managers seeking holistic financial advice.

Over 50,000 pros hold ChFC®1. It delivers real-world applications via case studies on business succession planning and special needs planning.

Why Pursue ChFC for Comprehensive Planning

ChFC designation sets you apart as a ChFC financial planner. Clients value ethical financial advice on wealth preservation and growth.

- Client growth: 49% higher in 3 years.

- Earnings boost: 32% more.

- Retention: 75% better.

Benefits of earning a Chartered Financial Consultant certification: Handle complex cases like divorce or income protection planning.

ChFC Requirements & Eligibility

Start easy – high school diploma suffices.

- Complete 8 chfc courses online.

- Pass proctored exams (no big final).

- Gain 3 years financial planning experience.

- Agree to ChFC ethical standards.

- Join ChFC continuing education (30 hrs/2 yrs).

How to get ChFC designation? Enroll at The American College2. ChFC requirements fit working pros.

ChFC course online: Self-paced, 10 weeks/course + 4-week exam window.

ChFC Courses Breakdown

Master 100+ topics in financial planning education:

- HS 300: Planning process, ethics.

- HS 311: Insurance planning.

- HS 321: Income tax planning.

- HS 326: Retirement planning.

- HS 328: Investments.

- HS 330: Estate planning.

- HS 333: Comprehensive case analysis.

- HS 347: Contemporary applications (succession, behavioral finance).

ChFC study program uses videos, quizzes, cases. How long to study for ChFC? Finish in <18 months.

ChFC Cost – Affordable Investment

- Single course: $955-$1,695.

- Full package: $6,395 (save $1,000 promo to $5,395).

ChFC cost pays off fast with chfc salary3 growth.

ChFC Salary & Career Wins

ChFC salary beats peers – higher income via expertise.

- Advise small business owners on succession.

- Guide families on tax and wealth management.

- Serve pros with fiduciary responsibility.

ChFC designation career opportunities: Financial advisor, consultant. Pair with retirement tips for impact.

ChFC vs CFP – Key Differences

AspectChFCCFPCourses8 (deeper cases)7DegreeNo bachelor’sRequiredExamPer courseComprehensiveEthicsAmerican College codeFiduciaryTime<18 monthsVaries

ChFC vs CFP: ChFC excels in application; qualifies for CFP exam. ChFC vs CLU: ChFC broader planning; CLU insurance focus. clu chfc combo powerful.

CfP vs chfc: ChFC for advanced needs.

ChFC vs CLU – When to Choose

ChFC vs CLU which is better? CLU for life insurance; ChFC for full comprehensive wealth management.

Clu chfc meaning: Insurance + planning mastery.

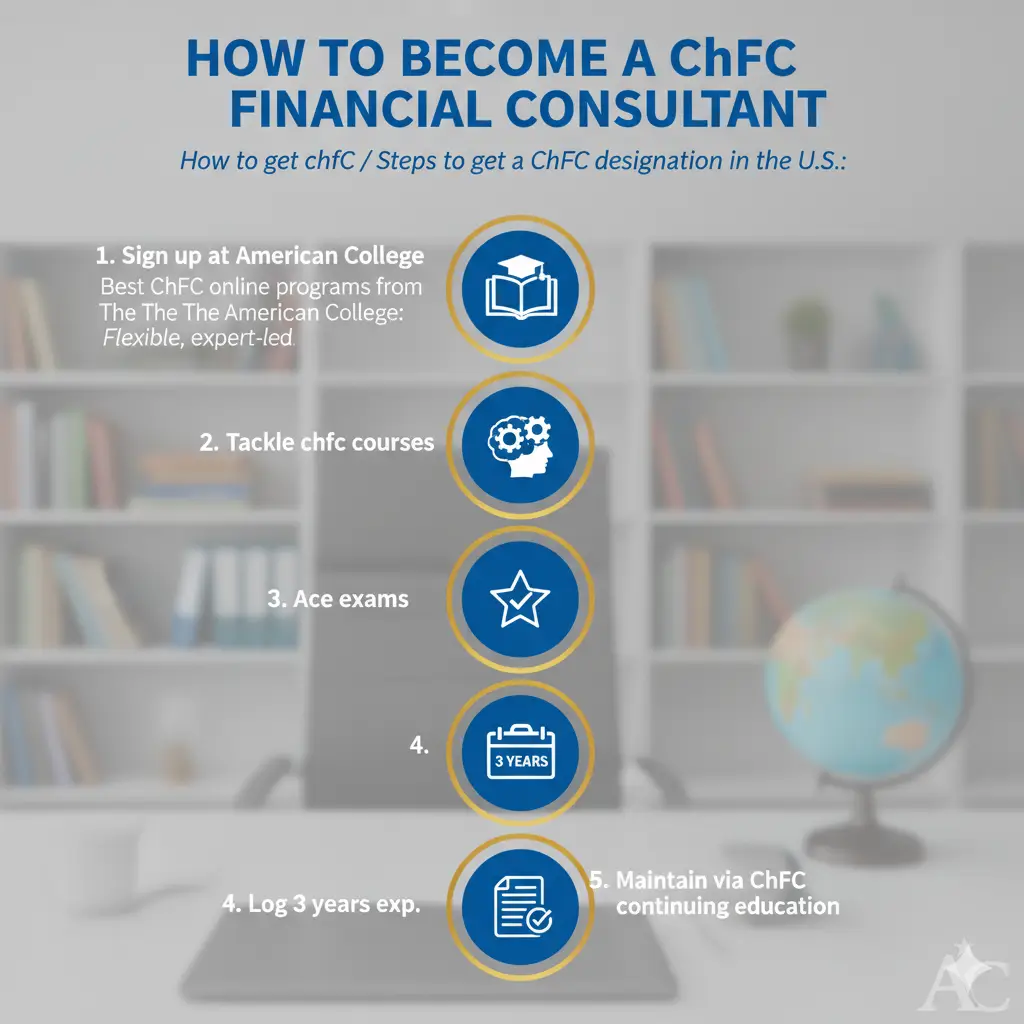

How to Become a ChFC Financial Consultant

How to get chfc / Steps to get a ChFC designation in the U.S.:

- Sign up at American College.

- Tackle chfc courses.

- Ace exams.

- Log 3 years exp.

- Maintain via ChFC continuing education.

Best ChFC online programs from The American College: Flexible, expert-led.

Is the ChFC Worth It?

Yes! ChFC professional designation boosts credibility. Why financial advisors choose ChFC certification: Client financial goals met holistically.

ChFC ethical standards: Client-first always.

Maintenance & Growth

ChFC continuing education requirements: 30 hrs/2 yrs via PRP.

Professional development in finance: Stay sharp on financial planning strategies.

Real Success Stories

- “Elevated my practice” – James Crunden, ChFC®.

- 80% report big skill gains.

Everything You Need to Know in 2025

What is ChFC?

ChFC stands for Chartered Financial Consultant. It is a respected professional financial designation from The American College of Financial Services. Advisors earn it by mastering advanced financial planning skills like taxes, retirement, estates, and insurance.

“The ChFC helped me move from selling policies to building full life plans for families.” – James Crunden, ChFC®, Wealth Advisor

You become a trusted ChFC financial planner who gives holistic financial advice — not just products.

What is a ChFC?

A ChFC is a certified expert who helps clients with comprehensive wealth management. Think of them as a “financial doctor” for:

- Retirement income

- Tax savings

- Estate transfer

- Business exit plans

- Special needs trusts

They use real-world planning situations to protect and grow wealth. Example: A ChFC helped a doctor save $120K in taxes over 5 years using smart retirement strategies.

What is ChFC certification?

ChFC certification means you passed 8 online courses and met experience rules. No bachelor’s degree needed — just 3 years in financial services.

It proves you can handle complex client financial goals like:

- Divorce asset splits

- Business sale planning

- Legacy for grandkids

Over 50,000 professionals hold this ChFC credential worldwide.

What is ChFC in finance?

In finance, ChFC means Chartered Financial Consultant — a pro who gives ethical financial advice across investment and insurance planning, estate and retirement planning, and tax and wealth management.

Unlike basic advisors, a ChFC sees the full financial picture.

Example: A ChFC saved a small business owner $80K by combining life insurance with a buy-sell agreement.

What does ChFC stand for?

ChFC = Chartered Financial Consultant

It’s a mark of professional development in finance — like a “PhD in real-life money planning.”

What does ChFC mean?

ChFC means you’re trained in applied planning knowledge for wealth preservation and growth. You follow a strict code of ethics and complete ChFC continuing education every 2 years (30 hours).

What is a ChFC certification?

It’s an advanced financial planning certification with:

- 8 self-paced online courses

- 100+ topics (tax, estate, investments)

- Case-based learning

- No final exam — just pass each course

You finish in under 18 months while working.

What is ChFC designation?

The ChFC designation is your official title: John Doe, ChFC®. You can use it on:

- Business cards

- Email signatures

- Client proposals

It signals ChFC professional recognition in the financial industry.

What is a ChFC designation?

It’s a professional badge from The American College. Only those who complete ChFC course structure and exam format and have 3+ years experience earn it.

It’s not a license — it’s a credential that boosts trust.

What is a ChFC in finance?

A ChFC in finance is a consultant who:

- Builds personal financial consulting plans

- Uses financial planning strategies

- Acts as a fiduciary (client-first)

They serve families, doctors, business owners — anyone with sophisticated financial needs.

What is the ChFC designation?

It’s the gold standard for comprehensive advanced financial planning. Created in 1982, it’s older than CFP and focuses on real-life case studies.

“ChFC gave me confidence to charge premium fees.” – Sarah Lee, ChFC®

What does CLU ChFC mean?

CLU ChFC means you hold two elite designations:

| Designation | Focus |

| CLU (Chartered Life Underwriter) | Life insurance & risk |

| ChFC | Full financial planning |

Together? You’re a super-advisor for insurance + planning. Many top agents earn both.

How long do you have to study for ChFC?

Most finish in 12–18 months:

- 1 course every 2–3 months

- 10 weeks study + 4 weeks exam per course

- 100–150 hours per course

Tip: Study 3–5 hours/week while working.

What is a ChFC license?

There is no “ChFC license” — it’s a designation, not a state license.

You still need:

- Series 7/65/66 (for investments)

- State insurance license (for products)

ChFC adds credibility, not legal authority.

How to get ChFC?

Follow these 5 simple steps:

- Enroll at The American College

- Complete 8 ChFC courses online

- Pass each exam (70%+)

- Submit 3 years experience

- Agree to ethics & CE

Start today — first course: HS 300 Financial Planning Process.

What is a ChFC?

A ChFC is a trusted financial guide who:

- Saves clients thousands in taxes

- Protects wealth across generations

- Builds retirement income that lasts

They turn complex problems into simple plans.

What does ChFC mean in insurance?

In insurance, ChFC means you go beyond selling policies. You use insurance as a tool in a bigger plan.

Example: A ChFC used life insurance to fund a business succession plan — saved family business from taxes.

What does ChFC stand for in insurance?

ChFC = Chartered Financial Consultant

In insurance, it means planning expert, not just salesperson.

What does ChFC stand for in finance?

ChFC = Chartered Financial Consultant

It means certified financial consultant with advanced skills in tax, estate, retirement, and investments.

How to get ChFC designation?

Easy 5-step path:

| Step | Action |

| 1 | Enroll online ($6,395 bundle) |

| 2 | Study 8 courses (videos, cases) |

| 3 | Pass exams (open-book, online) |

| 4 | Submit work history |

| 5 | Get ChFC® title! |

Conclusion

ChFC transforms advisors. Gain ChFC certification for financial literacy certification edge in estate and retirement planning. From chfc requirements to chfc salary, it delivers.

Ready for ChFC? What’s your next step?

References

- Wikipedia: ChFC – History, topics. Targets experienced advisors elevating to advanced financial planning certification, ChFC financial advisor roles. ↩︎

- The American College: ChFC – Chfc courses, cost, stats. ↩︎

- Investopedia: ChFC – Salary, vs CFP. ↩︎