Small business owners often look for ways to offer good benefits without breaking the bank. One big question is the average cost of health insurance for small business. In 2025, costs have gone up, but there are smart ways to handle them.

Health insurance helps attract and keep good workers. Many small business owners and HR managers search for benchmark costs to plan budgets. This guide breaks down the numbers in a simple way.

Why Health Insurance Matters for Small Businesses

Offering small business health insurance is a key part of small business employee benefits. It shows you care about your team’s health. Workers see it as a top perk.

In 2025, the average cost of health insurance for small business owners is higher than before. But it can pay off by lowering turnover. Happy workers stay longer.

Many small employers use group health insurance for small business plans. These spread risk and can be cheaper per person. UnitedHealthcare – Health Insurance for Small Business1

Key Stats on Costs in 2025

Data from the Kaiser Family Foundation (KFF) 2025 Employer Health Benefits Survey shows clear numbers:

- Average annual premium for single coverage: $9,325 (about $777 per month).

- Average annual premium for family coverage: $26,993 (about $2,249 per month).

Employers pay most of it. On average, they cover 84% of single plans and 74% of family plans.

For small firms (10-199 workers), costs can feel heavier. Deductibles are often higher, too.

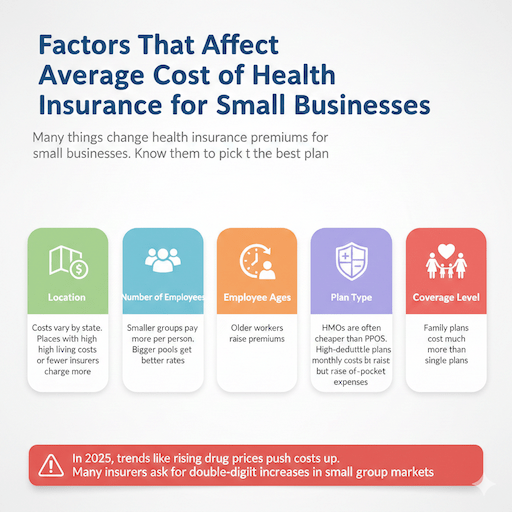

Factors That Affect the Average Cost of Health Insurance for Small Businesses

Many things change health insurance premiums for small businesses. Know them to pick the best plan.

Here are the main ones:

- Location: Costs vary by state. Places with high living costs or fewer insurers charge more.

- Number of Employees: Smaller groups pay more per person. Bigger pools get better rates.

- Employee Ages: Older workers raise premiums.

- Plan Type: HMOs are often cheaper than PPOs. High-deductible plans lower monthly costs but raise out-of-pocket expenses.

- Coverage Level: Family plans cost much more than single plans.

In 2025, trends like rising drug prices push costs up. Many insurers ask for double-digit increases in small group markets.

Average Costs Per Employee

The insurance cost per employee depends on coverage:

- Single: Employers pay around $650-700 per month on average.

- Family: Can reach $1,600 or more per month for the employer’s share.

Small businesses often pay a fixed amount per worker.

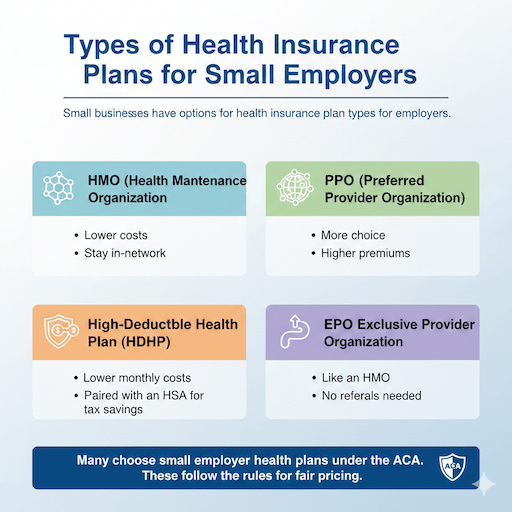

Types of Health Insurance Plans for Small Employers

Small businesses have options for health insurance plan types for employers.

Common ones:

- HMO (Health Maintenance Organization): Lower costs, but you stay in-network.

- PPO (Preferred Provider Organization): More choice, higher premiums.

- High-Deductible Health Plan (HDHP): Lower monthly costs, paired with an HSA for tax savings.

- EPO (Exclusive Provider Organization): Like an HMO, but no referrals needed.

Many choose small employer health plans under the ACA. These follow the rules for fair pricing.

Alternatives to Traditional Group Plans

Some small businesses try new ways for affordable health insurance small business options. Kaiser Family Foundation (KFF) – 2025 Employer Health Benefits Survey2

- QSEHRA: For businesses with under 50 employees. Reimburse up to set limits tax-free.

- ICHRA: More flexible, any size business. Employees pick individual plans.

These can control costs better than fixed group rates.

How Much Do Small Businesses Pay for Employee Health Insurance?

Many ask: how much do small businesses pay for employee health insurance?

In 2025:

- Employers cover most of the single coverage.

- For the family, workers pay more of the share.

Small firms sometimes cover 100% of single to compete for talent.

Employer health coverage costs are tax-deductible. That’s a big plus.

Tax Incentives and Credits

Look into tax incentives for small business health insurance.

If under 25 employees and low average wages, you may get credits up to 50% of premiums.

Small employer insurance subsidies help a lot. PeopleKeep – Small Business Health Insurance Costs3

Small Business Health Insurance Premiums by State

Costs differ by state. Northeast and West are often higher.

Examples (based on 2025 trends):

- High-cost states: Premiums 10-20% above the national average.

- Lower cost: South or Midwest sometimes cheaper.

Check local quotes for exact small business health insurance premiums by state.

Shop around for business health insurance quotes.

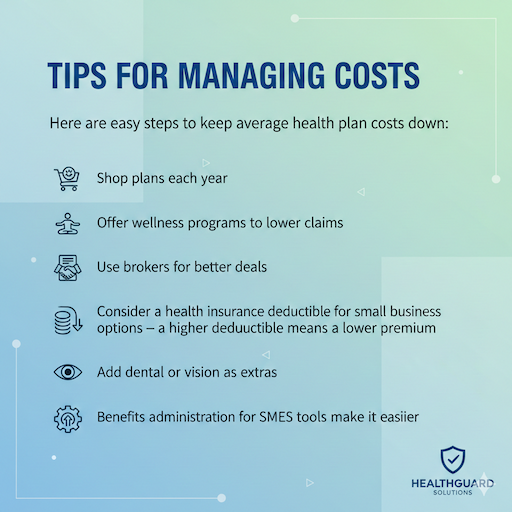

Tips for Managing Costs

Here are easy steps to keep average health plan costs down:

- Shop plans each year.

- Offer wellness programs to lower claims.

- Use brokers for better deals.

- Consider a health insurance deductible for small business options – a higher deductible means a lower premium.

- Add dental or vision as extras.

Benefits administration for SMEs tools make it easier.

Comparison of Small Business Health Insurance Costs

Look at the plans side by side.

| Plan Type | Average Monthly Premium (Single) | Employer Share | Deductible |

| HMO | $700-800 | 80-90% | Lower |

| PPO | $800-900 | 70-80% | Higher |

| HDHP | $600-700 | 80-100% | High |

Numbers are averages; your quote may vary.

Best Health Insurance Plans for Small Employers

Top picks in 2025 include big names like UnitedHealthcare, Blue Cross Blue Shield, and Kaiser.

Look for the best health insurance plans for small employers with good networks and service.

Many like plans with small business health insurance with low deductible for worker peace of mind.

ACA Health Plans for Small Business

The Affordable Care Act helps with ACA health plans for small businesses.

SHOP marketplace for under 50 employees.

Rules ensure no denials for pre-existing conditions.

Small Business Healthcare Compliance

Stay on top of small business healthcare compliance.

No mandate for under 50, but big firms have rules.

Track changes for 2025.

Conclusion

The average cost of health insurance for small businesses in 2025 is around $9,325 yearly for single and $26,993 for a family. Employers pay the bulk, but costs rise.

Smart choices like right plans, tax credits, and alternatives help manage the employer health benefits cost calculator needs.

Offering good employee health benefits packages builds a strong team.

See More

- Learn more about how to manage cash flow in a small business

- how to start a small business

- see how to do payroll for small business.