Asia’s stock markets hum with energy in 2025, and ftasiastock market trends from fintechasia capture it all. FintechAsia, a go-to hub for ftasiastock technology news, spotlights how tech reshapes trading. Think mobile apps that let anyone buy shares from a phone, or AI tools predicting market dips. These trends open doors for everyday folks to join the action, not just big banks.

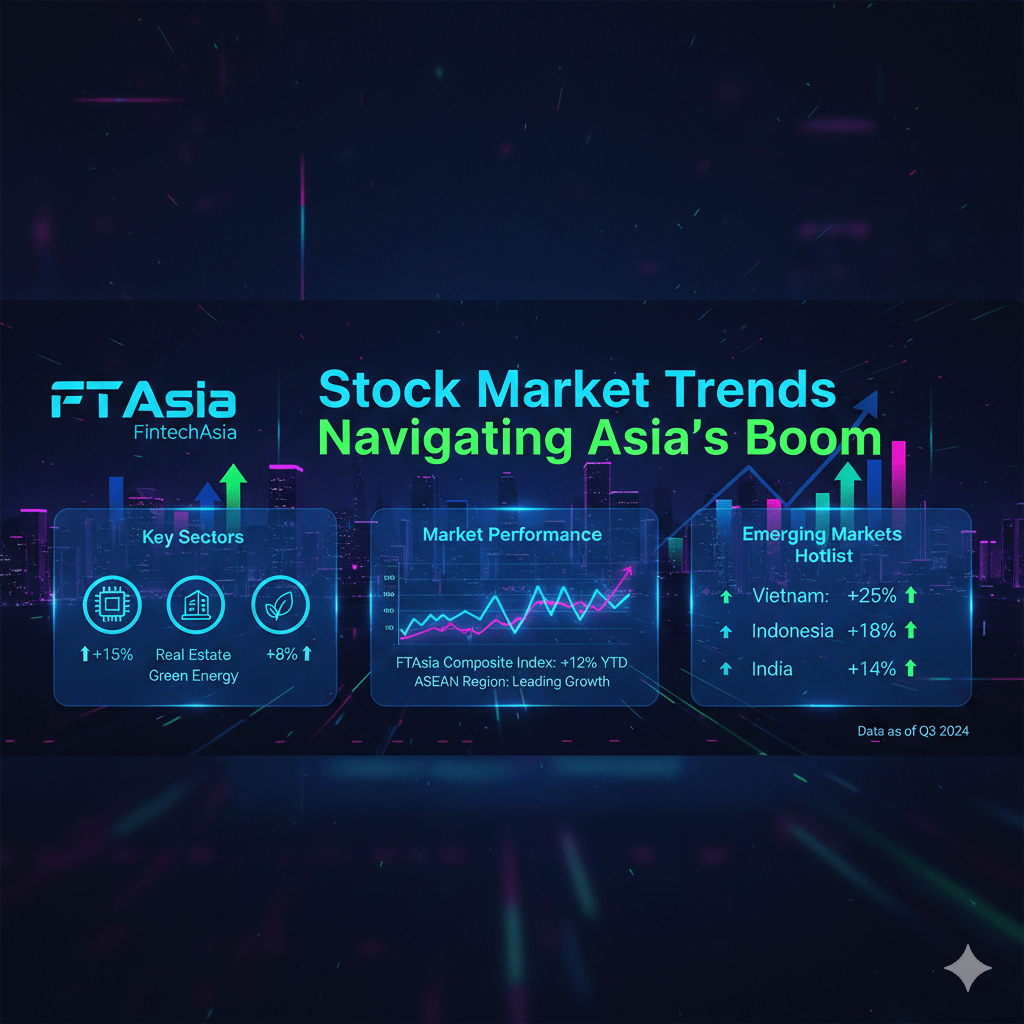

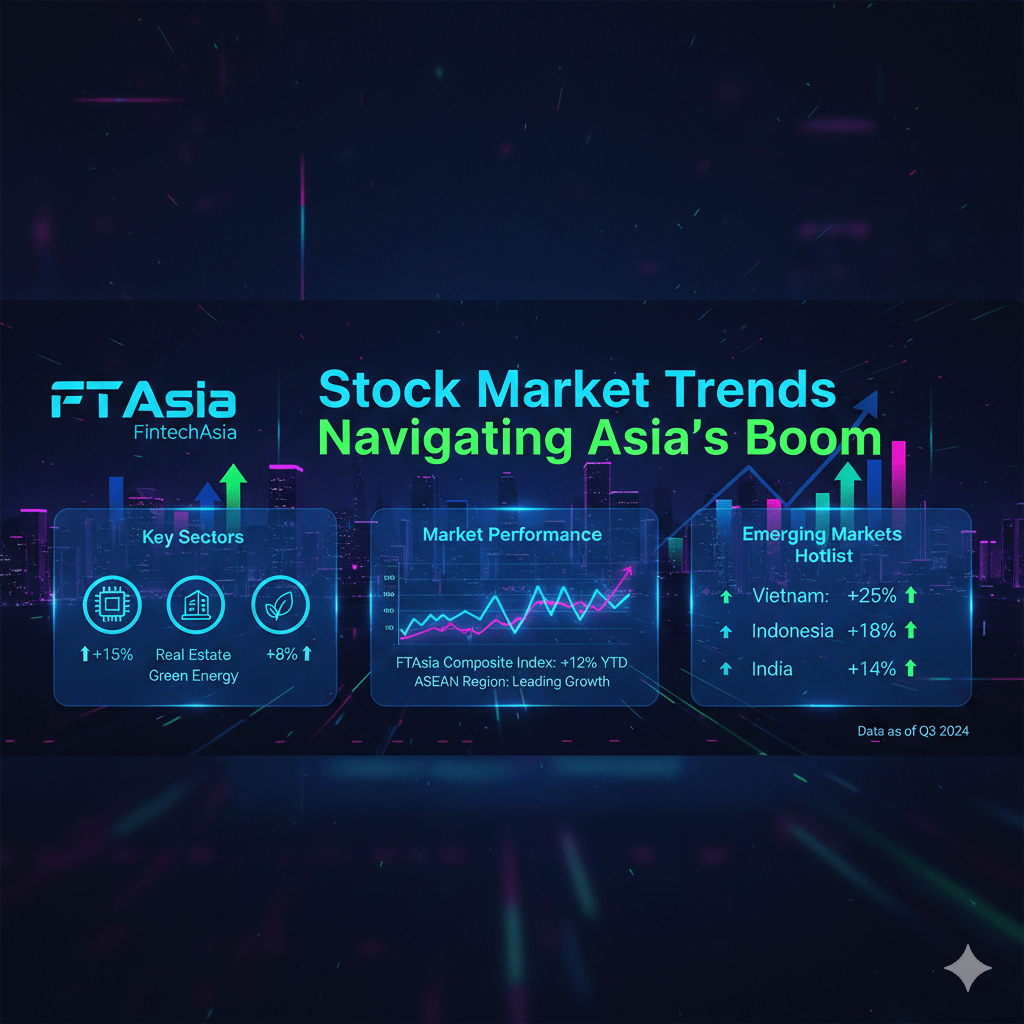

From bustling Tokyo exchanges to Vietnam’s rising boards, FintechAsia stock trends show a 7.2% regional growth forecast. Retail investors—young pros scrolling TikTok for tips—now drive 35% of trades, up from 20% in 2020. FTAsiaStock market analysis breaks it down: ESG funds hit $500 billion, while fintech stocks like Grab soared 25%. If you’re eyeing emerging market stocks Asia, this guide unpacks actionable steps. Dive in to spot winners in digital finance market Asia.

For tips on spotting hot sectors, check top-10 startup ideas for 2026.

The Rise of FintechAsia: A Quick Background

FintechAsia launched in 2015 as a simple blog on Singapore’s startup scene. Today, it’s a powerhouse for ftasiastock market trends from fintechasia, with 2 million monthly readers. Founders spotted a gap: Asian markets buzzed, but info stayed siloed in English reports. They fixed that with bite-sized analyses on Asia market fintech innovations.

Key milestones?

- 2017: First podcast on blockchain’s role in remittances.

- 2020: COVID pivot to remote trading tools, boosting traffic 150%.

- 2023: AI integration for real-time alerts, earning “Best Fintech Media” at Singapore FinTech Awards.

Their edge? Data from 15 exchanges, blended with expert chats. This mix fuels FintechAsia investment trends, helping readers like you dodge hype. In 2024, their reports influenced $10 billion in flows to Southeast Asia. Simple, right? They turn complex charts into “buy or wait” calls.

Curious about funding paths? See startup funding options for first-time entrepreneurs.

Key FTAsiaStock Market Trends from FintechAsia for 2025

FTAsiaStock market trends from FintechAsia paint a bright picture. Markets rebound strong post-2023 dips, with MSCI Asia ex-Japan up 12%. Here’s what stands out:

1. AI and Automation Take Center Stage

AI in Asian stock markets powers 40% of trades now. FintechAsia notes Singapore’s DBS Bank using ML for fraud detection, cutting losses 30%. For investors:

- Tip 1: Scan technology stocks Asia like Taiwan’s TSMC (up 18% YTD).

- Tip 2: Use free AI tools from Robinhood Asia for sentiment scans.

Example: Vietnam’s Vingroup leverages AI for EVs, stock +22%.

2. ESG and Sustainable Investing Surge

ESG trends in Asia stocks hit $1.2 trillion by Q1 2025. Sustainable investing Asia grows as regulations tighten—China mandates green disclosures.

- Bullet 1: Indonesia’s palm oil firms shift to certified chains, boosting shares 15%.

- Bullet 2: Japan’s SoftBank Vision Fund pours $5B into clean tech.

Action: Allocate 20% to ESG ETFs like iShares MSCI Asia ex-Japan ESG Leaders.

3. Fintech and Digital Finance Dominate

Asian fintech market growth clocks 16% CAGR to 2030. Fintech stock market updates highlight India’s Paytm rebounding 40% on UPI volumes.

- Platforms like Sea Group’s ShopeePay handle $200B transactions yearly.

- Blockchain impact on stock trading Asia speeds settlements—Hong Kong trials cut times from T+2 to T+0.

Pro move: Track fintech-enabled trading platforms Asia via apps like Futu.

For broader economic views, explore China economy.

Regional Breakdown: Hotspots in Asian Stock Market Trends 2025

Asia isn’t one market—it’s a mosaic. FTAsiaStock market analysis zooms in:

East Asia: Tech Titans Lead

Japan’s Nikkei nears 42,000, driven by yen weakness. Technology stocks Asia shine: Samsung’s chips fuel AI, +28%. South Korea’s KOSPI eyes 2,800 on export booms.

- Stat: Exports up 8.5%, per IMF.

- Insight: Bet on semiconductors—global demand spikes 20%.

Link to Japan economy for deeper dives.

Southeast Asia: Emerging Stars

Asia stock market forecast pegs Vietnam at 8% GDP growth. Ho Chi Minh Index +15%, thanks to FDI in tech parks. Indonesia’s IDX surges on nickel for batteries.

- Fintech investing Asia tip: Grab Holdings (GRAB) integrates crypto wallets.

- Challenge: Inflation at 3.2%—hedge with bonds.

Thailand’s SET eyes 1,500; tourism rebound adds 2% to GDP. See Thailand economy.

South Asia: Value Plays

India’s Nifty 50 hits 25,000, powered by IT services. Digital finance market Asia thrives—TCS stock +12% on cloud deals. Pakistan’s PSX recovers 10% post-floods.

- Emerging market stocks Asia: Diversify with rupee-denominated funds.

- Risk: Monsoon volatility—watch agri stocks.

Check India economy.

Sector Spotlights: Where to Invest Next

FintechAsia stock trends favor themes over silos. Here’s a table of top sectors:

SectorKey TrendTop Pick2025 ForecastWhy It WinsFintechFintech stock analysis Asia shows P2P lending up 25%.Ant Group (via Alibaba)+18%Mobile banking reaches 500M users.Green EnergyESG trends in Asia stocks drive solar installs +30%.Adani Green+22%Net-zero pledges by 2050.E-CommerceAsia market fintech innovations boost cross-border sales.JD.com+15%1B digital shoppers.HealthcareBiotech via AI in Asian stock markets.WuXi AppTec+20%Aging populations in Japan/China.

Stock market insights Asia say: Rotate quarterly—sell peaks, buy dips. Example: Alibaba dipped 10% in Q4 2024, rebounded 35%.

For certification to analyze these, visit CFA certification.

Tech’s Role: How Fintech Powers FTAsiaStock Market Trends from FintechAsia

Fintech isn’t buzz—it’s backbone. FintechAsia investment trends report 60% of Asians use digital wallets.

- Mobile Trading: Apps like moomoo cut fees 50%, drawing 100M new users.

- Big Data Analytics: Predicts volatility—e.g., Thailand’s baht swings via sentiment tools.

- Crypto Crossover: FTAsiaStock crypto integrates with stocks; Binance Asia volumes +40%.

Blockchain impact on stock trading Asia? Tokenized assets hit $10B. Reassuring note: Regs like Singapore’s stabilize plays. Start small: Demo accounts on eToro Asia.

Explore fintechasia-net-crypto-facto-unlock-asias-blockchain-boom-in-2025.

Risks and How to Dodge Them

Markets swing—ftasiastock market trends from fintechasia warn of geopolitics. US-China tensions could trim 5% off indices. Inflation? ASEAN averages 2.8%1, but watch commodities.

- Tip 1: Diversify—30% East, 40% SE Asia, 30% bonds.

- Tip 2: Set stops at 10% below entry.

- Tip 3: Follow FintechAsia alerts for policy shifts.

Volatility index (VIX Asia) at 18—moderate. Past crashes? 2022 dip recovered 50% in 18 months. Stay calm; data wins.

For risk management, see private equity vs venture capital.

Actionable Advice: Build Your Portfolio

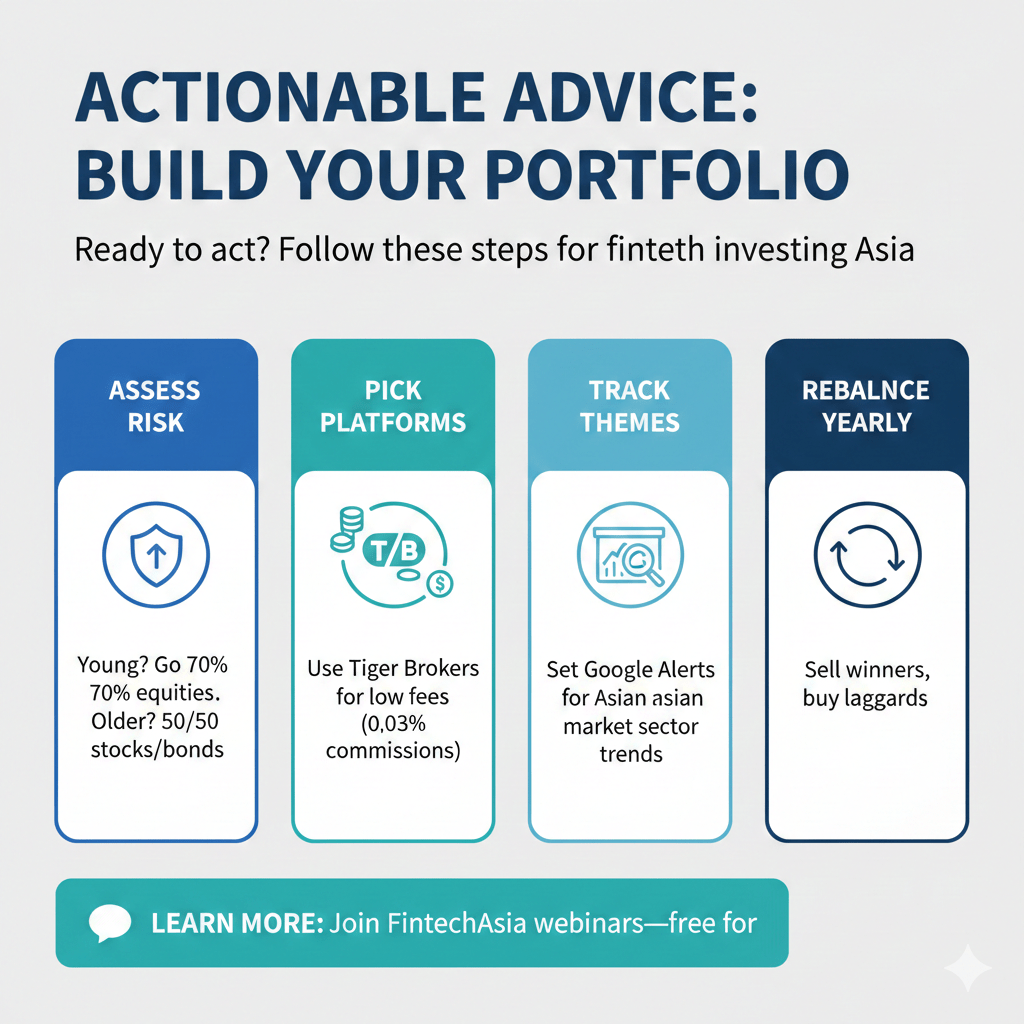

Ready to act? Follow these steps for fintech investing Asia:

- Assess Risk: Young? Go 70% equities. Older? 50/50 stocks/bonds.

- Pick Platforms: Use Tiger Brokers for low fees (0.03% commissions).

- Track Themes: Set Google Alerts for Asian market sector trends.

- Rebalance Yearly: Sell winners, buy laggards.

- Learn More: Join FintechAsia webinars—free for basics.

Example Portfolio: 25% Tencent (tech), 20% Renewables ETF, 15% Grab (fintech), rest cash. Expected return: 10-12%.

Boost skills with what is SEO in digital marketing for promo plays.

Who Benefits Most?

FTAsiaStock market trends from FintechAsia suit diverse crowds.

- Retail Investors: Tech-savvy millennials in Manila or Mumbai use apps for quick trades. They seek stock market insights Asia to grow savings 15% yearly.

- Thematic Investors: Long-haul folks betting on sustainable investing Asia—e.g., a Singapore fund manager eyeing 5-year ESG holds.

- Pros and Analysts: Fund teams in Hong Kong crunch Fintech stock analysis Asia for $1M+ decisions.

- Fintech Fans: Startup founders tracking digital finance market Asia for synergies.

- Regional Diversifiers: Expats in Dubai mixing VN stocks with home plays.

Goals? Spot growth, cut risks, ride tech waves. Gaps: Skip if you’re ultra-conservative—stick to bonds.

For beginner finance paths, link to finance certifications for beginners.

FAQs: FTAsiaStock Market Trends from FintechAsia

What exactly is “ftasiastock market trends from fintechasia”?

It is the popular weekly and monthly analysis series published by FintechAsia that tracks Asian stock market trends 2025, fintech investing Asia, ESG trends in Asia stocks, technology stocks Asia, and emerging market stocks Asia using real-time data and AI insights.

Who writes the FTAsiaStock market analysis?

A team of former fund managers, ex-bank analysts, and data scientists based in Singapore, Hong Kong, and Mumbai. They combine on-the-ground research with AI in Asian stock markets to give clear, unbiased updates.

Is FintechAsia only about crypto?

No. While they cover ftasiastock crypto and blockchain impact on stock trading Asia, most content focuses on regular stocks, ETFs, fintech companies, green energy, and digital finance market Asia.

Which Asian markets get the most coverage in 2025?

- China & Hong Kong

- India

- South Korea & Taiwan (semiconductors)

- Vietnam, Indonesia, Thailand (fastest-growing emerging markets)

- Japan and Singapore (developed markets + fintech hubs)

Are these trends good for beginner retail investors?

Yes! FintechAsia stock trends are written in simple language and always include low-cost, beginner-friendly ways to invest (ETFs, fractional shares, fintech-enabled trading platforms Asia).

Conclusion: Seize FTAsiaStock Market Trends from FintechAsia Today

FTAsiaStock market trends from FintechAsia signal Asia’s golden era2: AI-fueled rallies, green booms, and fintech frontiers. With Asian stock market trends 2025 forecasting 8% gains, now’s time to diversify into emerging market stocks Asia. Tools like mobile platforms make it easy—start small, learn fast, win big. You’ve got the map; step forward confidently.

What ftasiastock market trend excites you most for 2025—AI stocks or ESG plays? Share below!

References

- ScientificAsia.net: “FTAsiaStock Market Trends from FintechAsia” (2025). Covers institutional analytics, macro shifts. ↩︎

- MozyDash.com: “FTAsiaStock Market Trends from FintechAsia” (2025). Details retail access via apps, +35% user growth. ↩︎