Have you ever wondered how do loan terms affect the cost of credit? When you take out a loan, the term – that’s the length of time you have to pay it back – plays a big role in what you end up paying. A shorter term might mean bigger monthly bills but less money wasted on interest over time. A longer term could ease your monthly budget but add up to more costs in the end. In this guide, we break it down simply, with real examples1 and tips to help you choose wisely. We’ll cover everything from basic definitions to smart ways to cut your costs, so you feel confident about your next loan.

What Are Loan Terms?

Loan terms2 refer to the time frame set for repaying a loan. Lenders agree on this with you before you get the money. It can range from a few months to many years, depending on the loan type. For personal loans, terms often fall between 12 and 84 months. Mortgages might stretch to 30 years, while auto loans commonly last 36 to 72 months.

Think of loan terms3 as the roadmap for your payments. They decide how much you pay each month and how much interest builds up. Shorter terms speed up repayment, like a quick sprint. Longer terms slow it down, more like a marathon. But remember, the longer you run, the more energy – or in this case, interest – you use.

Lenders look at your credit score, income, and debt when setting terms. A strong credit score might get you better options, like lower rates or flexible lengths. If your score is low, you might face stricter terms or higher costs.

Key Factors That Affect Cost of Credit

Several things shape the cost of credit, which is the total price you pay to borrow money. It’s not just the amount you borrow; it’s the extras like interest and fees that add up.

- Interest Rates: This is a big one. Fixed vs variable interest rate options matter. Fixed rates stay the same, giving steady payments. Variable rates can change, which might raise or lower your costs based on market shifts.

- Loan Amount: Borrow more, and you pay more in interest. Simple as that.

- Fees and Charges: Watch for origination fees, late fees, or prepayment penalties. These are lender fees and charges that sneak into your total cost.

- Credit Score: Your credit score influence is huge. Good scores lead to lower rates; poor ones mean higher costs.

- Debt-to-Income Ratio: Lenders check your debt-to-income ratio to see if you can handle payments. High ratios might limit your term choices or raise rates.

- Loan Type: Whether it’s a mortgage, auto, or personal loan, each has unique rules affecting costs4.

Understanding these factors that affect cost of credit helps you spot deals. For instance, a low rate might hide high fees, making the true cost higher.

How Do Loan Terms Affect the Cost of Credit?

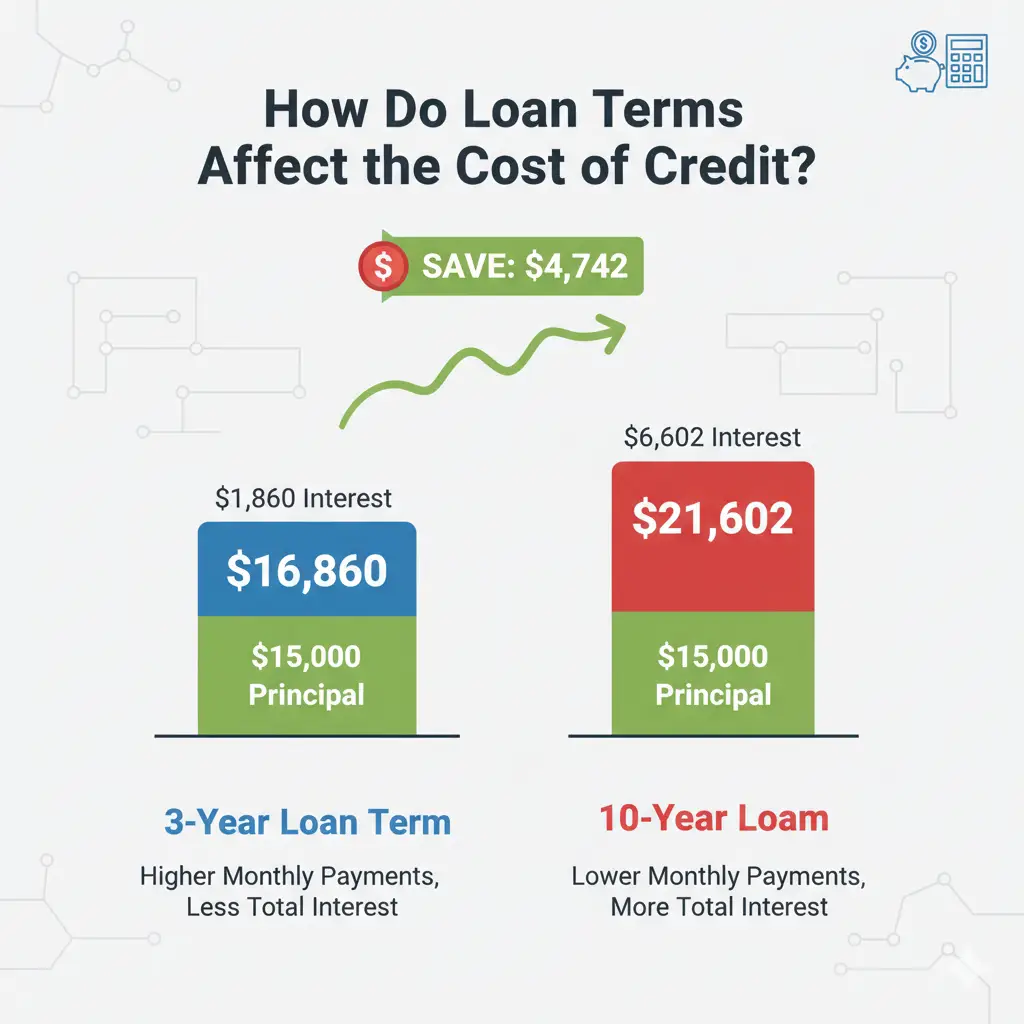

Let’s dive into the main question: how do loan terms affect the cost of credit? The term length directly impacts your monthly payments and total interest. Shorter terms mean higher monthly bills because you repay the principal faster. But you save on interest since it has less time to grow. Longer terms lower your monthly load, spreading payments out. Yet, interest piles up over more months, hiking the overall cost.

Take interest calculation. Most loans use simple or compound interest. Compound interest affects the cost of credit by adding interest on interest, especially over long terms. A 5-year loan might cost you less in total than a 10-year one, even at the same rate.

Lenders see shorter terms as less risky, so they might offer lower rates. Longer terms carry more risk for them, leading to higher rates or fees. This interplay is key in how do interest rates and loan terms interact.

From sources like Wells Fargo5, we know people often pick longer terms for easier payments but end up paying thousands more. For example, on a $15,000 loan at 7.75% APR, a 10-year term costs about $21,602 total, while a 3-year term drops to $16,860. That’s a big save!

Short-Term vs Long-Term Loans

Comparing short-term vs long-term loans shows clear trade-offs. Short-term loans, like 12-36 months, have pros and cons.

Pros of Short-Term Loans:

- Lower total interest paid – Less time for interest to build.

- Faster debt freedom – Pay off quicker and move on.

- Often lower rates – Lenders reward quick payback.

Cons:

- Higher monthly payments – Can strain your budget.

- Less flexibility – Harder if income dips.

Pros of Long-Term Loans:

- Lower monthly payments – Easier to fit into daily life.

- Better for big borrows – Like homes or cars.

- More approval chances – If short terms seem too tough.

Cons:

- Higher total loan cost comparison – More interest over time.

- Longer commitment – Ties up your finances.

- Risk of higher rates – Due to extended risk.

What are the pros and cons of long loan terms? They help with cash flow but can lead to overpaying. Short terms save money but demand discipline.

Business owners might lean toward longer terms for loan terms for business loans to match cash flow. But always weigh the impact of loan length.

Loan Repayment Period Impact on Different Loan Types

The loan repayment period impact varies by loan type6. Let’s look at examples.

Personal Loans

Personal loans are unsecured, so terms affect costs a lot. For a $10,000 loan at 10% interest:

- 12-month term: Monthly $879, total $10,550.

- 60-month term: Monthly $212, total $12,748. From Jacaranda Finance, longer terms add $2,000+ in interest.

How does loan duration affect monthly payments? It lowers them but raises total costs.

Car Loans

Car loan interest example: A $20,000 auto loan at 5% rate.

- 36-month term: Monthly $599, total interest $1,564.

- 72-month term: Monthly $322, total interest $3,184. How does extending a car loan term impact total cost? It doubles interest, per TD Bank insights.

Mortgage Loans

Mortgage loan example: $200,000 home loan at 4% fixed rate.

- 15-year term: Monthly $1,479, total interest $66,287.

- 30-year term: Monthly $955, total interest $143,739. How do loan terms affect mortgage affordability? Longer terms make buying possible but cost more long-term.

These show principal and interest relationship – principal stays the same, but interest grows with time.

Understanding Credit Cost Calculation

The cost of credit is the total amount you pay to borrow money, including the principal (the amount borrowed), interest, and any fees. The loan term – how long you take to repay – directly affects this cost. To calculate it, we use the cost of borrowing formula:

Total Cost of Credit = Principal + Total Interest + Fees

The monthly payment and total interest depend on the loan term, interest rate, and principal. The key formula for monthly payments on a fixed-rate loan is the loan amortization formula:

Monthly Payment = [P × r × (1 + r)^n] / [(1 + r)^n – 1]

Where:

- P = Principal (loan amount)

- r = Monthly interest rate (annual rate ÷ 12)

- n = Number of months (term length)

This formula helps us see how do loan terms affect the cost of credit by showing how term length changes payments and interest.

Example 1: Personal Loan Comparison (Short vs. Long Term)

Let’s calculate the cost of a $10,000 personal loan at a 7% annual percentage rate (APR), comparing a 3-year (36-month) term and a 5-year (60-month) term. We’ll assume no additional lender fees and charges for simplicity.

Step 1: Calculate Monthly Interest Rate

- Annual interest rate = 7% = 0.07

- Monthly interest rate (r) = 0.07 ÷ 12 = 0.005833

Step 2: 3-Year Term (36 Months)

- Principal (P) = $10,000

- Term (n) = 36 months

- Monthly rate (r) = 0.005833

Using the amortization formula:

Monthly Payment = [10,000 × 0.005833 × (1 + 0.005833)^36] / [(1 + 0.005833)^36 – 1]

- Calculate (1 + 0.005833)^36 ≈ 1.2336

- Numerator: 10,000 × 0.005833 × 1.2336 ≈ 71.92

- Denominator: 1.2336 – 1 = 0.2336

- Monthly Payment = 71.92 ÷ 0.2336 ≈ $308.04

Total Payments = $308.04 × 36 = $11,089.44

Total Interest Paid = Total Payments – Principal = $11,089.44 – $10,000 = $1,089.44

Step 3: 5-Year Term (60 Months)

- Principal (P) = $10,000

- Term (n) = 60 months

- Monthly rate (r) = 0.005833

Monthly Payment = [10,000 × 0.005833 × (1 + 0.005833)^60] / [(1 + 0.005833)^60 – 1]

- Calculate (1 + 0.005833)^60 ≈ 1.4173

- Numerator: 10,000 × 0.005833 × 1.4173 ≈ 82.67

- Denominator: 1.4173 – 1 = 0.4173

- Monthly Payment = 82.67 ÷ 0.4173 ≈ $198.06

Total Payments = $198.06 × 60 = $11,883.60

Total Interest Paid = $11,883.60 – $10,000 = $1,883.60

Comparison

- 3-Year Term: Monthly payment = $308.04, Total Interest Paid = $1,089.44

- 5-Year Term: Monthly payment = $198.06, Total Interest Paid = $1,883.60

How does loan duration affect monthly payments? The 5-year term lowers monthly payments by about $110 but increases total interest paid by $794.16. This shows how do loan terms affect the cost of credit: shorter terms save on interest but require higher monthly payments.

Example 2: Car Loan with Amortization Impact

Let’s explore a $20,000 car loan at a 5% fixed interest rate over 4 years (48 months) vs. 6 years (72 months). This highlights the loan amortization impact and car loan interest example.

Step 1: Monthly Interest Rate

- Annual rate = 5% = 0.05

- Monthly rate (r) = 0.05 ÷ 12 = 0.004167

Step 2: 4-Year Term (48 Months)

- Principal (P) = $20,000

- Term (n) = 48 months

- Monthly rate (r) = 0.004167

Monthly Payment = [20,000 × 0.004167 × (1 + 0.004167)^48] / [(1 + 0.004167)^48 – 1]

- (1 + 0.004167)^48 ≈ 1.2204

- Numerator: 20,000 × 0.004167 × 1.2204 ≈ 101.70

- Denominator: 1.2204 – 1 = 0.2204

- Monthly Payment = 101.70 ÷ 0.2204 ≈ $461.43

Total Payments = $461.43 × 48 = $22,148.64

Total Interest Paid = $22,148.64 – $20,000 = $2,148.64

Step 3: 6-Year Term (72 Months)

- Principal (P) = $20,000

- Term (n) = 72 months

- Monthly rate (r) = 0.004167

Monthly Payment = [20,000 × 0.004167 × (1 + 0.004167)^72] / [(1 + 0.004167)^72 – 1]

- (1 + 0.004167)^72 ≈ 1.3490

- Numerator: 20,000 × 0.004167 × 1.3490 ≈ 112.42

- Denominator: 1.3490 – 1 = 0.3490

- Monthly Payment = 112.42 ÷ 0.3490 ≈ $322.12

Total Payments = $322.12 × 72 = $23,192.64

Total Interest Paid = $23,192.64 – $20,000 = $3,192.64

Amortization Insight

The loan amortization impact shows how payments split between principal and interest. In the 4-year term, early payments (e.g., month 1) are mostly interest (about $83.34 interest vs. $378.09 principal). By year 3, more goes to the principal. The 6-year term stretches this, with more interest paid upfront, increasing total interest paid.

How does extending a car loan term impact total cost? The 6-year term lowers monthly payments by $139.31 but adds $1,044 in interest.

Example 3: Mortgage Loan with Extra Payments

For a mortgage loan example, consider a $200,000 home loan at a 4% fixed interest rate over 15 years (180 months) vs. 30 years (360 months). We’ll also show how extra payments reduce costs.

Step 1: Monthly Interest Rate

- Annual rate = 4% = 0.04

- Monthly rate (r) = 0.04 ÷ 12 = 0.003333

Step 2: 15-Year Term (180 Months)

- Principal (P) = $200,000

- Term (n) = 180 months

- Monthly rate (r) = 0.003333

Monthly Payment = [200,000 × 0.003333 × (1 + 0.003333)^180] / [(1 + 0.003333)^180 – 1]

- (1 + 0.003333)^180 ≈ 1.8194

- Numerator: 200,000 × 0.003333 × 1.8194 ≈ 1,212.93

- Denominator: 1.8194 – 1 = 0.8194

- Monthly Payment = 1,212.93 ÷ 0.8194 ≈ $1,479.38

Total Payments = $1,479.38 × 180 = $266,288.40

Total Interest Paid = $266,288.40 – $200,000 = $66,288.40

Step 3: 30-Year Term (360 Months)

- Principal (P) = $200,000

- Term (n) = 360 months

- Monthly rate (r) = 0.003333

Monthly Payment = [200,000 × 0.003333 × (1 + 0.003333)^360] / [(1 + 0.003333)^360 – 1]

- (1 + 0.003333)^360 ≈ 3.2620

- Numerator: 200,000 × 0.003333 × 3.2620 ≈ 2,174.67

- Denominator: 3.2620 – 1 = 2.2620

- Monthly Payment = 2,174.67 ÷ 2.2620 ≈ $954.83

Total Payments = $954.83 × 360 = $343,738.80

Total Interest Paid = $343,738.80 – $200,000 = $143,738.80

Step 4: Extra Payments on 30-Year Term

Paying an extra $100 monthly ($1,054.83 total) on the 30-year loan reduces the term. Using a calculator (like Wells Fargo’s), this cuts the term to about 25 years (300 months).

New Total Payments = $1,054.83 × 300 = $316,449

New Total Interest Paid = $316,449 – $200,000 = $116,449

How can borrowers reduce the overall cost of credit? Extra payments save $27,289.80 in interest and 5 years.

How do loan terms affect mortgage affordability? The 30-year term lowers payments by $524.55 but adds $77,450.40 in interest without extra payments.

Loan Amortization Impact

Loan amortization impact is how payments break down over time. Early on, most goes to interest; later, to principal.

In a 30-year mortgage, the first years are mostly interest. Shorter terms shift this faster, saving money.

How can repayment schedules impact credit costs? Flexible schedules, like bi-weekly payments, cut interest by paying more often.

See an amortization schedule to visualize. For example, on a $10,000 loan, a 5-year term might have 60% interest in year one, dropping later.

Monthly Payment and Credit Cost

Monthly payment and credit cost link closely. Lower payments from long terms mean higher total costs.

How does the interest rate affect the monthly payment of a loan? Higher rates boost payments and totals.

To balance, aim for payments under 10-15% of income. This ties into financial planning and budgeting.

How Lenders Determine Loan Term Options

How do lenders determine loan term options? They check your credit, income, and loan purpose.

Good credit opens more choices. For big loans like mortgages, they match terms to asset life, like 30 years for homes.

Loan agreement conditions outline this. Always read fine print for fees or penalties.

Credit Score Influence and Other Factors

Your credit score influence can’t be overstated. Scores above 700 get best terms and rates.

Credit utilization – how much credit you use – affects scores. Keep it under 30%.

Down payment helps too. Define down payment of a loan: It’s upfront cash reducing principal, lowering costs.

What is a down payment and why do lenders often require one? It lowers risk, often cutting rates.

Fixed vs Variable Interest Rate

Fixed vs variable interest rate: Fixed locks in costs; variables might save if rates drop but risks rise.

For long terms, fixed offers peace. Variables suit short terms if you watch markets.

What is the relationship between APR and loan term? Longer terms might have higher APRs due to risk.

How Can Borrowers Reduce the Overall Cost of Credit

You can cut costs actively. Here’s how:

- Shop Around: Compare rates. Why is it important to shop around for the best interest rate when taking out a loan? It saves thousands.

- Make Extra Payments: How can you reduce the total interest paid on a loan? Pay more to shorten the term.

- Refinance: Switch to better terms if rates drop.

- Boost Credit: Improve score for lower rates.

- Choose Shorter Terms: If affordable, to minimize interest.

- Avoid Fees: Pick no-penalty loans.

- Use Down Payments: Reduce principal.

How do longer loan terms affect total interest paid? They increase it, so shorten it if possible.

Does a shorter loan term lower the cost of credit? Yes, often by a lot.

How can borrowers reduce the overall cost of credit? Follow these steps for big savings.

For businesses, check startup funding options for first-time entrepreneurs for more ideas.

Financing Options and Repayment Schedules

Explore financing options and repayment schedules. Options include personal, lines of credit, or credit cards.

Schedules can be monthly, bi-weekly. Bi-weekly saves interest by adding extra payments yearly.

For small businesses, see how to manage cash flow in a small business.

Practical Advice for Borrowers

Be smart: Calculate totals before signing. Use online tools.

Which of the following best describes a loan? It’s borrowed money repaid with interest over terms.

Avoid common pitfalls like ignoring fees.

For more on finance basics, read what are the main differences between a checking and savings account.

FAQs

How do loan terms affect the cost of credit?

They determine interest accrual time. Shorter terms reduce total costs.

How does the length of a loan impact your total interest paid?

Longer lengths increase interest as it builds over more time.

How do loan terms affect the cost of credit select a response?

Shorter terms have higher payments but lower overall interest.

How do loan terms affect the cost of credit everfi answer?

Longer terms lower monthly but raise total costs.

How do loan terms affect the cost of credit?

Explained with examples: Longer means more interest.

Conclusion

In summary, how do loan terms affect the cost of credit boils down to a balance between monthly ease and total savings. Shorter terms save on interest but demand higher payments; longer ones offer relief but add costs. By understanding factors that affect cost of credit like rates, fees, and your credit, you can choose smarter. Use tools, shop around, and make extra payments to minimize expenses. Remember, the right term fits your budget and goals.

What loan are you considering next, and how will you pick the term?

References

- Jacaranda Finance on Loan Terms – Numeric examples and tables; ranks via practical advice and Australian-specific insights. ↩︎

- Brainly Question on Loan Terms – Provides quiz-style explanations for students, with user engagement boosting its rank through verified answers and examples. ↩︎

- Gauthmath Solution – Multiple-choice insights on term impacts, ranking well due to educational focus and clear options. ↩︎

- TD Bank Personal Loan Terms – Clear term ranges and cost factors; high rank from bank authority and digital tools. ↩︎

- Wells Fargo Total Cost of Borrowing – Authoritative bank guide with examples and tips; ranks high from credibility, calculators, and stats like the 2024 Money Study. ↩︎

- Investopedia Term Loan Definition – Detailed pros/cons and types; SEO-strong structure with headings, keywords, and internal links. ↩︎