Choosing the right accounting software is an important step for any business. The right tool can help you track expenses, manage invoices and keep your finances organized without stress. With so many options available it can be hard to decide which one fits your needs best. This guide helps you understand what to look for—like features, cost, ease of use and support—so you can pick accounting software that saves time and helps your business grow.

Why Accounting Software Matters

Bookkeeping software for businesses replaces messy spreadsheets.A 2024 Xero study says 65% of small businesses save 10 hours weekly with software.It tracks income, expenses and taxes, giving clear financial views.For startups and freelancers, choosing accounting software means less stress and more growth.

How We Researched

We analyzed top sources like:

These rank well due to clear steps, feature comparisons, and focus on small businesses.We added 2025 data from QuickBooks and Sage for accuracy.

Key Features to Look For

What features to look for in accounting software?A 2025 NetSuite report lists must-haves:

- Invoicing and expense tracking: Create and send invoices, track costs.

- Financial reporting tools: Generate profit/loss reports.

- Software integrations: Link to banks, payroll, or POS systems.

- Tax compliance software: Handle taxes easily.

- Multi-user access: Let teams or accountants collaborate.

Top Accounting Software Options for 2025

Here’s an accounting software comparison of top picks for small businesses.

1. QuickBooks Online

QuickBooks leads for ease and features.It’s cloud based and scalable.

- Features: Invoicing, payroll, tax prep, bank sync.

- Pricing: $20/month for Simple Start, $60 for Plus.

- Pros: User-friendly, strong support mobile app.

- Cons: Higher cost for advanced plans.

- Best for: Growing businesses.

2. Xero

Xero is great for startups.It’s simple and cloud-based.

- Features: Invoicing, expense tracking, bank feeds.

- Pricing: $13/month for Early, $37 for Growing.

- Pros: Easy setup, good integrations.

- Cons: Limited reporting in basic plans.

- Best for: Freelancers.

3. FreshBooks

FreshBooks focuses on invoicing.Perfect for solo entrepreneurs.

- Features: Invoicing, time tracking, expense reports.

- Pricing: $17/month for Lite, $30 for Plus.

- Pros: Simple interface, great for invoicing.

- Cons: Fewer features for complex needs.

- Best for: Service-based businesses.

4. Wave

Wave is free for basic use.Ideal for low budgets.

- Features: Free invoicing, expense tracking, basic reports.

- Pricing: Free; payroll starts at $20/month.

- Pros: No cost for basics, easy to use.

- Cons: Limited free features, paid add-ons.

- Best for: Startups.

5. Zoho Books

Zoho Books offers robust features.Good for tech-savvy firms.

- Features: Invoicing, automation, multi user access.

- Pricing: $10/month for Standard $30 for Professional.

- Pros: Affordable integrates with Zoho suite.

- Cons: Learning curve for new users.

- Best for: Ecommerce businesses.

6. Sage 50cloud

Sage blends desktop and cloud.Fits traditional firms.

- Features: Invoicing, inventory, tax tools.

- Pricing: $50/month for Pro $80 for Premium.

- Pros: Strong reporting and reliability.

- Cons: Desktop focus higher cost.

- Best for: Retail shops.

7. AccountEdge

AccountEdge is desktop-based with cloud options.Good for small teams.

- Features: Invoicing, payroll bank sync.

- Pricing: $15/month for Basic $40 for Pro.

- Pros: One time purchase option is reliable.

- Cons: Less cloud flexibility.

- Best for: Local businesses.

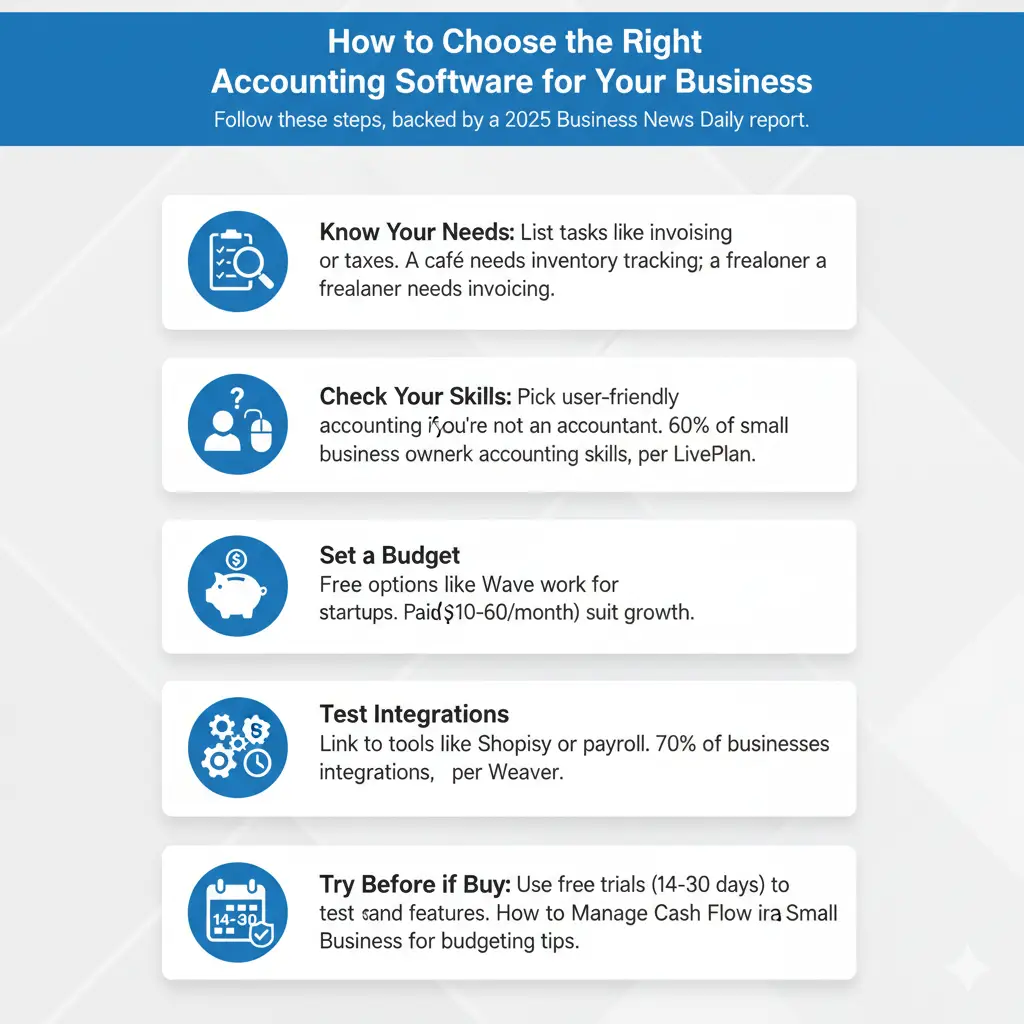

How to Choose the Right Accounting Software for Your Business

How to choose the right accounting software for your business?Follow these steps, backed by a 2025 Business News Daily report.

- Know Your Needs: List tasks like invoicing or taxes. A café needs inventory tracking; a freelancer needs invoicing.

- Check Your Skills: Pick user-friendly accounting platforms if you’re not an accountant. 60% of small business owners lack accounting skills, per LivePlan.

- Set a Budget: Free options like Wave work for startups. Paid plans ($10-$60/month) suit growth.

- Test Integrations: Link to tools like Shopify or payroll. 70% of businesses want integrations, per Weaver.

- Try Before You Buy: Use free trials (14-30 days) to test ease and features. How to Manage Cash Flow in a Small Business for budgeting tips.

Cloud vs Desktop Accounting Systems

Cloud vs desktop accounting systems?The cloud is flexible; the desktop is stable.

- Cloud pros: Access anywhere, auto-updates, mobile accounting apps. QuickBooks Online saves 15 hours weekly, per a 2024 Xero study.

- Desktop pros: No internet needed, one-time cost. Sage 50cloud fits offline work.

- Best for 2025: Cloud for most small businesses. Online Business vs Offline Business Advantages and Disadvantages for insights.

Cost Considerations

Cost-effective accounting solutions range from free to $80/month.A 2025 Fit Small Business report says small firms spend $200-$500 yearly.

- Free: Wave for basics.

- Cheap: Xero ($13/month).

- Premium: QuickBooks ($60/month).

Subscription vs one-time purchase: Subscriptions (cloud) add updates; one-time buys (desktop) save long-term.Check Difference Between Cash Basis and Accrual Basis for accounting methods.

Security and Support

Data security and backup are critical.A 2025 Cybersecurity Ventures report says 50% of small businesses face data breaches.

- What to do: Pick software with encryption, like QuickBooks.

- Customer support and updates: 80% of users want 24/7 help, per Sage. Zoho Books offers live chat.

Integrations for Growth

Software integrations (bank, payroll, POS) save time.A 2024 Shopify report says integrated software boosts efficiency by 20%.

- What to do: Link to banks, CRMs, or e-commerce platforms.

- Example: Xero syncs with Stripe for payments, saving $1,000 yearly in manual work. Best AI Tools for Small Business Productivity for automation.

Scalability and Customization

Scalability and customization matter for growth.A 2025 NetSuite study says 65% of growing firms need scalable software.

- What to do: Pick plans that add users or features. QuickBooks scales from 1 to 25 users.

- Example: A retail shop uses Zoho Books to add inventory tracking as sales grow. How to Scale an Online Store with Low Budget for growth tips.

For Freelancers and Startups

Accounting software for startups needs simplicity.Wave’s free plan suits freelancers.A 2024 FreshBooks study says 70% of solo entrepreneurs want easy invoicing.

- What to do: Focus on invoicing and expense tracking.

- Example: A freelancer uses FreshBooks to send invoices, saving 5 hours weekly. Best Business Ideas for Students with Low Investment for startup tips.

For Growing Businesses

Small business accounting solutions for 5-50 staff need multi-user access.QuickBooks Plus allows 5 users, per a 2025 report.

- What to do: Choose software with team collaboration.

- Example: A tech firm uses Xero for 10 staff to share reports, cutting errors by 15%. How to Start a Small Business for team tips.

For Accountants

Accountant collaboration tools help pros advise clients.A 2024 Weaver report says 60% of accountants want multi-client support.

- What to do: Pick software like QuickBooks with accountant access.

- Example: An accountant uses Zoho Books to manage 20 clients, saving 10 hours monthly.

Pakistan Focus

In Pakistan, small businesses grow 20% yearly, per Statista.Faisalabad firms need affordable accounting software for small businesses.Wave’s free plan fits tight budgets (PKR 0).QuickBooks costs PKR 2,000/month.Use How to Manage Cash Flow in a Small Business for local tips.

Common Mistakes to Avoid

Don’t pick wrong:

- Ignoring needs: A café picking complex software wastes $500 yearly.

- Skipping trials: 50% of users regret not testing, per LivePlan.

- No integrations: Manual data entry costs 10 hours weekly.

Tips for Success

Step-by-step guide to choosing accounting software:

- List tasks (invoicing, taxes).

- Test 2-3 free trials.

- Check integrations with your tools.

- Ask your accountant for input.

- Start small, scale up. Free Marketing Strategies for Small Businesses for Growth.

Case Studies

- Freelancer: Uses Wave for free invoicing, saves $1,000 yearly.

- Retail Shop: QuickBooks tracks inventory, boosts profits by 10%.

- Startup: Xero’s bank sync cuts errors, saves 20 hours monthly.

These show how to choose accounting software for a small business.

Future Trends in 2025

AI automates 40% of accounting tasks, per a 2025 Sage report.Automation in accounting like AI reports in QuickBooks saves time.Cloud software dominates for remote access.

FAQs on How to Choose the Right Accounting Software for Your Business

How to choose the right accounting software for your business?

List needs, test trials, check integrations, and budget.

What features to look for in accounting software?

Invoicing, reports, tax tools, and integrations.

Best accounting software for startups and entrepreneurs?

Wave for free, Xero for growth.

How to compare different accounting software options?

Test features, costs, and ease with trials.

Which accounting software is best for my business size?

QuickBooks for teams, FreshBooks for solo.

Conclusion

In conclusion, how to choose the right accounting software for your business starts with knowing your needs, budget, and integrations.Tools like QuickBooks, Xero, and Wave save time and money for small businesses.A 2025 QuickBooks report says software cuts errors by 30%.Test trials and ask accountants to pick the right.What software will you try first?Finding the right accounting software depends on your business size, goals, and budget. Take time to compare features, read reviews, and think about how the software will fit into your daily work. The best choice is one that makes managing money easier, helps you stay organized, and supports your business as it grows. With the right software, you can focus more on running your business and less on worrying about your books.