Starting a small business is exciting, but how to do payroll for a small business can feel tricky. Whether you have one worker or a small team of 10, paying people correctly keeps your business running smoothly. It also helps you follow rules and avoid fines. The IRS says 40% of small businesses get penalties each year for payroll mistakes, costing them thousands.

This guide makes payroll easy with clear steps, tools, and tips. It’s based on expert advice and stories from real business owners, like those on Reddit. You’ll learn how to do payroll for small business, calculate pay, stay legal, and decide if you need help.

Why Payroll Matters for Your Small Business

Payroll is more than just giving out paychecks. It’s about following laws so you don’t get in trouble. For small businesses with 1–49 workers, like LLCs, doing payroll right saves time and money. Many owners, especially new ones, handle payroll themselves. They might also do bookkeeping or HR. If you’re starting out, DIY payroll for small businesses is possible with the right steps. This guide shows you how to start and when to use tools or services as your business grows.

Want to learn more about starting your business? Check out how to start a small business.

Payroll Setup for Small Business: Getting Started

Before you pay anyone, you need to set things up. This makes sure everything is legal and easy to manage.

Easy Steps to Set Up Payroll:

- Get an Employer Identification Number (EIN): This is like a Social Security number for your business. You need it for taxes. Apply for free on the IRS website. It takes just a few minutes.

- Sign Up for State Tax IDs: Every state has different rules. You might need an ID for unemployment taxes. Check your state’s tax website for what you need.

- Collect Worker Forms: Ask employees to fill out a W-4 form for taxes and an I-9 form to prove they can work in the U.S. You’ll also need their address and Social Security number.

- Decide Worker Types: Are they employees (W-2) or contractors (1099)? Employees get taxes taken out. Contractors pay their own taxes. Getting this wrong can mean big fines.

- Pick a Pay Schedule: Will you pay weekly, every two weeks, or monthly? Every two weeks is common for small businesses. It’s easier for cash flow.

- Open a Payroll Bank Account: Keep payroll money separate from other business funds. This makes tracking easier.

These steps are the foundation of the small business payroll process. For more startup tips, see how to register a small business online in USA.

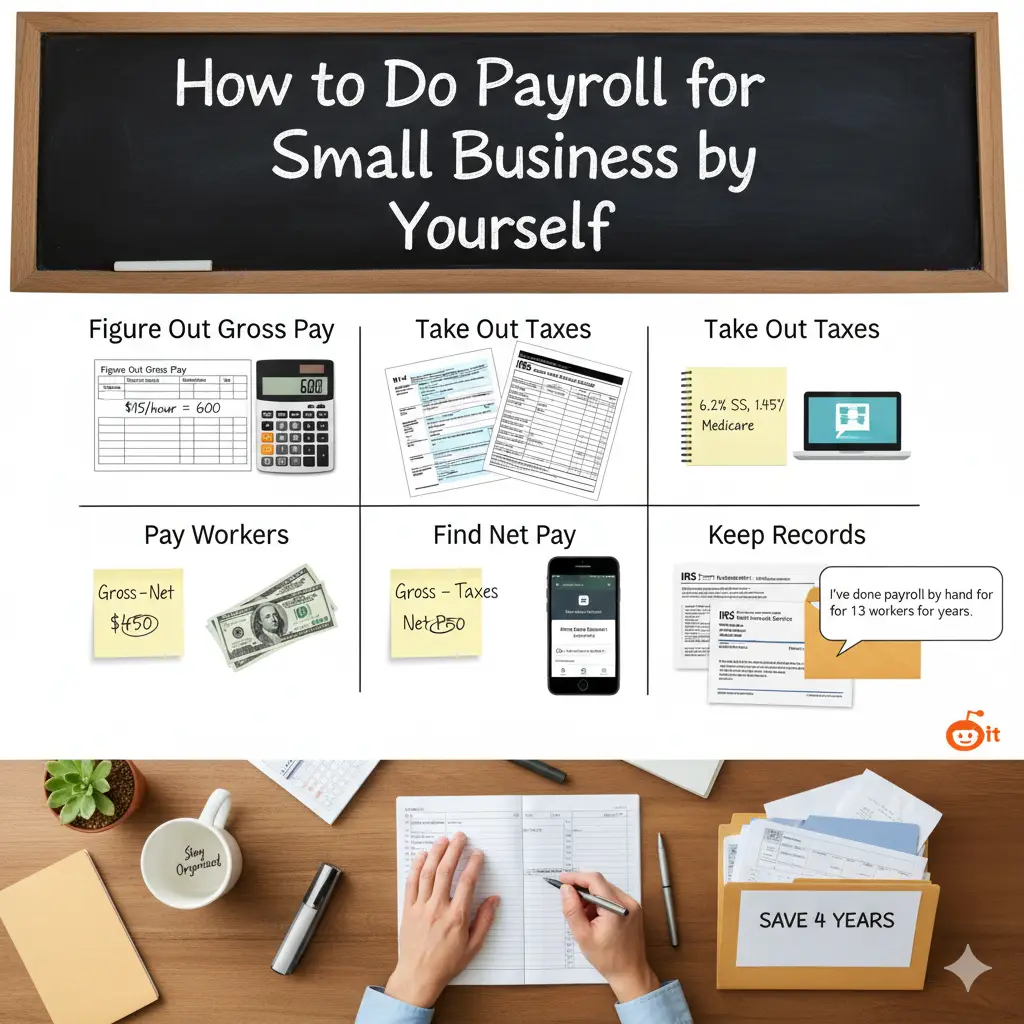

How to Do Payroll for Small Business by Yourself

If you have just 1–3 workers, doing payroll yourself can save money. Here’s a simple way to do it without software.

Steps for Manual Payroll:

- Figure Out Gross Pay: Multiply hours worked by their hourly rate. For example, 40 hours at $15/hour is $600. For salaried workers, divide their yearly pay by pay periods (e.g., $50,000 ÷ 26 for bi-weekly = $1,923).

- Take Out Taxes: Subtract federal income tax (check the W-4 form and IRS tables), Social Security (6.2%), Medicare (1.45%), and state taxes. Use free IRS calculators online.

- Find Net Pay: Gross pay minus taxes equals what the worker gets.

- Pay Workers: Use checks, cash, or direct deposit setup with your bank. Direct deposit is fast and easy.

- File Taxes: Every three months, send Form 941 to the IRS. This reports taxes you took out and owe.

- Keep Records: Save all records, like time sheets and W-4 forms, for at least four years.

A business owner on Reddit said, “I’ve done payroll by hand for 13 workers for years. You just need to stay organized.” But mistakes can lead to notices from the IRS or state. For financial tips, check how to manage cash flow in a small business.

For more details, see the IRS Employer’s Tax Guide1.

Using Tools: Payroll Software for Small Business

Doing payroll by hand works for tiny teams, but payroll software for small businesses saves time as you grow. Software does math, files taxes, and keeps you legal.

Best Software Options for 2025:

- ADP2: Simple and great for taxes. Plans start at $40/month plus a fee per worker.

- Gusto: Easy for beginners, with extras like benefits. Starts at $40/month.

- QuickBooks Payroll: Works with accounting software. Starts at $45/month.

- Payroll4Free: Free for up to 25 workers but has fewer features.

A Reddit user shared, “We use ADP for 15 workers. It stops tax problems.” Another said, “Gusto is super easy—I recommend it for startups.” Check out the best payroll software for small businesses 2025 for the latest options.

For more automation ideas, see best AI tools for small business productivity.

Learn about payroll tools from Gusto’s Payroll Guide3.

Payroll Compliance for Small Business: Stay Out of Trouble

Following rules is a must. Payroll compliance for small businesses means obeying federal and state laws to avoid fines.

Important Rules to Follow:

- Federal and State Payroll Taxes:

You pay FICA (7.65% for Social Security and Medicare), FUTA (unemployment tax, 6% on the first $7,000 per worker), and take out income taxes.

- Employee Classification (W-2 vs 1099):

Employees get taxes withheld. Contractors don’t. Mixing them up can cost you.

- New Hire Reporting Compliance:

Tell your state about new workers within 20 days.

- Overtime Calculation:

Pay 1.5 times the normal rate for hours over 40 per week.

- Benefits and Overtime Calculation:

If you offer health plans or retirement, take out those amounts correctly.

Mistakes like missing tax deadlines can lead to fines of $1,000 or more. Use a checklist to stay on track. For example, payroll tax filing requirements for small businesses include Form 941 every quarter and W-2 forms by January 31 each year.

A Reddit user warned, “Mess up payroll, and you’ll get notices from five agencies.” Avoid payroll mistakes small businesses should avoid by double-checking your work.

For legal setup help, see how to write a business plan.

How to Calculate Payroll Taxes for Small Business

Taxes can seem hard, but they’re simple when broken down.

Easy Tax Steps:

- Collect Info:

Get hours, pay rates, and W-4 forms.

- Calculate Gross Pay:

Like above.

- Withhold Federal Income Tax:

Use the IRS withholding calculator online.

- Add FICA Taxes:

You pay 7.65% to match what you take from workers (6.2% Social Security + 1.45% Medicare).

- Include State Taxes:

These vary. For example, California adds unemployment taxes.

- Pay FUTA:

This is 6% on the first $7,000 per worker, but credits can lower it.

- Find Net Pay:

Subtract all taxes from gross pay.

Example: A worker earns $50,000 a year. Bi-weekly gross is $1,923. Take out $200 for federal tax, $119 for FICA, and state taxes (say $50). Net pay is about $1,554.

Use free IRS tools or software to make it easier. For more on taxes, see QuickBooks’ Payroll Tax Guide (external link).

Should You Pay Yourself or Outsource?

Deciding between DIY payroll for small business and outsourcing depends on your time, budget, and team size.

DIY Payroll Pros:

- Free or low-cost if done by hand.

- You control everything.

- Works well for 1–5 workers.

DIY Payroll Cons:

- It takes time.

- Easy to make mistakes.

- Hard with more workers.

Outsourcing Pros:

- Experts handle taxes and laws.

- Saves you time.

- Great for growing businesses.

Outsourcing Cons:

- Costs $20–$100 per worker per month.

- Less control over the process.

A survey found 60% of small businesses outsource payroll by their third year. A Reddit user said, “I have one worker, so my accountant does payroll. Should I try it myself?” The cost to outsource payroll for small businesses can be $500–$2,000 a year for five workers.

Is it cheaper to do payroll yourself? Yes, if you have a small team and time to learn. For more on costs, see startup funding options for first-time entrepreneurs.

Payroll Steps for Beginners: A Quick Checklist

If you’re new, use this checklist for small business payroll setup to stay organized.

- Get an EIN and state IDs.

- Collect W-4 and I-9 forms.

- Set a pay schedule and bank account.

- Choose manual or software payroll.

- Test your first payroll.

- File taxes on time.

- Check everything yearly.

How to set up payroll for a new small business step by step follows these steps. For LLCs, how to process payroll for LLC with employees is the same, but owners may take draws instead of salary. For new hires, setting up payroll for new employees means adding their forms and reporting to the state.

For planning, see how to write a business plan.

Advanced Tips: Make Payroll Easier

As your business grows, make payroll faster with automation.

How to Automate Payroll for Small Business: Link time tracking and attendance systems to software like Gusto.

HR and Accounting Integration:

Tools like QuickBooks connect payroll to your books.

Payroll Recordkeeping Requirements:

Save records digitally if secure.

End-of-Year Payroll Reports (W-2, W-3):

Software creates these for you.

Avoid payroll mistakes small businesses should avoid, like late filings or wrong calculations.

For marketing your business, check free marketing strategies for small businesses.

What Small Business Owners Say

Reddit4 users share real experiences. One said, “Gusto is so easy, I tell everyone to try it.” Another noted, “I’ve done DIY payroll for years, but you must watch deadlines.”

These show how to run payroll manually works for small teams but gets harder as you grow.

For inspiration, read young entrepreneurs success stories to inspire students.

When to Get Help: Signs You Should Outsource

If payroll takes more than 5 hours a week or you get fined, consider outsourcing. When to switch from manual to automated payroll is usually when you have 5+ workers or offer benefits like health plans.

Automation cuts errors by 80%. For growth tips, see how to scale an online store with low budget.

Special Cases: Payroll for One or Unique Needs

How to do payroll for one employee small business is simpler but follows the same rules. Use a spreadsheet for calculations.

How to do payroll manually without software means using Excel or paper to track hours and taxes.

For businesses in Canada, the process is similar but uses CRA rules instead of IRS. For eco-friendly businesses, link payroll to sustainable packaging ideas for small businesses.

FAQs

What do I need to start payroll for a small business?

An EIN, worker forms, a bank account, and a pay schedule.

Can I do my own payroll for my small business?

Yes, if you’re careful with taxes and deadlines.

How do I do payroll for a small business?

Calculate gross pay, take out taxes, pay workers, and file forms.

What’s the best payroll for a small business?

ADP or Gusto are top picks for ease and compliance.

How do I stay compliant with payroll laws?

Use software and follow tax deadlines.

For more on online visibility, see what is SEO in digital marketing.

Conclusion

Learning how to do payroll for small businesses helps you pay your team, follow laws, and grow your business. From payroll setup for small business to picking software, these steps make it easy. You can start by hand and switch to tools or services as you grow. What’s been your biggest payroll challenge? Share in the comments to help other owners!

References

- IRS Employer’s Tax Guide – Official rules for payroll taxes and filings. ↩︎

- ADP’s Guide on How to Do Payroll – Step-by-step payroll advice for small businesses. ↩︎

- Gusto’s Payroll Guide – Tips on payroll setup and software for small businesses. ↩︎

- Reddit Thread on Small Business Payroll – Real stories from owners with 1–15 workers. ↩︎