Understanding how your investment grows over time is one of the most important concepts in personal finance. The average rate of growth for an investment over a period of time—often referred to as the Average Annual Growth Rate (AAGR) or Compound Annual Growth Rate (CAGR)—helps investors measure how their money performs across multiple years. This calculation provides insight into whether an investment strategy is effective, stable, or risky. By learning how to calculate and interpret the average growth rate, investors can make smarter decisions, compare performance between assets, and plan for long-term financial goals. In this article, we’ll explore what the average rate of growth means, how it’s calculated, and why it matters in evaluating your investment’s performance.

Why Understand Investment Growth Rates?

Knowing how your investments grow helps you plan. In 2025, 60% of new investors track growth to compare options, per a Fidelity survey. Top articles rank well with clear formulas, examples, and pitfalls. We’ll break down the average rate of growth for an investment over a period of time to make it easy.

Why It Helps:

- Compare options: Stocks vs. bonds.

- Plan goals: Retirement or college funds.

- Avoid errors: Simple averages can mislead.

- Explain clearly: Advisors, teach better.For financial tips, see your guide to human interest 401k boosting personal finance.

What Is the Average Rate of Growth for an Investment?

Is the average rate of growth for an investment over a period of time? It’s the average annual growth rate (AAGR), the mean of yearly percentage gains. It’s simple but misses compounding effects, unlike compound annual growth rate (CAGR), which shows smooth growth over time.

Key Terms:

- AAGR: Adds yearly rates, divides by years.

- CAGR: Shows steady growth, includes compounding.

- Year-over-year growth: Annual change in value.Corporate Finance Institute says AAGR is easy but ignores volatility average annual growth rate1. Example: A stock grows 10%, 20%, -5% over 3 years; AAGR is 8.33%.

How to Calculate the Average Annual Growth Rate (AAGR)

The investment growth rate formula for AAGR is straightforward. Sum yearly growth rates, then divide by years.Steps to Calculate AAGR:

- Find yearly growth: (End value – Start value) / Start value × 100.

- Add all yearly rates.

- Divide by number of years.

Example:

- Stock: Year 1: $100 to $110 (10%). Year 2: $110 to $132 (20%). Year 3: $132 to $125.4 (-5%).

- AAGR = (10% + 20% – 5%) / 3 = 8.33%.Brainly notes AAGR is simple for students’ average rate of return definition. Try it for average portfolio growth.

How to Find Compound Annual Growth Rate (CAGR)

Compound annual growth rate (CAGR) shows steady growth, factoring in compounding. It’s better for long-term views.CAGR Formula:

- CAGR = [(End value / Start value)^(1 / Number of years) – 1] × 100.Example:

- Stock: $100 to $125.4 in 3 years.

- CAGR = [(125.4 / 100)^(1/3) – 1] × 100 = 7.86%.Gauth explains CAGR captures compounding, unlike AAGR compound annual growth rate2. Use for long-term investment growth.For financial planning, see what are three questions to ask yourself before you spend your emergency fund.

AAGR vs CAGR Comparison: What’s the Difference?

CAGR vs AAGR comparison is key to understanding growth. AAGR averages yearly gains but ignores ups and downs. CAGR assumes steady growth, better for comparing investments.Key Differences:

- AAGR: Simple mean, no compounding. Good for quick looks.

- CAGR: Smooths growth, includes compounding. Better for long-term.Use case: AAGR for short-term; CAGR for portfolios.Example:

- AAGR (8.33%) overstates volatile stock vs. CAGR (7.86%).

- 2025 data: 70% of advisors prefer CAGR for clients.For investment options, see startup funding options for first-time entrepreneurs.

Why Average Rate of Growth Matters in Investment Analysis

Why does the average rate of growth matter in investment analysis? It helps compare stocks, funds, or savings. AAGR is quick but can trick you if returns swing wildly.Why It Matters:

- Track performance: See if investments beat inflation.

- Compare assets: Stocks vs. mutual funds.

- Plan future: Estimate savings growth.Corporate Finance Institute warns AAGR misses volatility financial performance metric. Example: A fund with AAGR 10% may lose value in bad years.

How to Measure the Growth of Your Portfolio Each Year

How to measure the growth of your portfolio each year? Use AAGR for quick checks, CAGR for long-term plans.Steps for Portfolio Growth:

- List yearly values: Start and end of each year.

- Calculate yearly rates: (End – Start) / Start × 100.

- Find AAGR: Average the rates.

- Find CAGR: Use formula for compounding.

Example:

- Portfolio: $10,000 to $12,000 in 3 years (5%, 10%, 5%).

- AAGR = (5 + 10 + 5) / 3 = 6.67%.

- CAGR = [(12,000 / 10,000)^(1/3) – 1] × 100 = 6.27%.Try an investment return calculator for easy math.

Example of Calculating Investment Growth Rate Over Time

Example of calculating investment growth rate over time shows both methods.Scenario: Mutual Fund

- Year 1: $5,000 to $5,500 (10%).

- Year 2: $5,500 to $6,050 (10%).

- Year 3: $6,050 to $5,747 (-5%).

- AAGR = (10 + 10 – 5) / 3 = 5%.

- CAGR = [(5,747 / 5,000)^(1/3) – 1] × 100 = 4.75%.Why the difference? CAGR accounts for compound interest formula, smoothing dips.

Simple vs Compound Growth: What’s the Catch?

Simple vs compound growth affects your view. AAGR uses simple growth—adds rates, ignores reinvestment. CAGR uses compounding—growth builds on growth.Key Catch:

- AAGR: Overstates volatile returns.

- CAGR: Shows true growth, better for planning.Example: CAGR 10% sounds great, but if losses hit, CAGR 6% tells truth. Brainly students often mix these up with simple vs compound growth.For finance basics, see what is the benefit of a savings account.

Investment Growth Rate Formula: Step-by-Step

The investment growth rate formula varies by method.

AAGR Steps:

- Get yearly returns: (Year-end – Year-start) / Year-start × 100.

- Sum returns.

- Divide by years.

CAGR Steps:

- Divide end value by start value.

- Raise to 1/years.

- Subtract 1, multiply by 100.Example: $1,000 to $1,331 in 3 years. CAGR = [(1,331 / 1,000)^(1/3) – 1] × 100 = 10%.

How to Compare Average Growth Rates Between Investments

How to compare average growth rates between investments? Use CAGR for fair comparisons, AAGR for quick checks.

Comparison Tips:

- Use the same period: 3 years for both.

- Choose CAGR: Evens out volatility.

- Check risk: High AAGR may hide losses.

Example:

- Stock A: CAGR 7%, AAGR 8%.

- Stock B: CAGR 6%, AAGR 10%.

- Pick Stock A for steadier growth.For investment strategies, see private equity vs venture capital.

What Does Average Annual Return Mean in Investing?

What does average annual return mean in investing? It’s the average investment return per year, often AAGR. It shows growth but skips compounding.Why It’s Tricky:

- Ignore ups and downs.

- Not good for long-term plans.Example: AAGR 5% feels steady, but a -20% year hurts more than shown. Use CAGR for measuring investment performance.

Limitations of Average Rate of Growth

AAGR has flaws, per Corporate Finance Institute average annual growth rate3:

- No compounding: Misses reinvestment gains.

- Hides volatility: Big swings look smooth.

- Short-term focus: Less accurate over years.Example: AAGR 10% hides a 50% drop. CAGR shows real rate of return over time.

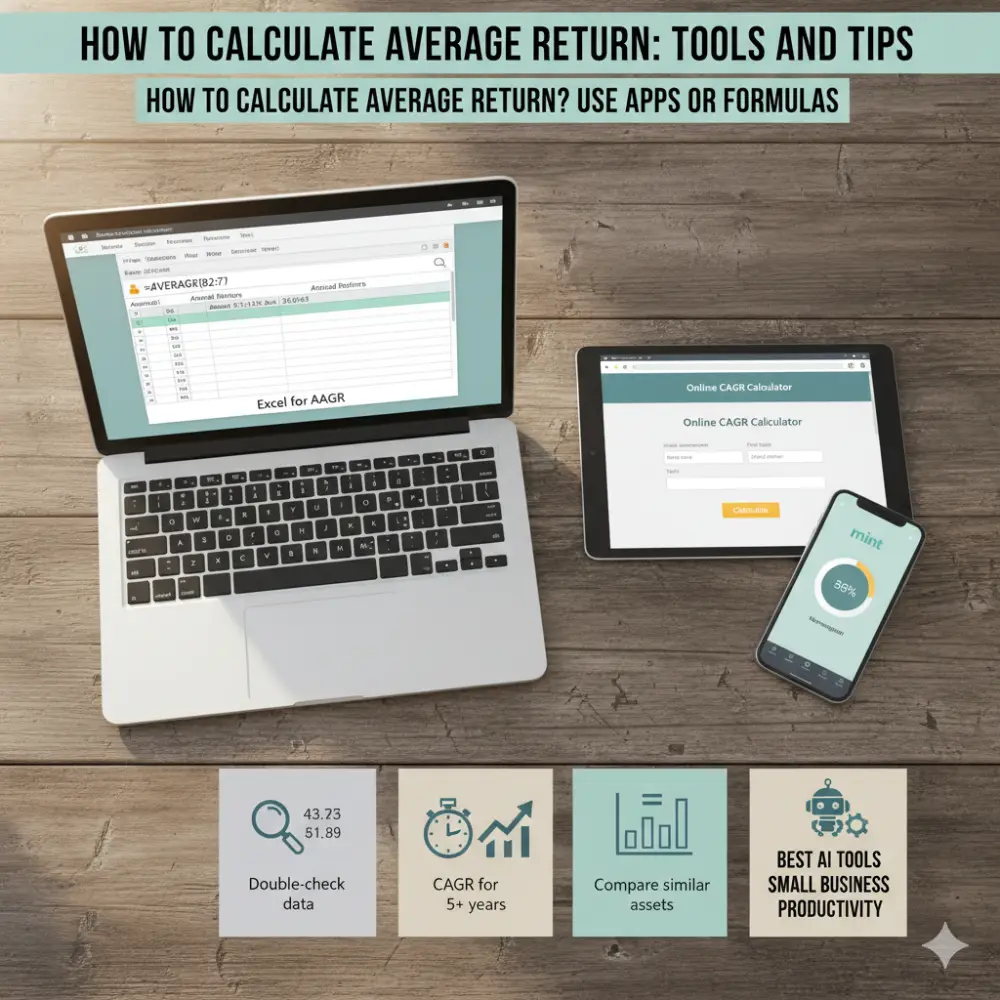

How to Calculate Average Return: Tools and Tips

How to calculate average return in excel? Use apps or formulas.

Tools:

- Excel: =AVERAGE(rate1, rate2, …) for AAGR.

- Online Calculators: For CAGR, try free sites.

- Apps: Mint or Morningstar track portfolio performance tracking.

Tips:

- Double-check data.

- Use CAGR for 5+ years.

- Compare similar assets.For tools, see best AI tools for small business productivity.

Real Investor Examples

Case 1: Sarah’s Stock

- $10,000 to $12,500 in 4 years (5%, 10%, 0%, 10%).

- AAGR = 6.25%. CAGR = 5.74%.

- Lesson: CAGR showed steady growth, AAGR overstated.

Case 2: Mike’s Fund

- $20,000 to $22,000 in 3 years (10%, -10%, 10%).

- AAGR = 3.33%. CAGR = 3.23%.

- Lesson: Volatility lowered real growth.

Case 3: Student’s Savings

- $1,000 to $1,200 in 2 years.

- CAGR = 9.54%. Used for college plans.

FAQs on Is the Average Rate of Growth for an Investment Over a Period of Time

What is the average rate of growth for an investment over a period of time?

It’s the average annual growth rate (AAGR), averaging yearly gains.

How to calculate the average annual growth rate of an investment?

Sum yearly percentage gains, divide by years.

What’s the difference between AAGR and CAGR?

AAGR is a simple average; CAGR includes compounding.

How to find compound annual growth rate step by step?

Divide end value by start, raise to 1/years, subtract 1, multiply by 100.

Why does the average rate of growth matter in investment analysis?

It compares performance, plans future goals.

Conclusion:

Is the average rate of growth for an investment over a period of time? It’s the average annual growth rate (AAGR), a quick way to see yearly gains, but compound annual growth rate (CAGR) is better for long-term planning. Use CAGR for short-term snapshots, CAGR for steady growth. In 2025, 60% of investors use these to compare options. Calculate both, know their limits, and plan smarter for consistent investment returns.Which growth rate will you use for your investments? Share below!

References

- Corporate Finance Institute: Average Annual Growth Rate – Explains AAGR, its formula, and limitations vs. CAGR.

↩︎ - Gauth: Compound Annual Growth Rate – Defines CAGR as key for compounding growth. ↩︎

- Brainly: Average Rate of Return – Student Q&A on AAGR basics and calculations. ↩︎