When it comes to paying for college, many students face the tough choice between federal and private student loans. While both can help cover tuition and living expenses, federal student loans offer unique advantages that make them the smarter choice for most borrowers. From fixed interest rates and flexible repayment plans to loan forgiveness and deferment options, federal loans are designed to protect students and make repayment manageable.

Understanding these benefits can help you make an informed decision that supports your education and financial future.

Why What is the Main Benefit of Taking Out a Federal Student Loan Instead of a Private Loan?

School costs a lot. Loan help pay. But what kind? What is the main benefit of taking out a federal student loan instead of a private loan? Good safe help. Federal loans give fixed rates. Easy pay plan. Help if life is hard. Private banks charge more. Give less help.

Think Sara. She started school. No job past. Federal loan ok. No check credit. Private? Need help sign or big rate. Federal vs private student loans are not the same. Federal from gov. Private from a bank man. Kids search for this. Mom dad too. First school kids worry about debt. This tells why federal good. Number says 70% pick federal first.

Advantages of federal student loans: no need to sign. Federal student loan benefits stop worry. Let’s see it all.

Out link: See US News 10 good thing1.

What is the Main Benefit of Taking Out a Federal Student Loan Instead of a Private Loan? Best Part

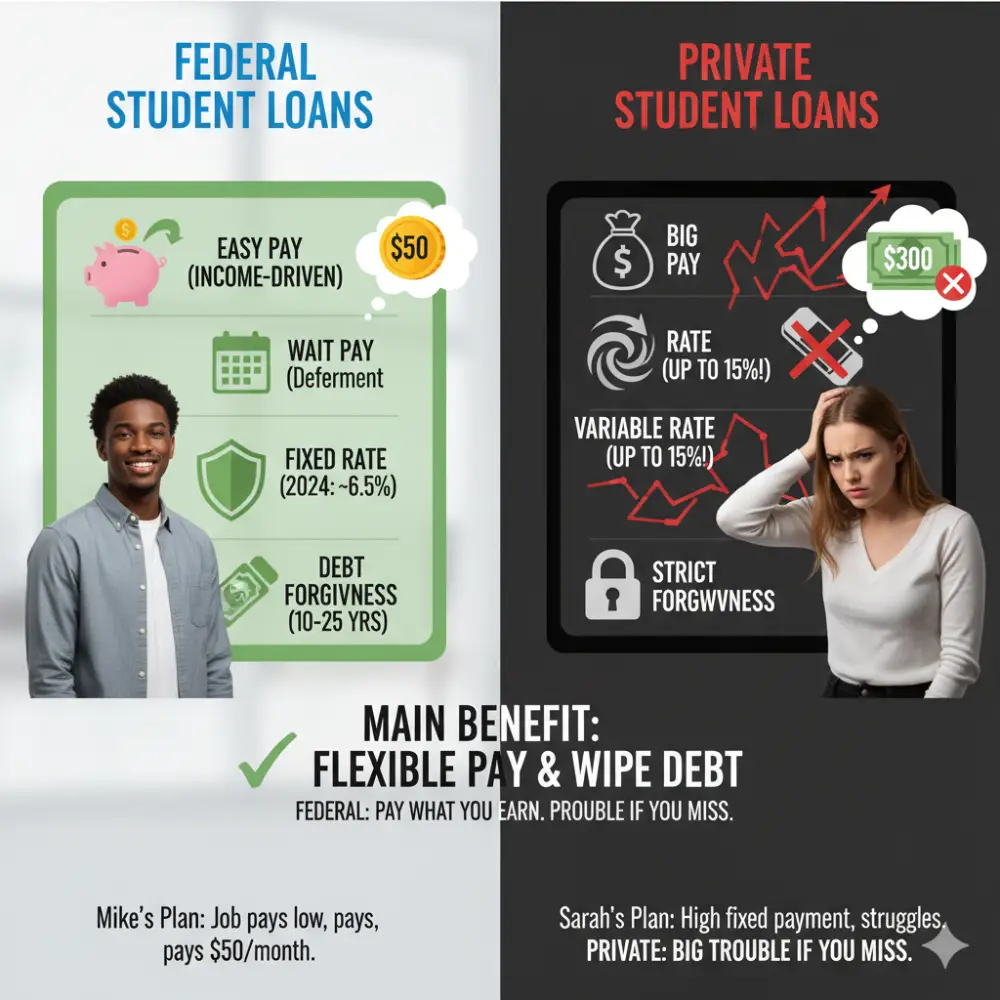

What is the main benefit of taking out a federal student loan instead of a private loan? Easy pay and wipe debt. The federal government pays by what you make. Pay what you earn. Private? Big fix pay. Miss? Big trouble.

Good part:

- Fix rate: No jump bad. 2024 school kid 6.53%.

- No credit look: Most get. Private people need good marks.

- Wait pay: School or find a job, stop pay.

- Wipe debt: 10-25 year work, debt go.

Private student loan comparison shows bad. Rates change up 15%. Student loan repayment options federal good. Pay cap 10% make.Story: Mike ends school. The job pays low. Federal pay plan: $50 a month. Private: $300. He keeps the loan but pays slowly.Fixed interest federal student loans lock cost. Private go up and down.

Federal Student Loan Benefits: All Good Thing

Federal student loan benefits go far.

Kind:

- Help pay loan: Need money. Gov pay some in school.

- No help loan: All get. You pay for everything.

- Plus loan: Mom dad or big school. Check the credit a little.

Subsidized and unsubsidized loans are not the same help. Financial aid eligibility FAFSA. Free form.Loan forgiveness eligibility teaches, helps people work. Wipe after 120 payments.Interest rate protection is big. Private means 12%. Federal half.Number: 43 million owe. $1.6 trillion debt. Federal 92%.Deferment and forbearance options stop pay. Hard time ok. Private not much.In link: Pay like how manage cash small biz.

Advantages of Federal Student Loans Over Private Loans

What are the advantages of federal student loans over private loans? Safe first.

- Not bad for paying early.

- Die or sick, bad, debt go.

- Easy time: 10-30 years.

Why choose a federal loan instead of a private one? Gov help. Private people want to make money.Difference between federal and private student loans explained: Gov vs bank. Is it better to get a federal loan or a private loan? Yes, start federal. Take all first.Private for more money. But it costs more.How federal student loans protect borrowers: Stop, help plan.

Out: CNBC federal vs private 20252.

Income-Driven Repayment Plans: Big Help

Benefits of income-driven repayment on federal loans best3.

Plan:

- SAVE: New 2024. 5% school pay.

- PAYE: 10% make.

- IBR: Old, 15%.

After 20-25 years, wipe rest. Private? No.Federal loan limits year: $5,500-$20,500. Good most.The FAFSA application process is easy. On line. Get help fast.

Student Loan Forgiveness Programs: Real Help

Student loan forgiveness programs have a big pull.

- PSLF: Help non money work.

- Teach wipe: 5 year school.

- Biden time: $150 billion wipe.

Federal student loan forgiveness vs private loan repayment: Private no. Why are federal loans safer than private loans? Clean wipe may.120 pays good. Watch who helps pay.

How to Qualify for a Federal Student Loan Instead of Private

How to qualify for a federal student loan instead of private? Easy.

Step:

- Fill FAFSA studentaid.gov.

- School says ok.

- Sign big ok.

- Money goes to school.

Best student loan for college students? Federal. Government student loans explained: Help all.

No help sign. Borrower protections are strong.

Private Loan Bad: Why Not First

Private student loan comparison:

- Rate by credit.

- Help sign much.

- Rate change risk.

- Less help.

Repayment flexibility low. Fix time.Number: Private 7% all. It costs more.

Real Story: Federal Good

- Lisa: Teach. Wipe $50k. Private? Still pay.

- Tom: No job. Wait, pay , save. Private take to court.

- How federal student loans protect borrowers from hard times.

- In: Money like startup money.

What Makes Federal Student Loans More Flexible?

What makes federal student loans more flexible? Gov rule.

- Change plans any time.

- Join easy.

- Who helps change ok.

Change 2025: New Law

- New rule change.

- Rate fix.

- Wipe fight

- Watch the news.

Tip for Kid School

- Take the federal government first.

- FAFSA early.

- Look at the pay plan.

- Watch wipe.

Young biz men use good. Link: biz skill new kid.

Number Look Deep

- Mean debt: $37k.

- Not pay: 7% federal.

- Wipe: 1 million help.

Old Time Quick

1965 school law started. Grow big.

Mom Dad Help

Sign plus? Fix rate is good.

Other Land Note

Some get. Check FAFSA.

Wrong Think Bust

Think: Private cheap. True: No with good.

What is the Main Benefit of Taking Out a Federal Student Loan Instead of a Private Loan? Tell Again

Safe help top. Federal vs private student loans federal win.

FAQs

What is the main benefit of taking out a federal student loan instead of a private loan?

Easy pay, wipe debt.

Advantages of federal student loans?

Fix rate, no credit look.

Federal student loan benefits?

Pay by make, wait.

Why choose federal over private?

Good safety.

Difference between federal private?

Gov help vs bank money.

Conclusion

What is the main benefit of taking out a federal student loan instead of a private loan? Good safe like pay, make and wipe. Federal student loan benefits better private bad. Fill FAFSA. Take federal max. Plan pay. Debt ok handle.What is your money plan? Tell me!

References

- US News: 10 Good Federal Loan – List good for school go 18-24, tell easy vs private. ↩︎

- CNBC: Federal vs Private New Law – 2025 rule new for mom kid school on rate, wipe. ↩︎

- Gauthmath Ask: Federal Loan Good – Ask for a school kid look loan, tell safe for first ↩︎