You stash cash to grow it. But which savings account will earn you the least money? Traditional brick-and-mortar bank accounts top the list. They pay tiny APY rates, often under 0.05%. Online high-yield options beat them by miles. New savers and students, this matters. Low yields eat gains. We break down types, rates, and switches. Facts from 2025 data guide you. Spot low yield savings accounts. Learn why. Move to better spots. Start smart today.

What Is a Savings Account and How Does It Work?

Savings accounts hold money safe. Banks insure up to $250,000 via FDIC. Earn compound interest. APY shows yearly gain after compounding.

Basics:

Deposit funds.The bank pays interest.Withdraw anytime, but limits apply (six per month old rule gone, but fees linger).Types vary. Rates tie to Fed funds. In October 2025, Fed rate at 4.75-5%.

Yet big banks lag.Stats: Average U.S. savings APY? 0.41% per FDIC. High-yield? 4.5%+.For beginners, grasp APY vs interest rate. APY factors compounding.Link to accounts: See what are the main differences between a checking and savings account.

Types of Savings Accounts Compared

Not all savings are equal. Earnings differ a lot.

Key types:

Traditional Savings (Brick-and-Mortar): Local banks like Chase, Bank of America. Lowest rates.

Online High-Yield Savings: Ally, Marcus. Top players.

Money Market Accounts: Higher minimums, check-writing.

Certificates of Deposit (CDs): Locked terms, fixed rates.

Specialty Accounts: Kids’ or senior, often low yield.

Traditional bank savings account rates drag. Why? High overhead—branches, staff.

Example: $10,000 at 0.01% APY earns $1 year. At 4.5%, $450.

Traditional Savings Accounts Will Earn You the Least Money

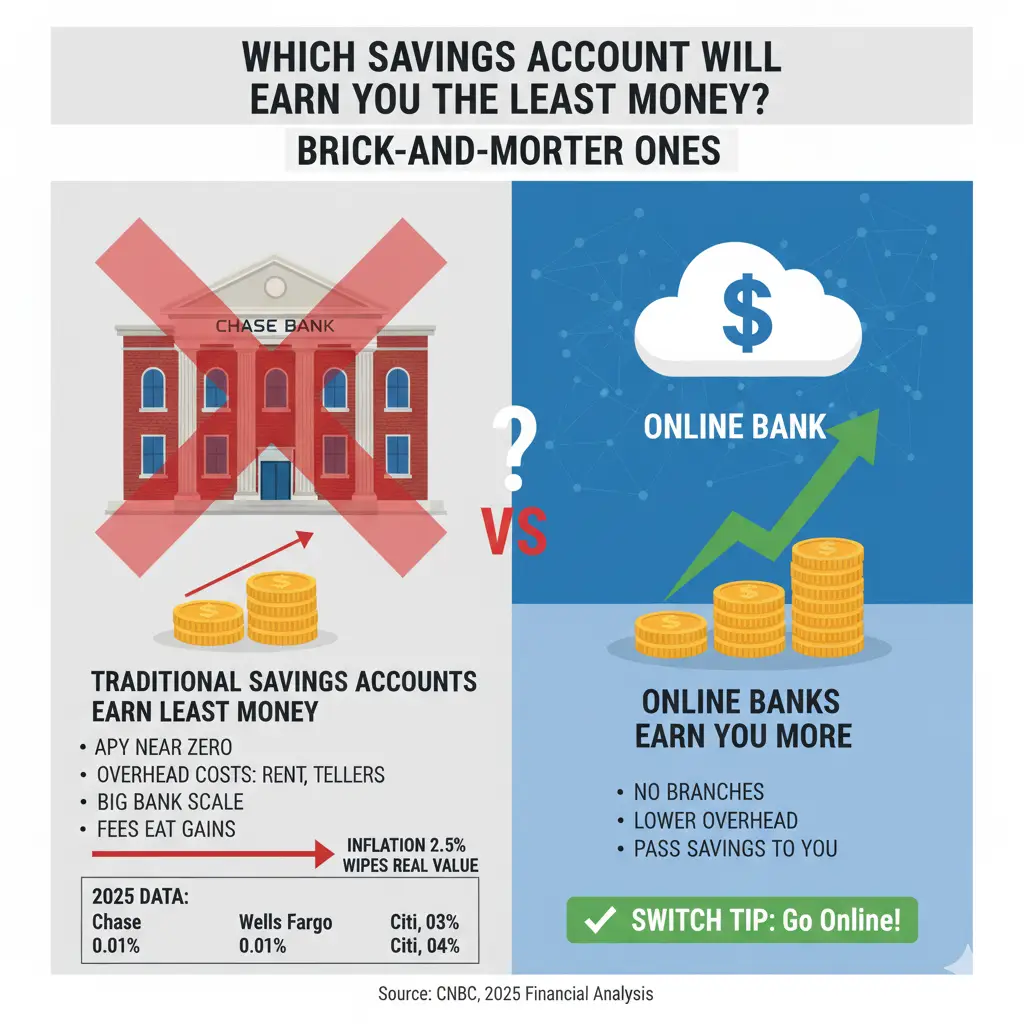

Which savings account will earn you the least money? Brick-and-mortar ones. APY near zero.

Reasons:

Overhead Costs: Rent, tellers eat profits. Less to share.

Big Bank Scale: Millions of deposits. No push for high rates.

Fed Lag: They adjust slowly.

Fees Eat Gains: Maintenance if balance dips.

2025 data: Chase 0.01%. Wells Fargo 0.01%. Citi 0.04%.

CNBC notes: These yield pennies. Inflation at 2.5% wipes real value.

Switch tip: Online banks have no branches, pass savings to you.

Current APY Rates for Low-Yield Accounts

Check 2025 numbers.

Low APY savings accounts:

Big Four (JPMorgan, BofA, Wells, Citi): 0.01-0.05%.

Regional banks: 0.10-0.50%.

Credit unions basic: 0.20% average.

High-yield contrast: SoFi 4.6%, Capital One 4.25%.

On $5,000:

Traditional: $0.50 a year.

High-yield: $225.

Fed impact: Rate cuts slow high-yield drops less.

Verify: FDIC site or Bankrate.

High-Yield vs. Regular Savings: Key Differences

High-yield savings account vs regular flips earnings.

Regular:

Low APY.

Branch access.

Often fees.

High-yield:

4%+ APY.

Online only.

No fees, ATM reimburses.

Pros regular: Face-time banking. Cons: Lost money.

Stats: 70% Americans in low-yield, per 2024 survey. Miss $1,000s.

Move funds: ACH free, 1-3 days.

Factors Affecting Savings Account Interest Rates

Rates shift.

Influencers:

Fed Funds Rate: Base for all.

Bank Type: Online wins.

Balance: Tiered rates.

Promos: New customer bumps.

Economy: Inflation pushes up.

Financial institutions interest rates vary. Online nimble.

Track: NerdWallet tools.

The Impact of Fees on Earnings

Fees kill low-yield more.

Common:

Monthly: $5 if under $300 balance.

Excess withdrawals: $10+.

Paper statements: $2.

Net: Negative yield possible.

High-yield? Fee-free norm.

Calc: $100 fee on $1,000 at 0.01%? Loss.

Avoid: Read terms.

Money Market Accounts: Better Than Basic Savings?

MMAs hybrid.

Features:

Higher APY (0.5-4%).

Checks, debit.

Minimums $1,000+.

Still beat traditional? Yes. But not always high-yield kings.

2025 avg: 0.6%. Online MMAs 4%.

For liquidity seekers, good middle.

CDs: Locked but Sometimes Low

CDs fix rates.

Short-term low if rates fall.

But traditional banks offer the lowest: 0.5% 1-year.

Online: 4.5%.

Penalty for early pull.

Not least, but avoid bank CDs.

How to Calculate Earnings from Savings Accounts

Simple math.

Formula: Interest = Principal × Rate × Time.

APY compounds: Use calculators.

Example: $10k, 0.01%, 1 year: $1.

Tools: Bankrate calculator.

Compound interest rate magic in high-yield.

Risks of Sticking with Low-Yield Accounts

Deposit account interest too low hurts.

Risks:

Inflation erosion: 2.5% eats 0.01%.

Opportunity loss: Stocks avg 7-10%.

Emergency drain: No growth buffer.

2025: $1T in low-yield, per Fed.

Switch: Builds wealth.

For retirement: your guide to human interest 401k.

Online Banks vs Traditional Banks for Savings

Online banks vs traditional banks clear winner: Online.

Online perks:

High APY.

No fees.

Apps are easy.

Traditional:

Low rates.

Branches.

Relationship perks are rare.

Stats: Online grew 20% deposits 2024.

Trust: FDIC same.

Start: Ally or Discover.

Tips to Maximize Savings Earnings

Ditch least earners.

Steps:

Check the current APY.

Compare 5+ banks.

Move via ACH.

Watch promos.

Automate deposits.

Bank savings rate comparison: Use DepositAccounts.

Annual review.

Common Myths About Savings Accounts

Myth: All savings are the same. Fact: Rates vary wild.

Myth: Branches mean safe. Fact: Online FDIC too.

Myth: High-yield risky. Fact: Insured.

Bust for smart cash.

Regulations Protecting Your Savings

FDIC insures $250k.

NCUA for credit unions.

Dodd-Frank caps fees.

Know rights.

Future Trends in Savings Rates

2025: Fed cuts possible. High-yield holds better.

Fintech rises: 5%+?

AI rates are personal.

Watch: Treasury yields.

Case Studies: Real Earnings Comparisons

Saver A: Chase 0.01%, $10k = $1/year.

Saver B: Ally 4.5%, $450.

Over 5 years: $2 vs $2,400+ compound.

Lesson: Switch pays.

How to Choose a Better Savings Account

Assess needs.

Emergency? High-yield liquid.

Goal? CD ladder.

Kid? Custodial high-yield.

Shop: Compare APY, fees, access.

Building a Savings Strategy

Layer accounts.

High-yield core.

MMA access.

Avoid traditional.

Automate. Track net worth.

Link biz: how to manage cash flow in a small business.

Global Perspective on Savings Rates

U.S. low traditional. Europe is similar. Japan near zero.

High-yield global via apps.

Tax Implications of Savings Interest

Interest taxable.

1099-INT over $10.

High-yield more tax, but worth it.

Roth IRA bypass.

FAQs

Which savings account will earn you the least money?

Traditional brick-and-mortar bank savings accounts. They offer low APY rates, often 0.01-0.05%, due to high overhead costs like branches and staff.

Why do traditional savings accounts have such low interest rates?

Big banks prioritize profits over customer yields. Overhead eats margins, and they adjust slowly to Fed changes. Online banks pass savings with higher APY.

What is the average APY for low-yield savings accounts in 2025?

Around 0.41% overall, but traditional ones dip to 0.01-0.05%. High-yield online accounts hit 4.5%+, per FDIC data.

How does a high-yield savings account compare to a regular one?

High-yield offers 4%+ APY, no fees, and online access. Regular accounts pay pennies, may charge fees, but provide branches. Switch for better growth.

What risks come with keeping money in low-yield accounts?

Inflation erodes value (e.g., 2.5% vs 0.01%), missed opportunities, and no real emergency buffer. Over years, it costs thousands in lost compound interest.

Conclusion

Which savings account will earn you the least money? Traditional brick-and-mortar ones. APY under 0.05% robs growth. Switch to online high-yield for 4%+. Check rates, move funds, compound wins. Students, savers—act now. Build real wealth.