Automating bank reconciliations saves time and makes work easier. Sage Intacct1 helps with this through its cash management tools. If you use different Intacct setups—like a test site (sandbox) or a live site (production)—you may need to copy rules between them. This article explains how to move Intacct bank rules from one Intacct instance to another. It helps you keep automation consistent without starting over.

This guide is for Intacct system administrators who set up the cash management module. It’s also for finance teams doing bank reconciliations, consultants moving setups, technical teams using APIs, and leaders improving processes. We’ll cover what rules do, how to set them up, and how to copy them. Let’s get started.

What Are Sage Intacct Bank Rules?

Bank rules in Sage Intacct make bank transactions match records automatically. This cuts down manual work, so your team can focus on other tasks.

There are two types of rules:

- Match rules: Connect bank transactions to Intacct records, like invoices, using details like amounts.

- Create rules: Make new entries for things like bank fees if no match is found.

Rules are grouped into rule sets in Sage Intacct. You assign one set to each bank account. You can use the same rule in many sets. This helps with bank feed reconciliation by sorting transactions correctly.

For example, a rule might match payments by their amount and date. This links multiple payments to one bank entry.

Why are rules important? Matching by hand takes hours. Rules automate most of it, making cash management workflows faster and more accurate.

Parts of Intacct Bank Rules

To copy rules, you need to know their parts.

- Filters: Decide when a rule runs. Always include a date filter to avoid old transactions.

- Grouping: Collects transactions by fields like date or number. This is optional.

- Matching Conditions: The main rule logic. You must include an amount. You can add things like document numbers.

These parts create transaction matching logic for Intacct reconciliation automation.

The Sage Intacct Bank Feeds: Matching Rules blog explains how rules work with bank feeds.

Permissions You Need

Before setting up or moving rules, check your access.

- Go to Company > Admin > Roles or Users.

- In Cash Management, allow:

- Bank Transactions: View, edit, match, or ignore.

- Bank Transaction Rules: Add, edit, delete.

- Bank Transaction Rule Sets: Add, edit, delete.

- Save changes.

Without these, you can’t work with rules. In multi-entity setup in Intacct, permissions may differ by company.

How to Create a Matching Rule

Here’s how to make a match rule. You’ll use this when copying to another instance.

- Go to Cash Management > Setup > + Matching and Creation Rules.

- Choose the Match rule as the type.

- Give it an ID (like MATCH-01) and a Name (like Match by Amount).

- Add a filter, like transactions after a certain date.

- Optionally, group by document number.

- Set conditions, like matching by amount and document number.

- Save the rule.

This builds Sage Intacct bank transaction matching. For create rules, pick Create type and set a template.

Making and Using Rule Sets

Rules need to be in a set to work.

- Go to Cash Management > Reconciliation Rules > Rule Set > Add.

- Enter an ID and Name.

- Set Account Type to Bank.

- Pick rules to include. Put specific ones first.

- Assign the set to a bank account.

When transactions come in, rules run. Check results in the performance log.

This helps with Sage Intacct setup and configuration.

Why Use Intacct Bank Rules?

Automation makes finance work better.

- Saves Time: Rules match 80-90% of transactions, says Sage.

- Fewer Mistakes: Rules follow the same logic every time.

- Works for Many Accounts: Great for multi-entity setup in Intacct.

- Shows Problems: Logs tell you what didn’t match.

Companies close books 79% faster with rules, per Sage. This fits with financial automation tools.

For cash flow tips, see how to manage cash flow in a small business.

Problems with Moving Rules

Copying rules between instances—like sandbox to production—can be tricky.

- No Easy Copy Tool: You can’t export rules like data.

- Different Setups: Each instance might work differently.

- Need Tech Skills: APIs require coding knowledge.

Solving these helps with Intacct setup consistency across entities.

How to Move Intacct Bank Rules from One Intacct Instance to Another

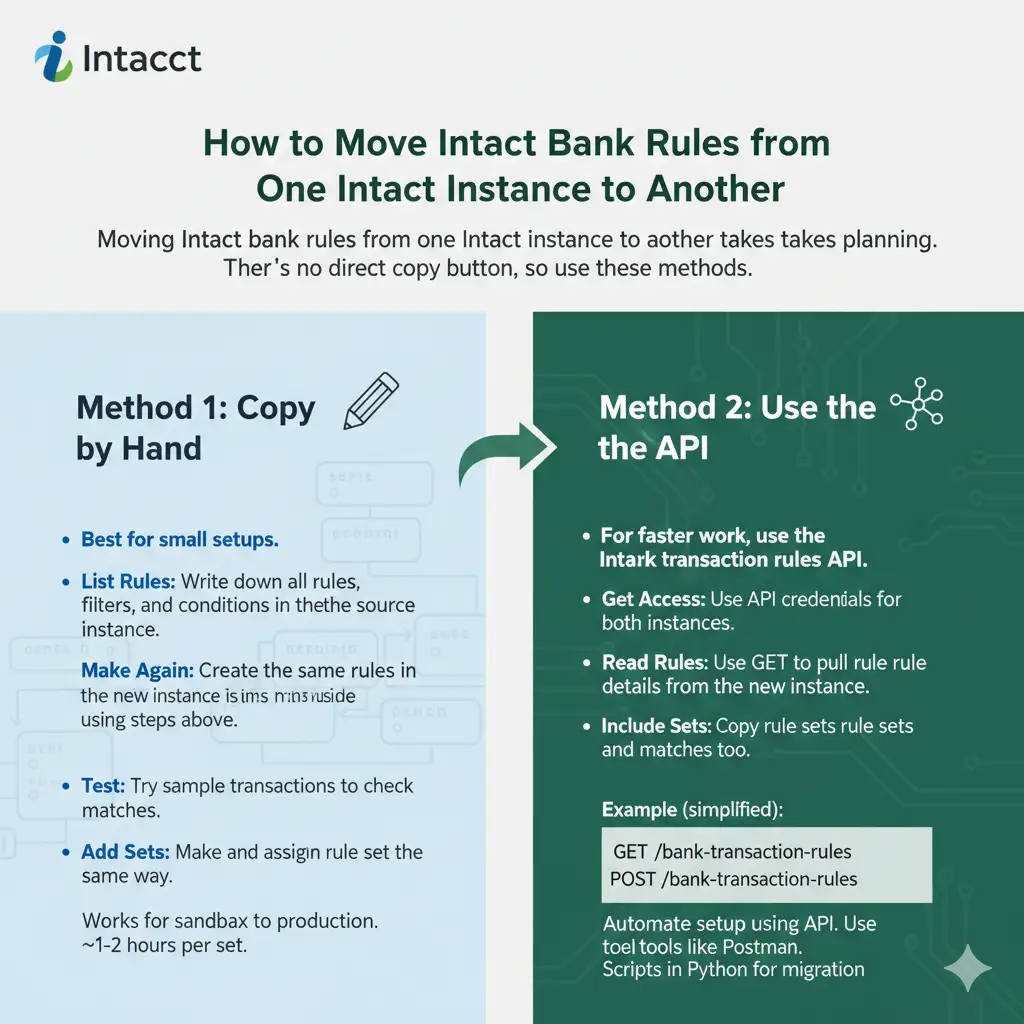

Moving Intacct bank rules from one Intacct instance to another takes planning. There’s no direct copy button, so use these methods.

Method 1: Copy by Hand

Best for small setups.

- List Rules: Write down all rules, filters, and conditions in the source instance.

- Make Again: Create the same rules in the new instance using steps above.

- Test: Try sample transactions to check matches.

- Add Sets: Make and assign rule sets the same way.

This works for Intacct sandbox to production. It takes about 1-2 hours per set.

Method 2: Use the API

For faster work, use the Intacct bank transaction rules API. See the Sage API docs2.

- Get Access: Use API credentials for both instances.

- Read Rules: Use GET to pull rule details from the source.

- Create Rules: Use POST to add them to the new instance.

- Include Sets: Copy rule sets and matches too.

Example (simplified):

- GET /bank-transaction-rules to see rules.

- POST /bank-transaction-rules to add a rule.

This supports automate Intacct bank rule setup using API. Use tools like Postman to test.

You can write scripts in Python to automate this. This is great for Intacct rule migration.

Best Tips for Moving Rules

Follow these to make it easy.

- Save a Backup: Export settings as XML first.

- Test in Sandbox: Try rules in a test site.

- Write Down Changes: Note differences between instances.

- Work Together: Admins set up; tech teams code.

- Check After: Use logs to see if rules work.

These match Intacct data migration best practices.

For payroll tips, see how to do payroll for small business.

Exporting and Importing Rules

Intacct doesn’t let you import rules directly, but you can try XML.

- In the source, go to Company > Setup > Import/Export > Export XML.

- Pick cash management items.

- Import XML in the new instance.

Rules may not copy perfectly. Test everything.

For exporting and importing bank matching rules in Intacct, tools from partners like Greytrix can help.

Automating Rule Creation

You can make rules faster with the API.

Write scripts to create rules from a template. This helps with reconciliation rule templates.

For example, use a loop to make many rules from one file.

This supports automated Sage Intacct bank transaction rule creation.

Keeping Rules the Same Across Instances

For companies with many entities:

- Use the same rule names and IDs.

- Share rules across entities if possible.

- Copy rules with API scripts for bank feed rule replication.

This helps with setting up consistent bank rules across Intacct instances.

For funding ideas, read private equity vs venture capital.

Managing Rules for Multiple Entities

In multi-entity setups:

- Rules can be for one entity or shared.

- Assign sets to each entity’s bank account.

- Copy rules for each entity when moving.

This supports managing bank rules in Sage Intacct for multiple entities.

Connecting Bank Feeds to Rules

Set up feeds first:

- Use Plaid or AccessPay for feeds.

- Rules work after transaction import.

This improves Intacct bank feed integration.

Using the Intacct API

Check the Intacct open API documentation for coding.

Key items: BankTransactionRule, BankTransactionRuleMatch.

This helps with the Intacct developer guide for bank transaction rule matches.

Real Examples

A company merged two Intacct setups. They used the API to copy rules, saving 70% of setup time.

Another moved rules from sandbox to production by hand. It worked smoothly for Intacct sandbox to production.

Sage says automated rules speed up reconciliations by 50%.

Tips to Make Rules Work Better

- Put specific rules first in sets.

- Check logs often.

- Use create rules for full accounting system automation.

For business tips, see how to start a small business.

Mistakes to Avoid

- Forgetting filters: Rules match too much.

- Wrong rule order: General rules run first.

- Skipping tests: Causes problems in live systems.

Helpful Tools

- Sage Developer Portal.

- Tools from partners like GUMU.

- Intacct community forums.

For marketing help, see what is SEO in digital marketing.

FAQs

How do I copy bank rules from one Intacct instance to another?

Write them down and recreate, or use the API.

What are the best tips for moving Intacct rules?

Backup, test, document, and automate with API.

How do I duplicate Sage Intacct bank feed rules?

List rules and make them again, or use Intacct bank transaction rules API.

Can I automate moving rules between Intacct companies?

Yes, with API for transferring reconciliation rules between Intacct companies.

What’s in the Intacct developer guide for bank transaction rule matches?

It shows how to use the API for rules.

For more tools, see best AI tools for small business productivity.

Conclusion

Moving Intacct bank rules from one Intacct instance to another makes your work faster and easier. You can copy rules by hand or use the API. Follow best practices to keep rules the same across systems. This saves time and reduces mistakes in cash management workflows. With automation, your team can focus on bigger tasks.

What problems have you had moving Intacct rules? Tell us in the comments.

References

- Sage Intacct Bank Feeds: Matching Rules – Guide on setting up bank rules.Sage Intacct API: Bank Transaction Rule Matches – API details for rules. ↩︎

- Sage Intacct API: Bank Transaction Rule Matches – API details for rules. ↩︎