Pick CFA vs MBA wisely to shape your finance path. Early pros with bachelor’s degrees and 0-5 years experience often face this choice. CFA dives deep into investment analysis and portfolio management. MBA covers broad business leadership like marketing and operations.Chartered Financial Analyst (CFA) suits financial analyst certification lovers. Master of Business Administration (MBA) fits those wanting a business management degree. Data shows CFA pass rates hover at 38-45%. MBA programs take 1-2 years full-time.

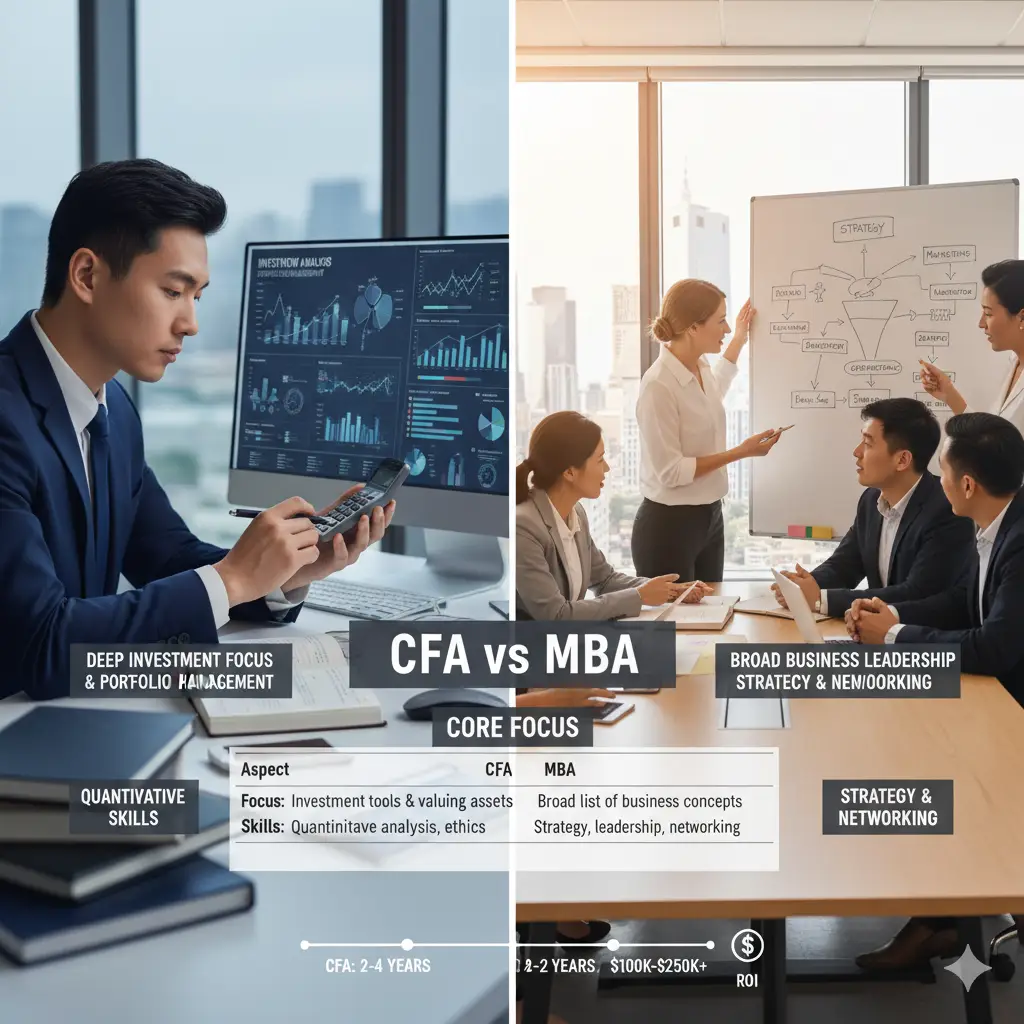

CFA vs MBA Core Focus

| Aspect | CFA | MBA |

| Focus | Investment tools & valuing assets | Broad list of business concepts |

| Skills | Quantitative analysis, ethics | Strategy, leadership, networking |

CFA teaches portfolio management. MBA builds corporate finance and soft skills. CFA vs MBA in finance? CFA wins for technical depth.

CFA vs MBA Difficulty & Time

CFA vs MBA difficulty leans CFA. Three levels, 900+ study hours each. Level I pass: 38% (2025). Total: 2-4 years self-study.

MBA: 1-2 years. Full-time immersive. CFA vs MBA duration: MBA faster but intense.

CFA vs MBA exam structure: CFA multiple-choice + essays. MBA cases, projects.

CFA vs MBA which is harder to complete? CFA – self-paced rigor.

CFA vs MBA Cost & ROI

CFA vs MBA cost huge gap.

- CFA: $3K-$5K total.

- MBA: $100K-$250K (top US).

CFA vs MBA ROI: CFA quicker payback. MBA from prestige schools boosts long-term.

Is CFA vs MBA worth it? Depends on goals.

CFA vs MBA Salary Comparison

CFA vs MBA salary varies.

- CFA: $180K median (portfolio mgrs $200K+).

- MBA: $170K starting (top schools). 3 years post: 130% jump.

CFA vs MBA salary comparison: CFA edges in investments. CFA vs MBA finance salary: Similar mid-career.

CFA vs MBA which one pays more? CFA for pure finance.

In India: CFA vs MBA finance salary in India – CFA ₹25L; MBA (IIM) ₹30L+.

CFA vs MBA Career Prospects

CFA vs MBA career prospects:

CFA jobs:

- Research analyst

- Portfolio management

- Risk mgr

MBA jobs:

- Consultant (McKinsey)

- Corporate finance

- GM roles

CFA vs MBA for investment banking: MBA from top schools opens doors. CFA adds edge.

CFA vs MBA for venture capital: MBA networking key. CFA for due diligence.

CFA vs MBA jobs: CFA specialist; MBA generalist.

CFA vs MBA for Investment Banking

CFA vs mba for investment banking: MBA preferred for associates. CFA helps analysts.

What is the best option for investment banking – CFA or MBA? MBA prestige + network.

CFA vs MBA in India & Global

CFA vs MBA in India: CFA cheaper, global. MBA (IIMs) for leadership.

CFA vs MBA in USA: MBA (M7) elite. CFA consistent.

CFA vs MBA which has better global recognition: CFA uniform worldwide.

CFA vs MBA Pros Cons

CFA Pros:

- Low cost

- Flexible

- Global business education in investments

Cons:

- No network

- Self-study

MBA Pros:

- Accredited MBA programs

- Alumni

- Pivot

Cons:

- Expensive

- Time out

CFA vs MBA pros cons: Match to goals.

CFA vs MBA Reddit & Community Views

CFA vs MBA reddit1: “Finance only? CFA. Management + network? MBA.”

CFA vs MBA quora: CFA respected in assets. MBA school-dependent.

CFA vs MBA wso: MBA for IB front office.

CFA vs MBA for Engineers & Freshers

CFA vs MBA for engineers: CFA leverages quant skills.

CFA vs MBA for freshers: CFA starts early. MBA needs experience.

CFA vs MBA for working professionals: CFA alongside job.

Can You Do CFA and MBA Together?

Can you do CFA and MBA together? Yes. CFA first, then MBA.

Should I do MBA after CFA? Boosts leadership.

Is CFA equivalent to an MBA in finance? No – deeper but narrower.

CFA vs MBA Requirements

CFA vs MBA requirements:

- Both: Bachelor’s.

- CFA: 4K hours exp.

- MBA: GMAT, essays.

CFA vs MBA for career advancement: Stack for elite.

CFA vs MBA Which is Better?

CFA vs MBA which is better2? Investments: CFA. Leadership: MBA.

CFA vs MBA finance which is better? CFA technical.

Mba vs cfa which is better? Goals decide.

CFA vs MBA for entrepreneurs: MBA strategy.

CFA vs MBA difference in exam structure: CFA levels; MBA holistic.

CFA vs MBA Comparison Chart3

| Factor | CFA | MBA |

| Cost | Low | High |

| Time | 2-4 yrs | 1-2 yrs |

| Salary | High investments | High management |

| Difficulty | Very hard | Moderate |

FAQ: CFA vs MBA

CFA vs mba which is better?

Depends – CFA investments, MBA broad.

CFA vs mba finance which is better?

CFA depth.

Mba vs cfa which is better?

MBA pivot, CFA specialize.

Is CFA better than MBA for a finance career?

Yes for analysis.

Which has more value: CFA or MBA?

CFA consistent; MBA school.

Difference between CFA and MBA in salary and scope?

CFA niche high; MBA broad.

Should I do MBA after CFA?

Yes for leadership.

Is CFA equivalent to an MBA in finance?

No.

CFA vs MBA which one pays more?

Similar.

What is the best option for investment banking – CFA or MBA?

MBA.

CFA vs MBA which is harder to complete?

CFA.

Can you do CFA and MBA together?

Yes.

Is CFA better than MBA for corporate finance?

MBA.

CFA vs MBA which has better global recognition?

CFA.

Which is better for stock market jobs, CFA or MBA?

CFA.

MBA finance vs CFA certification comparison?

MBA general.

CFA vs MBA pros and cons?

Above.

Which is more respected, CFA or MBA?

Both.

What are the benefits of CFA over MBA?

Cost, focus.

CFA vs MBA which is right for me?

Goals.

CFA vs MBA: which one should I choose after graduation?

CFA early.

Career growth after CFA vs MBA?

Both are strong.

CFA vs MBA difference in exam structure?

Levels vs cases.

Conclusion

CFA vs MBA offers clear paths. CFA for investment analysis mastery. MBA for business leadership. Weigh cfa vs mba salary, cfa vs mba difficulty, and fit.

CFA vs MBA: Which suits your finance dreams?

References

- Reddit r/CFA: CFA or MBA – Community views. ↩︎

- CFA Institute: Credential Comparison – Table, recognition. Targets early finance pros, students deciding cfa vs mba career prospects, ROI in investments or management. ↩︎

- Investopedia: MBA or CFA – Cost, paths, focus. ↩︎