Are you ready to boost your career with CPA certification? This top credential opens doors in accounting and finance. Many students and early pros seek CPA certification to gain trust, better pay, and big roles. It fits undergrads in business, workers wanting upgrades, or even career switchers. In this guide, we dive into why CPA certification matters and how to get it.

Why Choose CPA Certification?

CPA certification stands for Certified Public Accountant1. It proves you know accounting inside out. CPAs handle audits, taxes, and advice that others can’t.

Think about your goals. Do you want a higher cpa certification salary? Data shows CPAs earn more. Or maybe job moves across states or countries? CPA certification gives that freedom.

For undergrads, CPA certification builds on your degree. Recent grads ask how to get cpa certification. It starts with school credits and leads to exams.

Early pros in audit or tax see CPA certification as a promotion key. It adds credibility fast.

Even non-US folks eye what is cpa certification. They check if their background fits US rules.

Career changers wonder requirements for cpa certification without an accounting2 degree. Good news: You can add courses to qualify.

Benefits That Pay Off

- Higher pay: CPAs often make 10-20% more than non-CPAs in similar jobs.

- Job options: Work in public firms, companies, or government.

- Trust factor: Clients and bosses rely on CPAs for big decisions.

One stat: Over 660,000 active CPAs in the US, per NASBA reports.

Step-by-Step Guide to CPA Certification

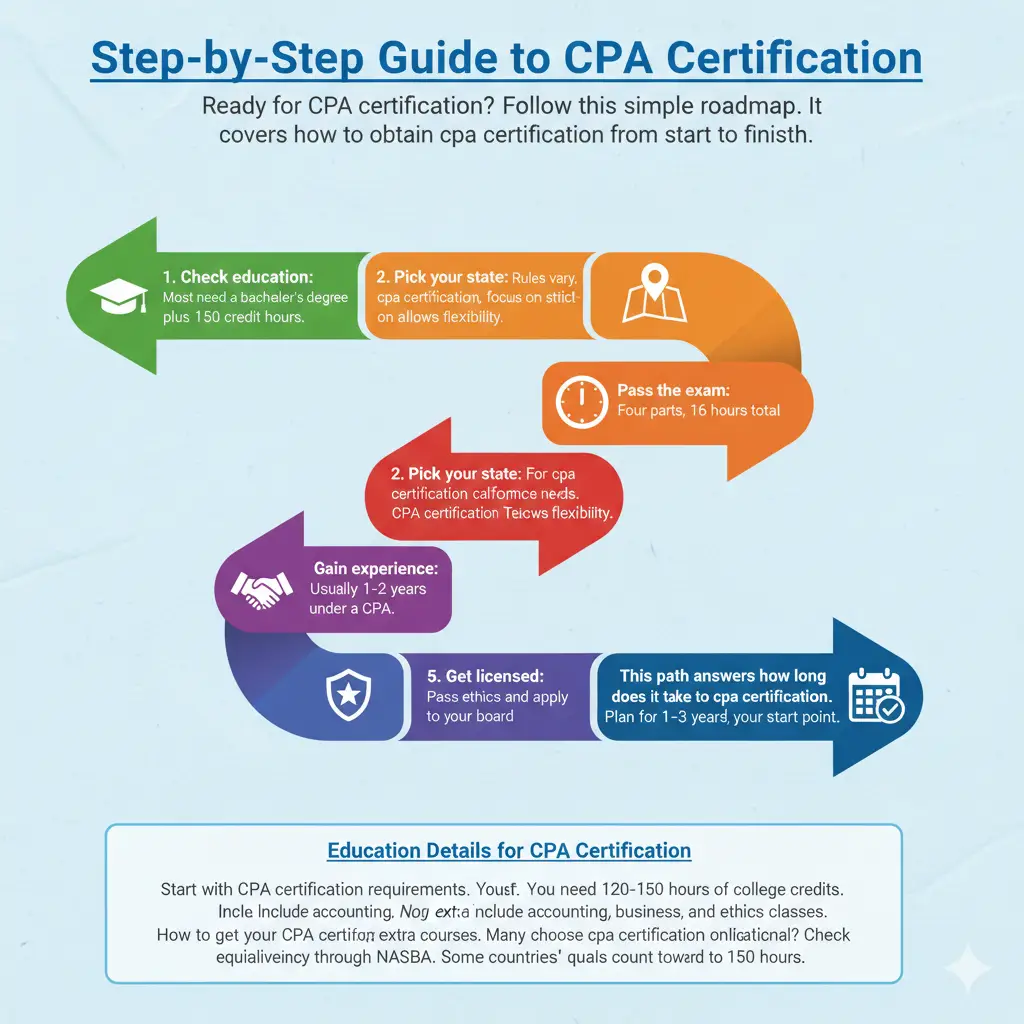

Ready for CPA certification3? Follow this simple roadmap. It covers how to obtain cpa certification from start to finish4.

- Check education: Most need a bachelor’s degree plus 150 credit hours. That’s about one extra year after a four-year degree.

- Pick your state: Rules vary. For cpa certification california, focus on strict experience needs. CPA certification Texas allows flexibility.

- Pass the exam: Four parts, 16 hours total.

- Gain experience: Usually 1-2 years under a CPA.

- Get licensed: Pass ethics and apply to your board.

This path answers how long does it take to get a cpa certification. Plan for 1-3 years, based on your start point.

Education Details for CPA Certification

Start with CPAcertification requirements. You need 120-150 hours of college credits. Include accounting, business, and ethics classes.

No accounting degree? No problem. Take extra courses. Many choose cpa certification online options for this.

How to get your CPA certification if you’re international? Check equivalency through NASBA. Some countries’ quals count toward the 150 hours.

Exam Breakdown: What to Expect

The Uniform CPA Exam tests key skills. It’s tough but fair5.

- AUD: Auditing, 4 hours.

- BEC: Business concepts, 4 hours.

- FAR: Financial accounting, 4 hours.

- REG: Regulation, 4 hours.

Pass score: 75 on each. You have 18 months to finish all after the first pass.

Prep with cpa certification course materials. Many use online platforms. Practice tests help a lot.

How long does cpa certification take for the exam? Most study 300-400 hours total.

For online cpa certification, exam centers are worldwide. International candidates take it in select spots.

Experience and Licensing Needs

After exams, build work time. Requirements for cpa certification include 1-2 years in accounting tasks.

Sign reports? Audit? That counts. A licensed CPA must supervise.

Then, apply for your license. Maintain CPE credits – 40 hours yearly in most states.

Is cpa a license or certification? It’s both. Exam gives certification; state gives license to practice.

State differences matter. Cpa certification florida needs one year experience. Check your board.

Costs and ROI for CPA Certification

Cpa certification cost adds up. Expect:

- Education: $10,000+ for extra credits.

- Exam fees: $1,000-$2,000.

- Prep courses: $2,000-$3,000.

- License: $100-$500.

Total: $15,000-$30,000. But ROI is strong.

Cpa certification salary boost? Entry CPAs earn $60,000-$80,000. Seniors hit $100,000+.

How much does cpa certification cost vs. benefits? Payback in 2-5 years with higher wages.

Challenges on the CPA Certification Path

It’s not easy. Exam pass rates hover at 45-55% per section.

Time commitment: Balance work, study, life.

State variations: Move? Reciprocity helps, but check.

Alternatives? CMA for management, but CPA is gold for public accounting.

How long to get a CPA certification if you work part-time? Up to 5 years.

Tips to succeed:

- Study daily.

- Join study groups.

- Use cpa certification program reviews.

International Paths to CPA Certification

Non-US pros ask what is a cpa certification globally. US CPA is respected worldwide.

Eligibility: Evaluation your degree. IQEX exam for some mutual recognition countries.

Test outside the US? Yes, in Japan, Europe, and the Middle East.

CPA certification programs for internationals include NASBA services.

FAQ About CPA Certification

What is CPA certification?

It’s a top accounting credential for audits, taxes, and finance advice.

How do you get a CPA certification?

Earn 150 credits, pass four exams, gain experience, get licensed.

How long does it take to get CPA certification?

1-3 years full-time.

What are CPA certification requirements?

Degree, credits, exam, experience.

Cpa certification online – is it possible?

Parts yes, like courses and some exams.

How much is a CPA certification?

$15,000-$30,000 total.

Advance Your Career with CPA Certification Today

CPA certification changes lives. It brings skills, pay, and respect. Students build strong starts. Pros climb faster. Switchers pivot smart.

Invest time in CPA certification for long rewards. Start with education checks or prep courses.

What step will you take first toward CPA certification? Share below!

References

- Investopedia – CPA Definition and Roles: Explains scope, benefits, and career paths for CPAs. ↩︎

- Accounting.com – CPA Certification Guide: Covers requirements, salary data, and ROI insights. ↩︎

- Accounting.com – How to Become a CPA: Step-by-step roadmap with education and experience focus. ↩︎

- Wikipedia – Certified Public Accountant: Details state licensing and history. ↩︎

- AICPA & CIMA – CPA Exam Toolkit: Exam format, international options, and prep tips. ↩︎