Pick the right path with CFA vs ChFC. Early finance grads and advisors with 1-5 years experience face this choice. CFA dives into portfolio analysis certification and global markets. ChFC masters retirement and estate planning credential for families and owners.

CFA vs ChFC certification comparison shows clear splits: CFA for Wall Street numbers; ChFC for Main Street life plans. Over 200,000 hold CFA; 50,000+ ChFC. Recent grads in finance or economics often search CFA vs ChFC for beginners to plan their financial certification roadmap.

CFA vs ChFC Core Focus and Skills

CFA1 builds Chartered Financial Analyst (CFA) designation for investment management certification. You learn portfolio management, asset valuation, and ethics. ChFC offers Chartered Financial Consultant (ChFC) credential via The American College of Financial Services. It covers financial planning vs portfolio management with real cases in taxes, estates, and insurance.

| Focus Area | CFA | ChFC |

| Main Skills | Quantitative analysis, economics | Holistic planning, client counseling |

| Typical Use | Fund management, research | Wealth management education, family advice |

CFA vs ChFC for investment management: CFA dominates. CFA vs ChFC for wealth management: ChFC shines. A financial analyst vs financial consultant split drives the choice.

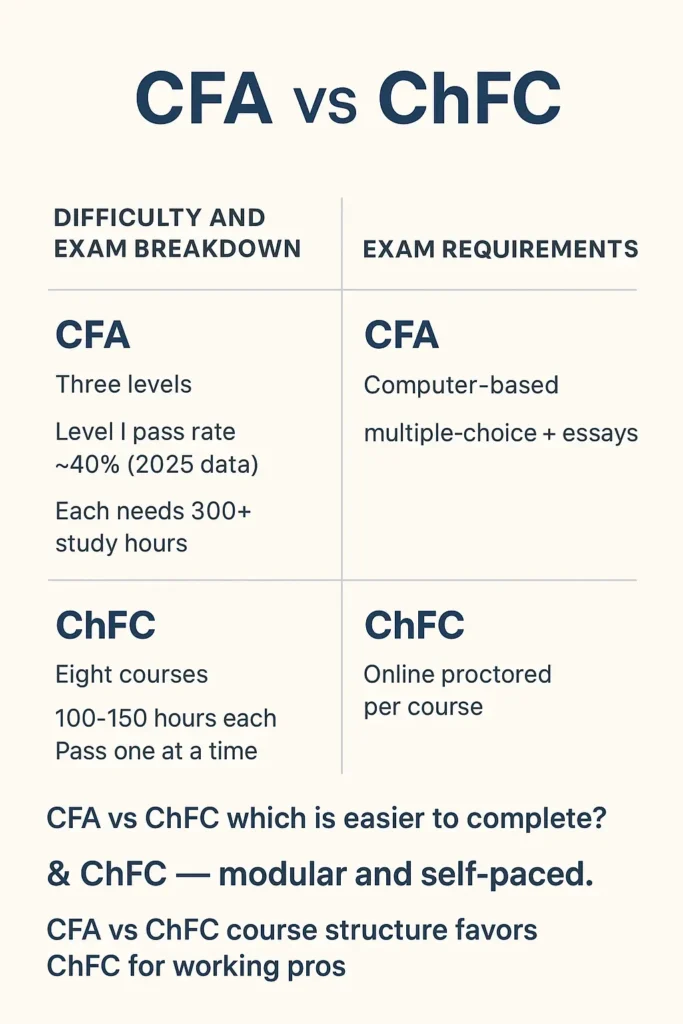

CFA vs ChFC Difficulty and Exam Breakdown

CFA vs ChFC difficulty leans toward CFA being tougher.

- CFA: Three levels. Level I pass rate ~40% (2025 data). Each needs 300+ study hours.

- ChFC: Eight courses. 100-150 hours each. Pass one at a time.

CFA vs ChFC exam requirements:

- CFA: Computer-based, multiple-choice + essays.

- ChFC: Online proctored per course.

CFA vs ChFC which is easier to complete? ChFC — modular and self-paced. CFA vs ChFC course structure favors ChFC for working pros2.

CFA vs ChFC Time, Cost, and Eligibility

CFA vs ChFC eligibility:

- CFA: Bachelor’s degree + 4,000 hours experience.

- ChFC: 3 years in finance (no degree needed).

Time and cost difference between CFA and ChFC:

| Factor | CFA | ChFC |

| Duration | 2-4 years | Under 18 months |

| Cost | $3,000-$5,000 | $6,000 bundle |

| Format | Self-study | Guided online |

CFA vs ChFC course duration: ChFC fits busy schedules. CFA curriculum topics demand deep focus on CFA exam levels.

CFA vs ChFC Salary Difference and Payoff

CFA vs ChFC salary difference shows CFA leading in big finance.

- CFA holders: $180,000 median. Analysts hit $200K+.

- ChFC pros: $150,000+ via fees and retainers.

CFA vs ChFC which pays more in 2025? CFA in institutional roles. ChFC boosts financial advisor qualifications for premium clients. CFA vs ChFC vs CPA salary comparison: CFA often tops.

CFA vs ChFC Career Paths and Job Fit

CFA vs ChFC career paths split clearly.

CFA opens:

- Portfolio manager

- Equity research

- Risk analyst

ChFC leads to:

- Wealth advisor

- Retirement specialist

- Business succession planner

CFA vs ChFC job opportunities and demand: CFA strong in banks/funds. ChFC grows in advisory firms. CFA vs ChFC for financial advisors: ChFC builds client trust.

Which is better for a financial advisor – CFA or ChFC? ChFC for direct service. Should I get a CFA or ChFC for a career in wealth management? ChFC.

CFA vs ChFC for Investment Analysts vs Planners

CFA vs ChFC for investment analysts: CFA required.

CFA vs ChFC for retirement planning professionals: ChFC excels.

CFA vs ChFC benefits:

- CFA: CFA vs ChFC global recognition and industry acceptance.

- ChFC: Practical ChFC course modules for real cases.

Is ChFC worth it compared to CFA? Yes for personal financial planning careers.

CFA vs ChFC vs CFP and Other Options

CFA vs ChFC vs CFP:

| Credential | Best For |

| CFA | Investment advisory |

| ChFC | Advanced planning |

| CFP | Broad advice |

How to choose between CFA, CFP, and ChFC? Ask: Investments or clients? CFA vs ChFC vs CPA: CFA for analysis; ChFC for consulting.

CFA vs ChFC Recognition Worldwide

CFA vs ChFC recognition in USA / international: CFA leads globally (CFA Institute). ChFC is strong in US advisory. Emerging markets value CFA more.

CFA vs ChFC Pros, Cons, and Tips

CFA Pros:

- High prestige

- Top pay

Cons:

- Intense exams

- Long timeline

ChFC Pros:

- Fast finish

- Client-ready skills

Cons:

- Less global

Difference between CFA and ChFC certifications: CFA math-heavy; ChFC case-based.

Tips:

- Start ChFC if you are advising me now.

- Add CFA later for funds.

- Check retirement savings to fund study.

CFA vs ChFC FAQs

CFA vs ChFC which is better?

Depends on goals.

CFA vs ChFC: Which pays more in 2025?

CFA.

CFA vs ChFC: Which is easier to complete?

ChFC.

Difference between CFA and ChFC certifications?

Focus and depth.

Should I get a CFA or ChFC for a career in wealth management?

ChFC.

CFA vs ChFC for investment analysts?

CFA.

CFA vs ChFC for retirement planning professionals?

ChFC.

How to choose between CFA, CFP, and ChFC?

Match to clients.

CFA vs ChFC job opportunities and demand? Both high.

ChFC vs CFA for personal financial planning careers?

ChFC.

CFA vs ChFC vs CPA salary comparison?

CFA leads.

Which certification do clients value more – CFA or ChFC?

Need-based.

Time and cost difference between CFA and ChFC?

ChFC lower.

CFA vs ChFC global recognition and industry acceptance?

CFA.

Conclusion

CFA vs ChFC defines your finance future. CFA powers professional finance designations in investments. ChFC delivers financial consulting career strength for planners. Review cfa vs chfc salary difference3, cfa vs chfc difficulty, and your clients.

CFA vs ChFC: Which fits your vision?

References

- Investopedia: CFA Details – Focus and value. Targets early-career pros seeking CFA vs ChFC career paths, professional certification in finance, global options. ↩︎

- Google Groups: Credential Debate – Real pros discuss paths. ↩︎

- Augustus Wealth: Differences Guide – Clear breakdowns. ↩︎