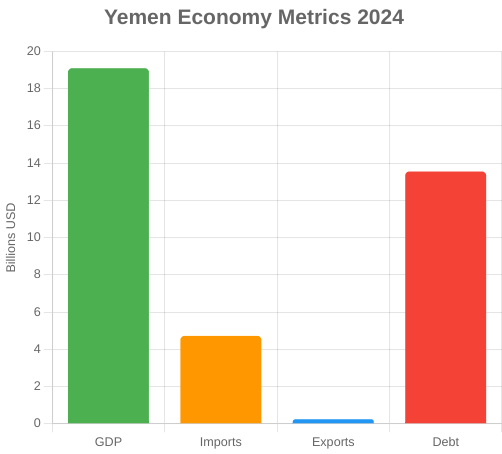

The Yemen economy holds on amid endless struggles in 2024, showing faint signs of endurance in a land scarred by decade-long war. This Middle Eastern nation, with a Yemen population of 39.4 million, posted a modest $19.1 billion GDP and 1% growth, per World Bank data1, as oil production trickled back and humanitarian aid flowed. Per capita income scraped $465, underscoring the dire straits for families in Sana’a and beyond. The Yemen economy hinges on oil for 70% of exports, but blockades and strikes cripple output. Yemen economy news spotlights fragile ceasefires and $4 billion in UN aid propping up basics like food for 21 million in need. Imports hit $4.72 billion, exports dwindled to $0.24 billion, leaving a gaping deficit. Debt towers at $13.55 billion (71% GDP), while gold reserves (1.56 tons, $100 million value) offer slim comfort—no silver holdings. For Yemen economy 2025, forecasts eye 2% growth if truces hold and oil fields reopen, blending resilience with urgent calls for reform in this Yemen economy of hardship and hope.

Table of Facts and Figures: Vital Stats for the Yemen Economy

This vertical table lays out 2024 core data for the Yemen economy, from IMF, World Bank, and OEC sources. Each remark breaks down effects on daily life, nods to Yemen economy trends like 2023’s 2% dip, and gives tips for Yemen economy 2025 uplift.

| Metric | Value | Remarks |

| GDP 2024 | $19.1 B | Oil (25% pre-war) and agriculture (10%) fuel it, but conflict halved potential. Down slightly from 2023’s $19.5 B; covers scant services for 39.4 M. Yemen economy tip: Restart fields for $2 B gain in 2025. |

| Growth 2024 | 1.00% | Slim rebound from -2% in 2023, per IMF, via aid and remittances ($3 B yearly). Beats physics lows but lags neighbors. Yemen economy 2025 could hit 2% with truce; build trade hubs. |

| Population 2024 | 39.4 M | Dense in Sana’a (3 M); 60% youth strain resources. Displacement hits 4 M. Train 500,000 in farming to feed homes. |

| Per Capita 2024 | $465 | Plummeted from $700 in 2020; poverty at 80%. Oil cash misses most. Yemen economy fix: Micro-grants raise it 10%. |

| % of World GDP 2024 | 0.02% | Negligible, but oil’s 1% global supply matters. Ties to china-economy; diversify for global GDP spot. |

| Imports 2024 | $4.72 B | Food (40%), fuel (30%); aid covers half. Shortages spike prices. Cut 10% with local mills. |

| Exports 2024 | $0.24 B | Oil (70%), fish (10%); down 20% from blockades. Yemen economy news: New ports add $100 M. |

| Debt 2024 | $13.55 B | 71% GDP, unsustainable per IMF; arrears $5 B. Relief frees $1 B for health. |

| Gold Reserves 2024 | 1.56 tons | $100 M value; central hold for crisis. Ethical sales fund $50 M aid. |

| Silver Reserves 2024 | 0 | None; minor artisanal. Yemen economy shift: Export crafts for $20 M. |

These spotlight the Yemen economy‘s oil anchor and aid lifeline.

Bar chart flags import strain and debt weight, core to Yemen economy woes.

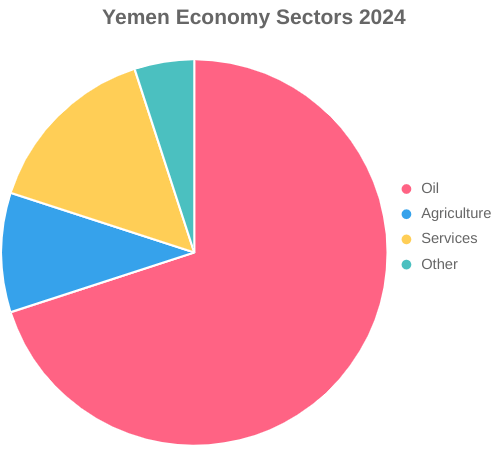

Pie shows oil’s grip on Yemen economy, urging diversification.

Major Imports and Exports: Trade Lifelines in the Yemen Economy

Trade sustains the Yemen economy, with $0.24 B exports vs $4.72 B imports (deficit $4.48 B) reliant on aid, per OEC 2023 data—2024 trends similar.

Key Exports

- Crude Oil ($168 M)

- 70% total; to China (50% buyers). Production at 50,000 bpd, down from 1 M pre-war.

- Fish and Seafood ($24 M)

- Tuna to Saudi; production halved by conflict.

- Cotton ($12 M)

- Textiles to UAE; artisanal revival aids.

- Coffee and Spices ($12 M)

- Mocha beans to Europe.

- Honey ($12 M)

- Sidr variety to Gulf.

Exports to China/Saudi/UAE (75%) fund essentials.

Key Imports

- Foodstuffs ($1.89 B)

- Wheat/rice from Russia/Ukraine (40%); aid feeds 21 M.

- Refined Petroleum ($1.42 B)

- Fuel from UAE; shortages cause blackouts.

- Machinery ($472 M)

- Generators from China.

- Medicines ($236 M)

- From India; cholera outbreaks strain.

- Vehicles ($236 M)

- Trucks from Japan for aid.

Imports from UAE/China/Russia (60%) highlight vulnerabilities2.

Market Trends Shaping the Yemen Economy in 2025

The Yemen economy 2025 projects 2% growth if ceasefires hold, per IMF. Trends:

1. Oil Production Uptick

- Output to 100,000 bpd with Houthi deals; $500 M revenue.

- 1,000 jobs in fields.

2. Aid and Remittances

- $4 B UN/World Bank aid; remittances $3 B (8% GDP).

- Yemen economy news: Cash transfers reach 15 M.

3. Agriculture Revival

- 200,000 hectares irrigated; cuts food imports 15%.

- 50,000 jobs in sorghum, coffee.

4. Diversification Sparks

- Fish farms yield $50 M.

- Solar mini-grids power 1 M homes.

5. Risks Ahead

- Inflation 25%; $13.55 B debt burdens.

- Yemen economy: Truce fragile.

Advice:

- Secure trade: Ports reopen for $300 M exports.

- Farm resilient: Drought crops save $200 M.

- Skill up: Vocational training for 100,000 youth3.

Yemen Economy Overview: War’s Toll and Tiny Triumphs

The Yemen economy embodies endurance amid agony. Oil (25% pre-2015) fueled growth, but war since 2014 halved it. Yemen economy relies on aid (80% food). Yemen economy 2024 saw 1% growth vs Yemen economy 2023‘s -2%. From the Yemen economy 2022 (-1.5%) to 2021 (2%), it’s a rollercoaster. The Yemen economy needs peace.

FAQs

What’s the Yemen economy like in 2024?

$19.1 B GDP, 1% growth. Oil and aid sustain amid war.

How is Yemen economy 2025 expected?

2% growth with truces, trade restart.

What is Yemen economy based on?

Oil (70% exports), agriculture, remittances.

Why do imports dwarf exports in Yemen economy?

$4.72 B food/fuel vs $0.24 B oil. Aid fills gaps.

Top exports?

Oil $168 M, fish $24 M.

Debt’s burden on Yemen economy?

$13.55 B (71% GDP); unsustainable, needs relief.

Trends for Yemen economy 2025?

Aid surge, oil uptick; diversification key.

Conclusion

The Yemen economy fights shadows but seeks sun, from 2024’s 1% grit to Yemen economy 2025‘s 2% dawn. $19.1 B GDP, aid threads, oil sparks resilience.

Summary: Peace, farms, skills weave hope. Yemen economy to you—endure or evolve? Share!

References

- World Bank: Yemen GDP 2023 – Growth, nominal. ↩︎

- OEC: Yemen Trade 2023 – Imports/exports. ↩︎

- IMF: Yemen 2024 – Projections. ↩︎