If you’re earning $23 an hour or eyeing a job that pays this rate, you likely want to know $23 an hour is how much a year after taxes. This question pops up often for job seekers and wage earners in the US. It helps you plan budgets, compare offers, and check if this pay covers your living costs. In this article, we break it down step by step. We use real 2025 tax rules to show gross pay, deductions, and net income. We’ll also cover monthly and biweekly takes, plus tips to make the most of your earnings. All info targets workers in Tier 1 countries like the US, where taxes play a big role in take-home pay.

Understanding Your Gross Annual Salary from $23 an Hour

First, figure out your gross pay before any cuts. Gross means the full amount without taxes or deductions. For hourly workers, this depends on hours worked1.

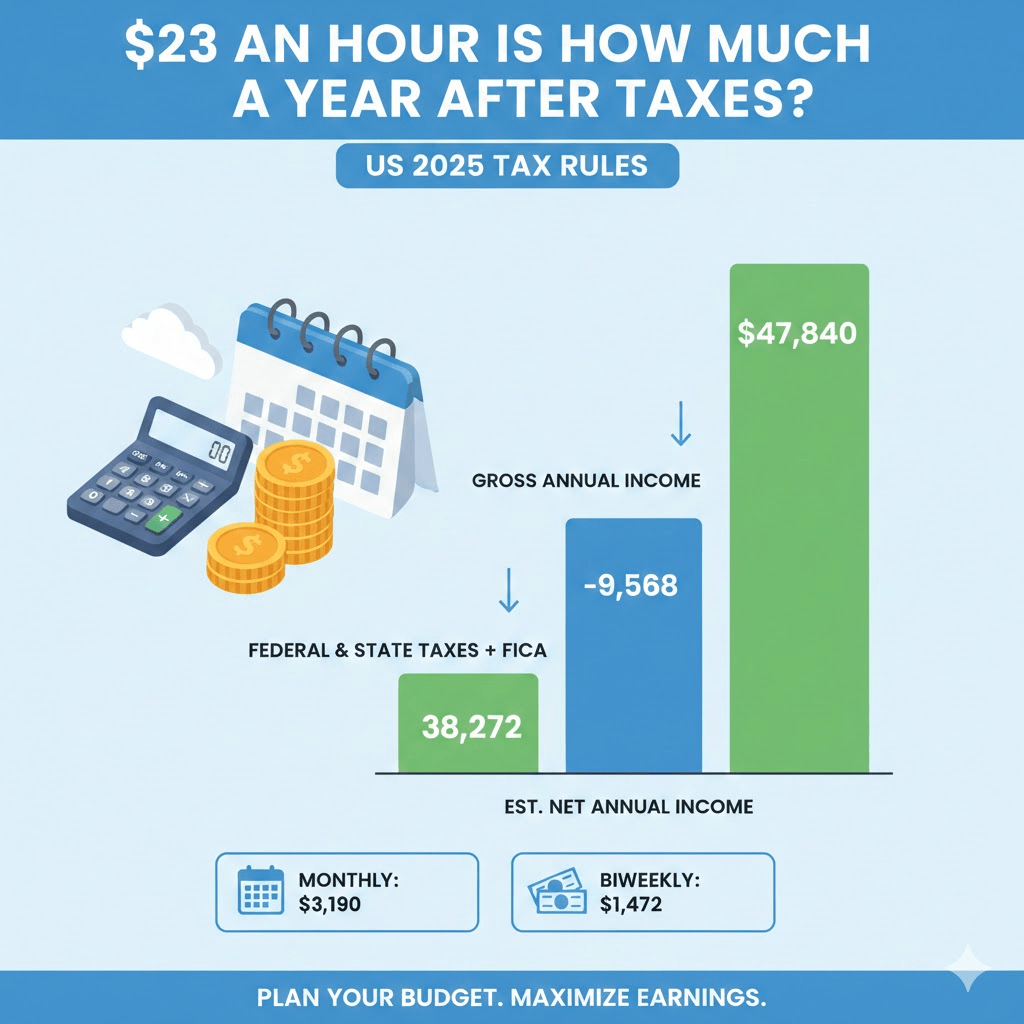

Assume a full-time job: 40 hours per week, 52 weeks a year. That’s 2,080 hours total. Multiply by your rate:

- $23 per hour × 2,080 hours = $47,840 gross yearly.

This matches what sites like Talent.com show for conversions. But real life varies. If you work part-time, say 30 hours weekly, it’s $23 × 1,560 = $35,880 gross.

Many jobs offer overtime at 1.5 times the rate after 40 hours. Add that if it applies. For now, we stick to standard full-time to answer $23 an hour is how much a year after taxes.

Breaking Down Taxes: Federal, State, and More

Taxes eat into your gross. In the US, key ones include federal income, FICA (Social Security and Medicare), and state income. Local taxes might apply too, but we focus on averages.

Federal Income Tax

The IRS sets brackets for 2025. For a single filer with no kids:

- Standard deduction: $15,750 (this lowers your taxable income).

- Taxable income: $47,840 – $15,750 = $32,090.

Brackets:

- 10% on first $11,925 = $1,192.50.

- 12% on next $20,165 (up to $48,475) = $2,419.80.

Total federal: about $3,612.

If married filing jointly, deduction jumps to $31,500, cutting taxes more.

FICA Taxes

These fund Social Security and Medicare. You pay 7.65%:

- Social Security: 6.2% on up to $176,100.

- Medicare: 1.45% with no limit.

For $47,840: 7.65% = $3,660.

Your boss pays the same, but you only see your share withheld.

State Income Tax

This varies widely. Nine states have no income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming.

Average effective rate across US states is around 4-5% on taxable income. For our example:

- 5% on $32,090 = $1,604.

In high-tax states like California, it could hit 9% or more, adding $2,888. In Illinois (like Chicago discussions on Reddit), flat 4.95% on gross minus deductions.

Total taxes for average: $3,612 (fed) + $3,660 (FICA) + $1,604 (state) = $8,876.

$23 an Hour Is How Much a Year After Taxes?

Now, the net: Gross minus taxes.

For single filer in average state:

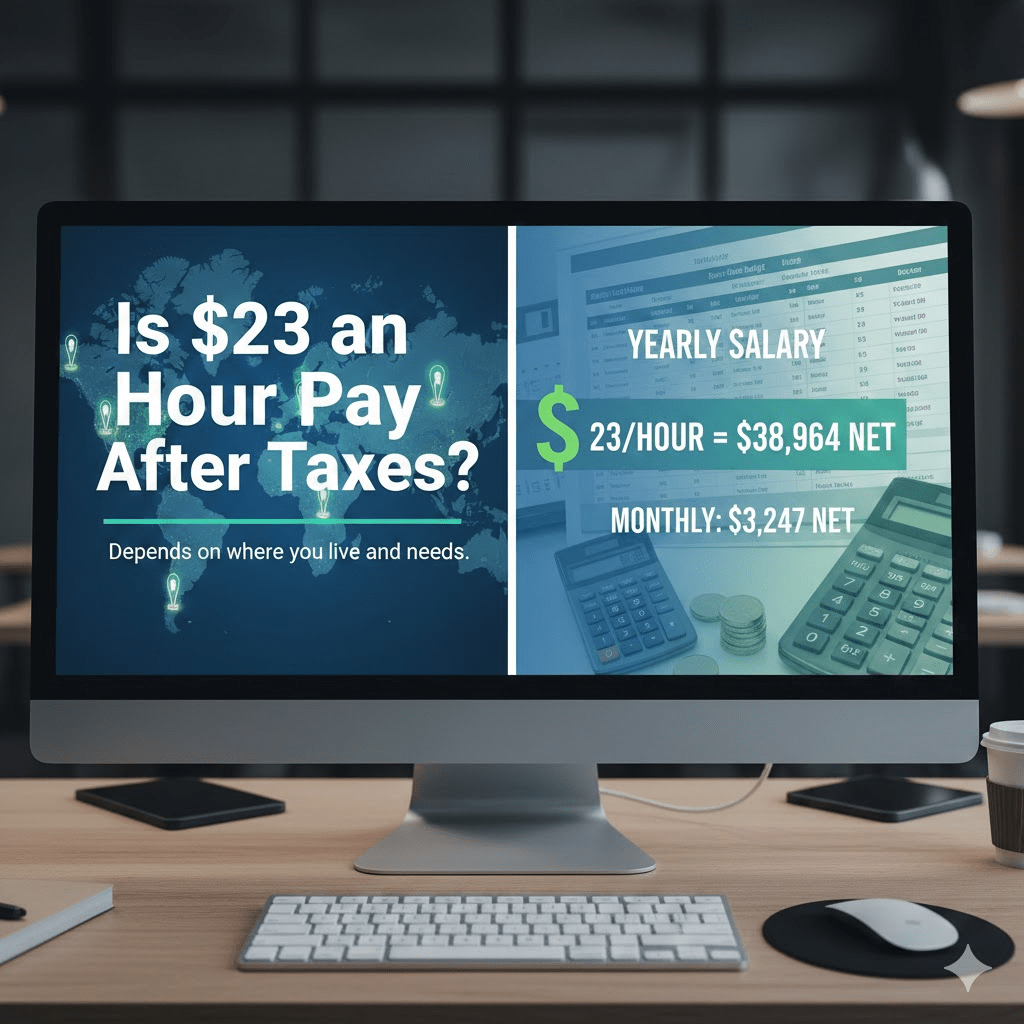

- $47,840 – $8,876 = $38,964 net yearly.

That’s about $23 an hour salary after taxes. But adjust for your situation:

- No state tax (e.g., Texas): Save $1,604, net $40,568.

- High tax (e.g., California): Net around $37,000.

- With dependents: Claim credits like Child Tax Credit ($2,000 per kid), dropping taxes.

Use tools like ADP’s paycheck calculator for exacts. Factors like health insurance premiums or 401(k) contributions lower taxable income too.

For $23 an hour take-home pay, biweekly (every two weeks, 80 hours):

- Gross: $1,840.

- After 18-20% taxes: $1,472-$1,564.

Monthly: About $3,247 net.

Variations by Filing Status and Location

Your net changes based on life details.

Single vs. Family

Single no kids: As above, $38,964.

With one dependent: Extra $2,000 credit, plus head of household deduction $23,625. Taxable drops to $24,215.

- Fed tax: ~$2,665.

- Total taxes: ~$7,929.

- Net: $39,911.

State Examples

- Florida (no state tax): Net $40,568.

- New York: Effective rate ~6-7%, net $38,000.

- Chicago (Illinois): Flat 4.95%, net ~$39,200 (matches Reddit chats on local costs2).

Check your state’s site or use take home pay calculator for precision.

Is $23 an Hour Good Pay After Taxes?

Depends on where you live and needs. $23 an hour yearly salary nets $38,964, or $3,247 monthly.

Compare to costs:

- Average US rent: $1,300/month.

- Groceries: $400.

- Utilities: $200.

- Leaves room for savings if budgeted.

In pricey areas like New York, it’s tight. In affordable spots like Texas, it’s solid for entry-level roles.

Related: If you’re starting a business on the side, check how to start a small business for extra income ideas.

Converting to Monthly and Biweekly Pay

Hourly pay confuses budgeting. Here’s how:

Monthly

Weeks vary, but average 4.33 per month.

- Gross: $23 × 40 × 4.33 = $3,983.

- $23 an hour monthly take home after 18-20% taxes: $3,186-$3,346.

Biweekly

Common paycheck cycle: 80 hours.

- Gross: $1,840.

- $23 an hour biweekly after taxes: $1,472-$1,564.

Track with apps for biweekly paycheck calculation.

Tips for Maximizing Your Take-Home Pay

Boost your net without raising hours.

- Contribute to Retirement: 401(k) lowers taxable income. Aim 10-15%.

- Health Savings Account (HSA): If eligible, pre-tax dollars for medical.

- Adjust Withholdings: Use IRS W-4 form to avoid overpaying.

- Side Hustles: Add income taxed lower if under brackets. See small business ideas with low investment.

- Move to Low-Tax State: If possible, no-state-tax areas save big.

For entrepreneurs, learn how to manage cash flow in a small business to build wealth.

Budgeting with $23 an Hour Net Income

Smart budgeting turns $23 an hour net income into stability.

- 50/30/20 Rule: 50% needs (rent, food), 30% wants (fun), 20% savings/debt.

- Example monthly $3,247 net:

- Needs: $1,623 (housing $1,000, food $400, transport $223).

- Wants: $974 (dining, hobbies).

- Savings: $650 (emergency fund, retirement).

Track net vs gross income to avoid surprises. Use budgeting with hourly pay apps like Mint.

Stats: Bureau of Labor shows median hourly wage $20.50 in 2025, so $23 beats average.

Common Deductions Beyond Taxes

Taxes aren’t all. Other cuts:

- Health insurance: $100-300 biweekly.

- Union dues: $20-50/month.

- Garnishments: If debts.

After these, real $23 an hour paycheck shrinks. Quora users note monthly nets around $3,000 after everything.

Cost of Living Comparison

See if $23 hourly wage yearly works where you are.

- Low-cost (e.g., Midwest): Covers family basics.

- High-cost (e.g., coasts): May need roommates.

Use cost of living comparison sites. For instance, $38,964 in Texas equals $50,000 in California buying power.

If switching careers, explore best business ideas for students with low investment for supplements.

How Much Is $23 an Hour Annually for Part-Time?

Not full-time? Adjust:

- 20 hours/week: Gross $23,920, net ~$20,000 after taxes.

Ideal for students or side jobs.

$23 an Hour After Taxes: Single Filer vs. With Dependents

Single: $38,964 net.

With kids: $23 an hour after taxes with dependents adds credits. Two kids: $4,000 credit, net up to $41,000.

File as head of household for bigger deduction.

Can You Live on $23 an Hour After Taxes?

Yes, with planning. Millions do on similar. Focus on:

- Debt payoff.

- Emergency fund (3-6 months expenses).

- Investments for growth.

Reassuring: This wage supports modest living in most US areas. Build skills for raises.

For more on finances, read what is the benefit of a savings account.

FAQs

$23 an hour is how much a year after taxes in the US?

In the US, full-time gross is $47,840, but after federal, FICA, and average state taxes, net pay lands around $38,964 for a single filer.Adjust for no-tax states like Texas to boost net to $40,568, or high-tax areas like California where it drops to about $37,000.

How much do you take home making $23 an hour?

Your take-home depends on deductions, but for full-time, expect $38,964 yearly net after 18-20% taxes on $47,840 gross.This translates to roughly $3,247 monthly or $1,500 biweekly, minus extras like insurance for real-world paychecks.

$23 an hour take home pay after federal and state taxes?

After federal (about $3,612) and state (average $1,604) plus FICA ($3,660), net is $38,964 from $47,840 gross.Varies by location—zero state tax saves $1,600; use calculators for your exact federal and state combo.

$23 an hour paycheck after deductions?

Biweekly gross $1,840 minus taxes and common deductions like health ($100-300) nets $1,200-$1,400.Factor in retirement contributions to lower taxes, but expect unions or garnishments to cut further for accurate take-home.

Conclusion

In summary, $23 an hour is how much a year after taxes comes to about $38,964 net for a single filer in an average US state, based on 2025 rules. This gives a clear picture for hourly wage to annual salary planning. Adjust for your state, family, and deductions to get your exact. With smart budgeting, this wage builds a solid foundation.

What are your plans for your $23 an hour yearly salary? Share in comments!

References

- Salary Converter – Talent.com: Provides gross conversion tools, useful for quick hourly to yearly calcs. Targets job seekers comparing offers. ↩︎

- Reddit Thread on Take-Home Pay in Chicago: Real user estimates on local taxes and nets, great for urban wage earners. ↩︎