Warren Buffett, the legendary investor known as the Oracle of Omaha, has always been a beacon for individual investors. In 2024, warren buffett warned investors a $134 billion correction was coming by taking decisive actions with Berkshire Hathaway’s portfolio. He sold a net $134 billion in stocks while building a massive cash pile. This move sent a clear signal amid high market valuations and growing risks.

Many retail investors watch Buffett’s decisions closely. His net sales in 2024 raised eyebrows because they happened during a strong bull market. As the S&P 500 soared, Buffett chose caution. This article explores what his actions mean, why they matter for stock market correction risks, and how you can apply his lessons to your own investment strategy 2025.

Warren Buffett warned investors a $134 billion correction was coming.

Warren Buffett started his journey in investing at a young age. Born in 1930, he bought his first stock at age 11. He studied under Benjamin Graham, the father of value investing. Buffett focuses on buying great companies at fair prices and holding them for the long term.

In 1965, he took control of Berkshire Hathaway, a struggling textile company. He turned it into a holding company for investments. Under his leadership, Berkshire’s stock has grown at about 20% per year on average. That far beats the S&P 500’s roughly 10% annual return over the same period.

Buffett’s philosophy is simple:

- Buy businesses you understand.

- Look for companies with strong moats (competitive advantages).

- Be patient and ignore short-term noise.

Individual investors follow him because his approach suits long-term, buy-and-hold strategies. When he sells big or builds cash, it often signals caution about market volatility or overvaluation.

Understanding the $134 Billion Sell-Off

In 2024, Berkshire Hathaway sold $143 billion in stocks but bought only $9 billion. This led to a net sell-off of $134 billion – a record for the company.

Key sales included big cuts in Apple and Bank of America shares. Buffett reduced Berkshire’s huge Apple stake significantly. He also trimmed other holdings.

At the same time, Berkshire’s Buffett cash position grew to over $334 billion by year-end. That’s almost double from the prior year. Warren Buffett Sent Wall Street a $134 Billion Warning

Why did this happen? Buffett has said he couldn’t find many good deals at reasonable prices. Markets were expensive, with the S&P 500 Shiller CAPE ratio above 35 – a level seen only a few times in history.

These Berkshire Hathaway moves weren’t about predicting a crash. They showed discipline in value investing signals. Buffett prefers holding cash over buying overpriced stocks.

Warren Buffett Warned Investors a $134 Billion Correction Was Coming: Key Facts

Here are the main numbers from 2024:

- Net stock sales: $134 billion

- Total stocks sold: $143 billion

- Stocks bought: $9 billion

- Cash pile at end of 2024: Around $334 billion

- Stock portfolio value: About $272 billion (smaller than cash for the first time)

This shift highlighted concerns about equity market risk.

What Does This Mean for a Stock Market Correction?

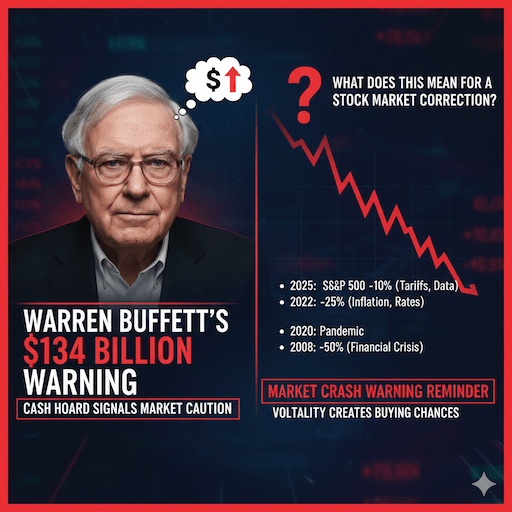

Buffett’s actions came before the S&P 500 entered S&P 500 correction territory in early 2025. The index dropped over 10% from its peak due to factors like tariffs and economic data.

History shows markets often correct when valuations are high. Past corrections include:

- 2022: The S&P 500 fell about 25% amid inflation and rate hikes.

- 2020: A quick 34% drop during the pandemic.

- 2008: Over 50% decline in the financial crisis.

Buffett has navigated these before. He famously said to be “greedy when others are fearful.” His current cash hoard positions Berkshire to buy during downturns.

For individual investors, this is a market crash warning reminder. High valuations can lead to market volatility. But corrections are normal and often create buying chances. Warren Buffett $134 Billion Warning to Wall Street

Buffett’s Strategy: Lessons in Value Investing

Warren Buffett investing focuses on quality over quantity. He looks for companies with:

- Strong economic moats

- Reliable earnings

- Good management

- Fair prices

In expensive markets, he waits. That’s why the Buffett sell-off happened. It wasn’t panic – it was smart stock portfolio rebalancing.

Buffett has warned about risks before. In letters to shareholders, he stresses long-term thinking. Short-term predictions are hard, even for him.

Historical Market Corrections and Buffett’s Responses

Buffett has seen many downturns. Here’s how he handled some:

- 1973-1974 Bear Market: Stocks fell 48%. Buffett bought great companies cheaply.

- 2000 Dot-Com Bubble Burst: He avoided tech hype and bought later.

- 2008 Financial Crisis: Invested in Goldman Sachs and others at bargain prices.

Each time, patience paid off. His actions today echo portfolio risk management. Warren Buffett’s Warning to Wall Street Just Got Distinctively Louder

Actionable Advice for Individual Investors in 2025

As a self-directed investor, you can learn from Buffett. Here’s what to do:

- Build cash reserves: Keep some dry powder for opportunities.

- Focus on quality stocks: Look for strong businesses, not hot trends.

- Avoid overpaying: Check valuations like price-to-earnings ratios.

- Hold long-term: Don’t sell in panic during market volatility.

- Diversify wisely: Own a mix of stocks, but know what you own.

Consider these steps for your investment strategy 2025:

- Review your portfolio for overvalued holdings.

- Add to positions in solid companies if prices drop.

- Learn more about portfolio risk management basics.

- Stay informed on financial market trends.

For those interested in building wealth steadily, explore ideas like how to build passive income through online entrepreneurship.

Signs of Potential Market Downturn in 2025

Current signals include:

- High Shiller CAPE ratio

- Rising interest rates in some forecasts

- Geopolitical risks

- Slowing earnings growth

An economic downturn forecast isn’t certain, but preparation helps. Buffett’s moves suggest caution on Wall Street warning levels.

How to Protect Your Portfolio

Use these tips:

- Rebalance regularly: Sell winners if they’re too pricey.

- Build an emergency fund: As suggested in what is the benefit of a savings account.

- Invest in index funds: For broad exposure, like S&P 500 trackers.

- Learn from pros: Read Buffett’s annual letters.

Many investors track investor sentiment to gauge fear or greed.

Buffett’s Top Holdings: What He Still Likes

Even after sales, Berkshire holds strong names like:

- Apple (reduced but still large)

- American Express

- Coca-Cola

- Chevron

These show his preference for durable businesses.

For more on smart investing, check understanding the difference between venture capital and private equity.

Common Mistakes Investors Make During High Valuations

Avoid these:

- Chasing hot stocks

- Borrowing to invest

- Selling everything in fear

- Ignoring basics like diversification

Instead, follow value investing signals.

What History Says About Corrections After Buffett’s Caution

In years when Berkshire was a net seller, S&P 500 returns varied. Sometimes lower than average, but markets recovered. Long-term holders won1.

This aligns with historical market corrections.

Preparing for Volatility: Practical Steps

- Assess your risk tolerance.

- Set clear goals.

- Use tools like the best AI tools for small business productivity for tracking, even as an individual.

- Stay educated on stock market outlook.

Long-Term Outlook: Why Stay Invested?

Despite warnings, stocks have historically risen over time. Corrections pass. Buffett’s career proves patience works2.

For retirement planning, see your guide to human interest 401k.

FAQs

What did Warren Buffett do with stocks in 2024?

Warren Buffett, through Berkshire Hathaway, sold a lot more stocks than he bought. He sold about $143 billion worth and only bought $9 billion. This created a net sale of $134 billion, which was a big record for the company.

Why is the $134 billion sale called a warning?

Buffett sold so much because he thought the stock market was too expensive. He could not find many good companies at fair prices. This big cash move is seen as a careful signal that a market correction or drop might happen.

How much cash did Berkshire Hathaway build up?

By the end of 2024, Berkshire had over $334 billion in cash and safe investments. This huge cash pile grew a lot from the year before. It gives Buffett money ready to buy great companies if prices fall.

Did the stock market really have a correction in 2025?

Yes, the S&P 500 dropped more than 10% from its high early in 2025. This put it in correction territory because of things like high prices before and new economic worries. Buffett’s careful moves in 2024 look smart now as he sat on cash during the drop.

What can regular investors learn from Buffett’s actions?

Be patient and only buy good companies at fair prices. Keep some cash ready for better chances during market drops. Focus on quality businesses with strong advantages, and hold them for the long term instead of chasing hot trends.

Conclusion

Warren Buffett warned investors a $134 billion correction was coming by net selling $134 billion in stocks and building a huge cash position in 2024. His actions highlight the need for caution in overvalued markets. For individual investors, this is a call to focus on quality, patience, and smart portfolio risk management.

While corrections can be scary, they often lead to opportunities. Stay disciplined, learn from Buffett, and keep a long-term view.

References

- Warren Buffett’s Warning to Wall Street Just Got Distinctively Louder – Nasdaq article on Buffett’s sales and market implications. ↩︎

- Warren Buffett $134 Billion Warning to Wall Street – Motley Fool details on 2024 net sales and historical performance. ↩︎