Argentina heads into 2025 at a pivotal moment, showing real signs of recovery after years of instability. With President Javier Milei’s reform agenda gaining traction and foreign partnerships expanding, confidence is returning to markets. Inflation is easing, exports are rising, and GDP growth has outperformed early forecasts. While challenges like high debt and social tension remain, Argentina’s focus on fiscal discipline, energy investment, and open trade is steering the economy toward a more stable path. This overview looks at key facts, trade dynamics, and the policies driving Argentina’s economic turnaround.

Why Focus on the Argentina Economy Now?

Search interest in Argentina economy today has surged, driven by pivotal political and economic developments. On October 26, 2025, President Javier Milei’s party secured a commanding victory in the midterm elections, gaining critical seats in Congress . This strengthened legislative support accelerates Milei’s aggressive agenda to cut public spending, deregulate markets, and stabilize the peso.

The milei Argentina economy strategy gained further credibility with a landmark $20 billion currency swap agreement with the United States, bolstering foreign reserves and reducing default risk . Global investors and analysts are closely watching these Argentina economy news updates, as they signal a potential turning point after decades of fiscal instability.

A Rocky Start, Now Showing Promise

The Argentine economy under milieu began with sharp austerity in late 2023. Monthly inflation peaked above 25% in December 2023, triggering social unrest. Yet, disciplined monetary policy has since driven inflation down to a projected 41%1 annual rate by end-2025 .

Is the Argentine economy improving? The data says yes. GDP expanded 6.3% year-on-year in Q2 2025, surpassing Q1’s 5.8% growth . Real wages are recovering, foreign reserves are rising, and industrial output is rebounding—especially in energy and agriculture.

But historical context matters. Why is Argentina economy so bad for so long? Decades of excessive money printing, populist spending, and debt defaults created vicious boom-bust cycles. Milei’s administration is breaking that pattern through fiscal surplus targets and central bank independence.

Regional Comparison and Global Integration

Argentina’s reform pace now outstrips many peers. While Brazil’s economy battles persistent inflation and political gridlock, Argentina posts faster disinflation and bolder deregulation. Similarly, Mexico’s economy thrives on nearshoring and manufacturing exports—yet Argentina’s soy and lithium boom positions it as a rising commodity powerhouse.

These dynamics reflect deeper trends in economic globalization. Argentina’s integration into global supply chains—especially with China, the EU, and the U.S.—is strengthening, supported by trade surplus growth and new investment frameworks.

Table of Facts and Figures

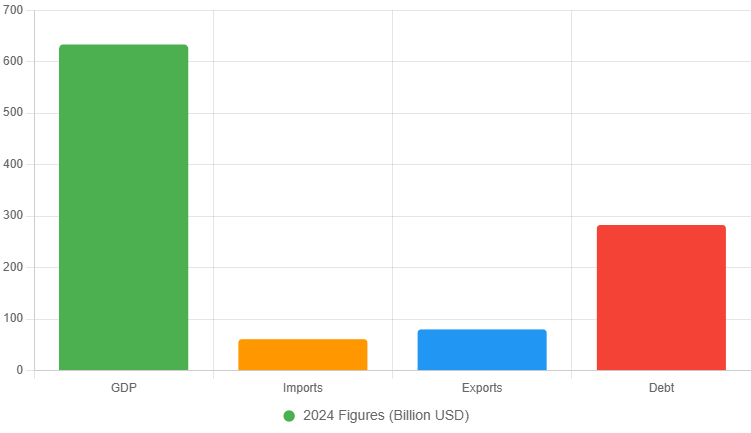

To spot trends, check this table. It pulls 2024 numbers, base for 2025 jumps. Data comes from trusted sources like the World Bank2 and IMF3.

| Metric | Value | Notes |

| GDP 2024 | $633.3 Billion | Steady base amid reforms. |

| Growth 2024 | 1.70% | Modest rebound from prior dips. |

| Population 2024 | 45.70 Million | The young workforce aids recovery. |

| Per Capita 2024 | $13,858 | Rises with efficiency gains. |

| % of World GDP 2024 | 0.60% | Small but vital in South America. |

| Imports 2024 | $61 Billion | Down 17% from 2023, smart cuts. |

| Exports 2024 | $80 Billion | Up 19%, agro leads charge. |

| Debt 2024 | $282.8 Billion | High burden, but swaps ease it. |

| Gold Reserves 2024 | 61.7 Tons | Safe haven, moved abroad for deals. |

| Silver Reserves 2024 | N/A (Minimal) | The central bank focuses on gold; no major silver holdings are reported. |

Remarks on These Terms:

- GDP 2024 ($633.3B): This total output shows resilience. Reforms under Milei trimmed fat, setting up 5%+ growth in 2025. It beats india-economy per capita but lags in scale. (Link: India’s Giant Leap)

- Growth 2024 (1.70%): Slow start, but Q4 picked up. Argentina economy collapse fears fade as activity hums.

- Population 2024 (45.70M): Diverse cities like Buenos Aires drive services. Youth bulge means job needs, but also fresh ideas.

- Per Capita 2024 ($13,858): Everyday wealth gauge. Up from 2023, thanks to export wins. Still, inequality bites—top 10% hold most.

- % of World GDP 2024 (0.60%): Tiny slice, yet agro feeds globals. Ties to world-economy-ranking-2025 spot it mid-pack. (Link: 2025 Global Ranks)

- Imports 2024 ($61B): Fell sharp, easing forex strain. Focus on essentials like fuel.

- Exports 2024 ($80B): Star performer. Soy and meat top lists, up 19%.

- Debt 2024 ($282.8B): Heavy load at 45% GDP. U.S. deal cuts risk; watch for rollovers.

- Gold Reserves 2024 (61.7 Tons): Key buffer. Banks shipped some abroad for swaps, sparking talks.

- Silver Reserves 2024 (N/A): Unlike gold, banks skip silver. Argentina mines it (800 tons output), but holds little centrally.

This table paints a clear picture. Now, visualize the big flows.

Here’s a bar chart showing core financials for 2024. It highlights GDP against trade and debt—easy to see strengths.

See how exports nearly match imports? That’s balance building.

Major Imports and Exports: Trade Engines of Argentina Economy

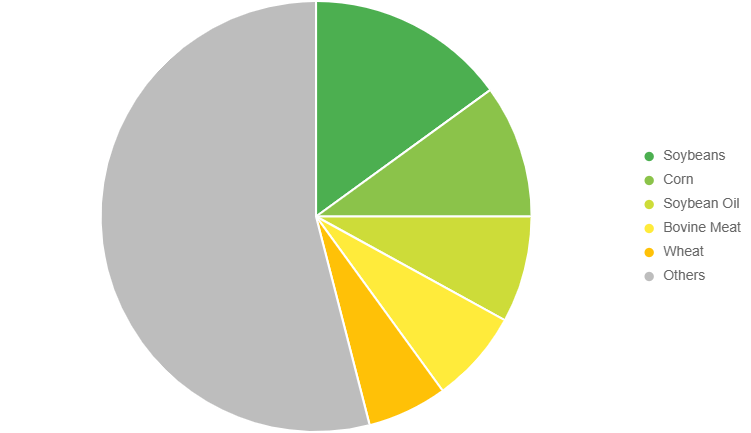

Trade fuels the economy of Argentina. In 2024, exports hit $80 billion, imports $61 billion—a surplus that pads reserves. What type of economy does Argentina have? Mixed market, heavy on commodities. Here’s the breakdown:

Top Exports (2024, Key Shares):

- Soybeans: 15% ($12B) – Feeds China, Brazil.

- Corn: 10% ($8B) – Global food staple.

- Soybean Oil: 8% ($6.4B) – Cooking and biofuel king.

- Frozen Bovine Meat: 7% ($5.6B) – Premium steaks to Europe.

- Wheat: 6% ($4.8B) – Bread base for world tables.

These agro stars drove 19% growth. Partners: Brazil (15%), China (10%), India (8%). (Link: India’s Role)

Top Imports (2024, Key Shares):

- Machinery/Parts: 20% ($12.2B) – Builds factories.

- Motor Vehicles: 15% ($9.15B) – Cars from Brazil.

- Petroleum/Gas: 12% ($7.32B) – Energy must-have.

- Chemicals/Plastics: 10% ($6.1B) – Industry basics.

- Telephones/Circuits: 8% ($4.88B) – Tech from China.

Imports dropped 17%, as local swaps cut needs. Partners: China (25%), Brazil (20%), U.S. (15%). (Link: U.S. Ties)

Quick tip: Watch soy prices. A dip could slow Argentina economy growth. But diversification into lithium batteries eyes future wins.

This pie chart breaks exports by top categories. Colors pop for quick reads—greens for agro dominance.

Argentina Economy 2025: Bright Path Ahead?

Argentina economy 2025 looks solid. IMF sees 4.5% GDP rise, OECD4 5.2%. Argentina economy outlook 2025 hinges on Milei’s cuts. Inflation? Down to 30% per BBVA5. Javier milei Argentina economy bets big: Ditch peso controls, lure investors.

Argentina economy current status 2025? Strong Q3 activity, wages up 5% real terms. Argentina economy updates today with midterm highs—Milei vows faster reforms. Argentina economy news today 2025 highlights U.S. aid: $20B swap fights volatility.

Challenges? What happened to Argentina economy pre-Milei? Debt spirals and prints. Now, how is the economy in Argentina? Stabilizing. Does Argentina have a good economy? Improving, yes—ranks above russia-economy in growth speed. (Link: Russia’s Hurdles)

Argentina economy type: Resource-rich mixed. Services 60%, industry 25%, agro 15%. What kind of economy does Argentina have? One shifting to free markets. What is the economy of Argentina? Dynamic, with Vaca Muerta gas as the next gem.

Argentina economy news today September 2025? Early wins, but floods hit soy. October? Election boost. Argentina economy current situation 2025: Upward, yet watch debt rolls.

How is Argentina’s economy doing? Better than 2024’s Argentina economy collapse scares. Is Argentina’s economy improving? Data says yes. What is the economy like in Argentina? Vibrant ports, fertile fields.

Argentina’s economy rebounds. How is the Argentine economy? Gaining steam. What economy does Argentina have? Resilient one. How is the Argentine economy? On mend.

Tips to Track Argentina Economy Shifts

Stay sharp:

- Follow INDEC reports monthly—exports lead news.

- Check IMF updates; they flag risks early.

- Watch peso: Stable means investor trust.

- Link to globals: China economy buys soy big. (Link: China’s Demand)

Quote from Milei: “We chainsaw the state to free the people.” Harsh, but it works—growth proves it.

FAQs on Argentina Economy

What is Argentina economy?

It’s a mixed system with strong agro exports and growing services, now leaning freer under Milei.

How is the economy in Argentina now?

In October 2025, it expanded at 5% pace, with midterm wins aiding reforms and U.S. aid boosting confidence.

Why did Argentina economy collapse?

Past overspending and prints caused hyperinflation; Milei’s fixes reverse that trend.

What type of economy is Argentina?

Resource-driven mixed economy, blending state and market, focused on commodities like soy.

Argentina economy overview 2025?

Expect 4.5-5.5% growth, lower inflation, and trade surplus as key drivers.

Is Argentina economy improving?

Yes, GDP up 6% Q2, wages rising, and reserves growing signal clear progress.

How is Argentina economy doing?

Solid rebound in 2025, with exports shining and debt eased by global pacts.

Wrapping the Argentina Economy Story

In sum, the Argentina Economy turns a corner in 2025. Milei’s midterm triumph, 5% growth forecast, and $80B exports paint promise. Trade balances and reserves strengthen, easing old pains. Yet, steady reforms keep it on track. Compared to Germany-economy precision or Japan-economy tech, Argentina’s agro edge shines in global-gdp. (Link: World GDP View) (Link: Germany’s Model)

What step will Milei take next to lock in gains? Share your take below.

References

These references draw from leading international organizations and news outlets, providing credible data on Argentina’s economic reforms, growth projections, and trade dynamics under President Milei. For readers interested in global economics—whether investors tracking emerging markets, students studying Latin American policy, or business professionals eyeing trade opportunities—they offer actionable insights like GDP forecasts (e.g., 4.5-5.5% growth in 2025) and reform impacts, helping contextualize Argentina’s rebound amid global volatility. All links are active as of October 27, 2025.

- Reuters. (2025, October 27). Argentine markets expected to rally after Milei’s election victory. Link – Breaking coverage of Milei’s midterm win (41% vote share, gaining key congressional seats), predicting bond/stock rallies up to 15%; timely for investors gauging political risk reduction until 2027. ↩︎

- World Bank. (2025). Argentina Overview. Link – Updated snapshot with 4.6% GDP growth estimate for 2025, tied to $12B support package for private-sector jobs; great for development enthusiasts focusing on poverty reduction via agro/energy investments.

↩︎ - IMF. (2025). Argentina and the IMF. Link – Official data on the $20B Extended Fund Facility, including 4.5% GDP growth and 41.3% inflation forecasts for 2025; essential for finance pros tracking debt sustainability and structural shifts toward energy/mining sectors.

↩︎ - OECD. (2025, July 7). OECD Economic Surveys: Argentina 2025. Link – A comprehensive policy review highlighting macroeconomic stabilization, with 5.2% growth expected in 2025 post-reforms; useful for audiences exploring business environment improvements and export tax reductions to boost competitiveness.

↩︎ - BBVA Research. (2025, June 26). Argentina Economic Outlook. June 2025. Link – This monthly report analyzes sectoral growth (e.g., 5.5% GDP projection for 2025 driven by consumption and investment) and inflation trends (down to 28% y/y), ideal for understanding uneven recovery in agro and services amid fiscal discipline. ↩︎