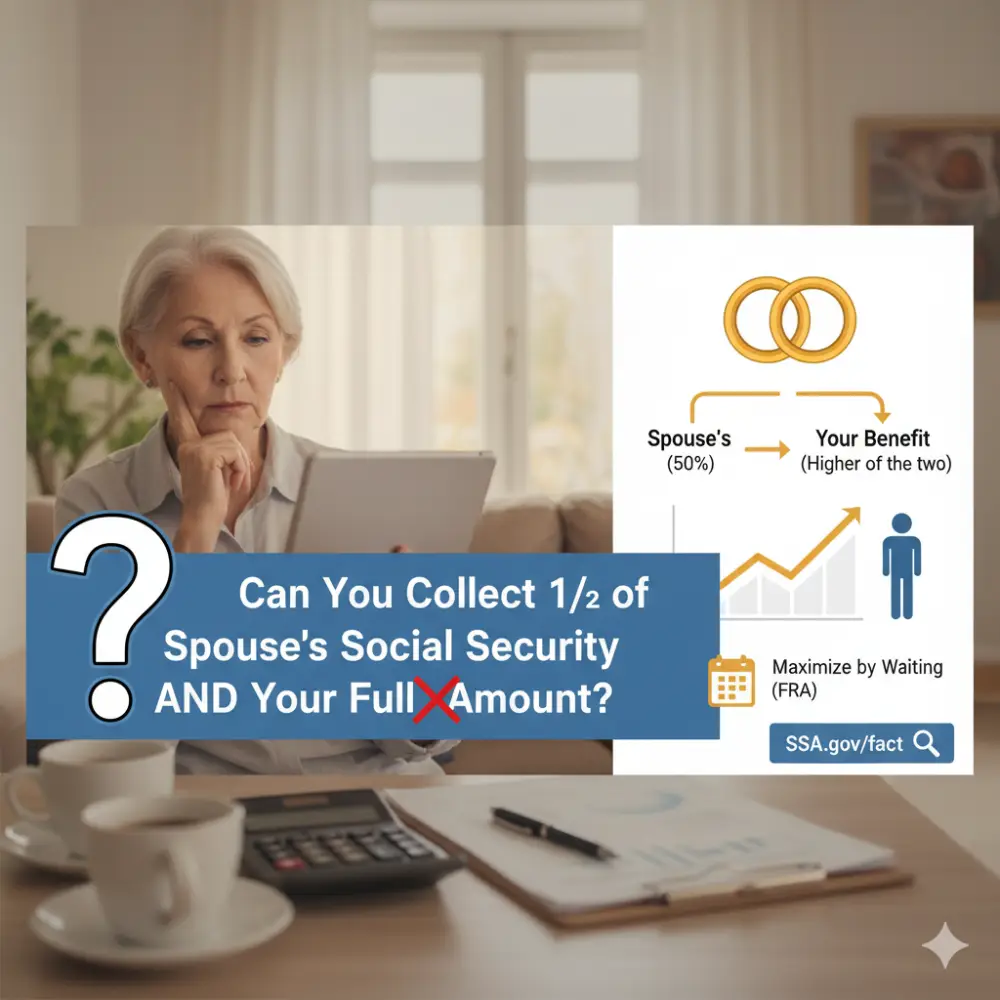

Many retirees wonder if they can collect half of their spouse’s Social Security benefits and then later switch to receive their full amount. It’s a common question — and one that often causes confusion. The truth is, Social Security has specific rules about when and how you can claim spousal benefits, as well as how those benefits interact with your own retirement payments. Understanding these rules is key to maximizing your income during retirement.

In this guide, we’ll break down whether you can receive 50% of your spouse’s Social Security and later switch to your full benefit, how the “deemed filing” rule works, and the best strategies to make the most of your Social Security benefits as a couple.

Exploring Can You Collect 1/2 of Spouse’s Social Security and Then Your Full Amount?

Many old people ask if you can collect 1/2 of your spouse’s social security and then your full amount. I hope to get more. But SSA rules stop adding. You get a big one of your own or spouse. Not all add. But waiting for my own claim helps max.Social Security started 1935. Help 65 million now. Spouse helped add 1939 no work man. Now two workers find a way. Social security spousal benefits give half partner main pay at full old age (FRA). But my own win is big.This tells the wrong thing. Use SSA fact. You learn who gets, math, and stories. Good marry 55+, no marry, plan man. The number says 4 million get spouses. Mean $800 a month.

Social Security Spousal Benefits: Easy Tell

Social security spousal benefits let claim partner work. Up half FRA help.

Key:

- Who gets: Marry 1+ year. Partner take or can.

- How much: Half partner PIA at FRA. Less early.

- Own check: SSA pays a big own or spouse.

How spousal social security benefits work: File 62+. Cut 35% before FRA. No up wait past FRA.Social security retirement benefits for married couples mix. One big work? Other spouses.Story: John PIA $2,000. Mary owns $800. Spouse $1,000. She got $1,000 all.In: Plan old like human 401k help.

Can You Collect 1/2 of Spouse’s Social Security and Then Your Full Amount? True

Can you collect 1/2 of your spouse’s social security and then your full amount? Not all. Deem file rule. File one, SSA check two. You get a big one.Switching from spousal benefits to own benefits can if one grows. Wait down 70-8% year up.Deemed filing rule social security: FRA or late, split claim ok. Before? One app two.Claiming spouse’s social security before mine: Yes partner file. Then switch down big late.Number: 25% spouse wait credit. Mean up $300 a month.Spouse social security eligibility rules: Age 62+, no new marry if no marry (10+ year marry). Use SSA Spouse Math Tool1.

How to Maximize Social Security Benefits as a Couple

How to maximize social security benefits as a couple? Smart file.

Help:

- Big work waits 70.

- Small claim spouse early.

- See no marry rule: Ex spouse free.

Social security filing strategies for spouses: File stop. Now deem.Full retirement age (FRA) 67 born 1960 + .Delayed retirement credits: 8% year past FRA 70.Primary insurance amount (PIA) base all.Story: Anna spouse $900 62. Wait on 70. Switch $1,500.Can I take spousal benefits first then my own? Yes, my own big late.

Benefit Reduction for Early Filing: See

- Benefit reduction for early filing cut spouses 25-35%. Own too.

- Early retirement penalty social security: 5/9% month before FRA.

- Working spouse vs nonworking spouse benefits: Two get. Work cut under FRA.

- Dual entitlement social security: One help type.

- In: Do money like cash vs add base.

Survivor Benefits vs Spousal Benefits: Diff

Survivor benefits vs spousal benefits: Spouse two lives. Survivor 100% after death.Can I collect my ex-spouse’s social security and later my own? Yes, marry 10+ years.How does the deemed filing rule affect spousal benefits? Stop early split claims.

Joint Retirement Planning: Couple

- Joint retirement planning mix claim.

- Maximize lifetime social security income: Make a story.

- Social security claiming age: 62-70.

- Tool: SSA web math.

- Out: SSA Blog Spouse Get2.

Spousal Benefit Calculation Examples

Spousal benefit calculation examples:

- Partner PIA $3,000. Spouse max $1,500 FRA.

- Claim 64: Cut $1,300.

Can You Get Both Your Social Security and Your Spouse’s?

Can you get both your social security and your spouse’s? Not all two. Fix if the spouse is big.How does social security spousal benefit switching work? Auto FRA is better.

How to Apply for Half of Spouse’s Social Security Benefits

How to apply for half of a spouse’s social security benefits?

- Web ssa.gov.

- Call 1-800-772-1213.

- Go to the office.

2025 Update

New law fix. More wipe? Spouse same.

In: See social security change 2025.

Tip No Marry

Can I get spousal benefits while my spouse is still alive? Yes.

Number Help

- Spouses mean $800.

- 4 million get.

- Women 90%.

Say Good Man

“Max, wait.” – SSA.

Low Work Man

No work spouse half.

How to qualify for 50 percent of a spouse’s social security? FRA take.

Out: Quora Half Then All3.

Plan Tool

My Social Security web.

Bad Do

Early take lock small.

Can You Collect 1/2 of Spouse’s Social Security and Then Your Full Amount? Last Say

No straight ad. Get max can.

FAQs

Can you collect 1/2 of your spouse’s social security and then your full amount?

Switch can, no add.

Social security spousal benefits rule?

Half PIA FRA.

Switching from spousal to own benefits?

Own big late.

How do spousal social security benefits work?

Partner work base.

Claiming spouse’s social security before mine?

Yes then switch.

conclusion

Can you collect 1/2 of your spouse’s social security and then your full amount? No mix but switch big. Social security spousal benefits up money smart. File good. Use a math tool. Max life.What Social Security plan? Tell me!

References

- SSA Spouse Math – Tool marry couple 55-70 math help, say no mix. ↩︎

- SSA Blog: Get Spouse Help – Tell who gets a spouse low work wants max money. ↩︎

- Quora: Take Half Then All – Talk plan man stop wrong think switch.

↩︎