In this fast moving world, where everything happens online, digital real estate is becoming a hot topic for smart investors. But what is digital real estate? Simply put, it’s like owning property on the internet, think websites, domain names, social media pages, virtual land in the metaverse, or even NFTs non-fungible tokens. Unlike buying a house, you don’t need a big loan or a realtor; you can start small and grow from there. Curious about starting your journey? Check out this step-by-step guide to becoming an entrepreneur for a broader roadmap to building your online empire.

Why invest in digital real estate investing now? The online world is exploding. According to recent data, the global metaverse real estate market was worth about $1.69 billion in 2023 and is set to hit $59.83 billion by 2032, growing at a whopping 48.6% each year. Plus, real estate tokenization turning physical properties into digital shares has already reached $20 billion in value and could soar to $1.5 trillion by 2025. For beginners, this means low entry costs often under $500 and chances for passive income, like renting out virtual space or earning from ads.

In this guide, we’ll break down how to invest in digital real estate step by step. We’ll cover what is digital real estate investing the best platforms, real examples of how to make money from digital real estate, and tips to avoid scams since many ask, “is digital real estate legit?” By the end, you’ll have a clear plan to start your digital real estate investing for beginners journey in 2025. Let’s dive in.

What Is Digital Real Estate?

Digital real estate meaning is straightforward: it’s any online asset you can own, develop, and profit from, just like a physical building. The digital real estate meaning has evolved from simple domain names in the 90s to today’s immersive virtual worlds.

At its core what is digital real estate? It’s virtual “land” or properties that exist only online. These assets have real value because people and businesses pay for visibility, traffic and community. For example:

- Domain Names: Short, catchy web addresses like “Cars.com,” which sold for $872 million in 2014.

- Websites and Blogs: Sites you build or buy that attract visitors.

- Social Media Accounts: Pages with thousands of followers, like Instagram profiles for influencers.

- Metaverse Land: Virtual plots in platforms like Decentraland or The Sandbox, where you can host events.

- NFTs: Unique digital collectibles tied to art, music, or even property rights.

- E-commerce Stores: Ready-made shops on Shopify that sell products.

How does digital real estate work? You buy low, add value like better content or design and sell high or rent it out. There’s no need for plumbers or mortgages! In 2025, with AI tools making creation easier, even non-techies can join. But remember, value comes from demand: a domain in a hot niche like AI or crypto sells faster.

The beauty? Digital real estate investing diversifies your portfolio. While stocks fluctuate, online assets grow with internet use expected to reach 7.5 billion users by 2025. If you’re wondering “examples of digital real estate,” think of lasvegas.com, sold for $90 million after holding it for years. Exciting, right?

Why Invest in Digital Real Estate in 2025?

2025 is the perfect year for digital real estate investing for beginners. With remote work booming and the metaverse maturing, demand is skyrocketing. Here’s why it’s worth your time:

- Low Barrier to Entry: Start with $10 for a domain or $100 for a basic website. No credit checks needed, unlike traditional real estate.

- Passive Income Potential: Once set up, assets earn money while you sleep. How to make money from digital real estate? Through ads, rentals, or sales—more on that later.

- Global Reach: Your “property” reaches billions. A blog on eco-friendly living can attract readers from anywhere. Learn why online businesses outshine offline ones for more on global scalability.

- High Growth: Stats show the digital real estate market is on fire. AI investments in real estate tech hit $100 billion, speeding up trends like virtual tours. Plus, 81% of real estate firms plan big tech spends in 2025.

- Diversification: Mix it with stocks or physical property. Digital real estate investing hedges against inflation virtual land in high-traffic areas appreciates like beachfront homes.

But is digital real estate legit? Yes! It’s not a fad; major companies like Republic Realm bought Atari’s virtual property for $4.3 million. Governments are even creating rules for tokenized assets. Risks exist (volatility, scams), but with research, it’s a solid bet. In 2025, expect more stability as regulations grow.

If you’re a beginner, this is your chance to build wealth without leaving home. Ready to learn how to start digital real estate?

Types of Digital Real Estate Assets

Not all digital properties are the same. Here’s a breakdown of popular types for digital real estate investing, with pros, cons and tips:

1. Domain Names

These are the “addresses” of the web. Buy “AItools.com” cheap, hold, and flip.

- Pros: Easy to buy/sell low cost $10–$100.

- Cons: Needs market research to pick winners.

- Example: Voice.com sold for $30 million.

- How to buy digital real estate like this? Use GoDaddy or Namecheap.

2. Websites and Blogs

Build or buy a site, add content, and monetize.

- Pros: Endless income via ads/affiliates.

- Cons: Requires upkeep (SEO, updates).

- Example: A niche blog on fitness can earn $5K/month from Google Ads.

- Platforms: WordPress for building, Flippa for buying established ones.

3. Social Media Accounts

Grow or buy Instagram/TikTok pages with followers.

- Pros: Quick monetization via sponsorships.

- Cons: Platforms can ban accounts.

- Example: Cristiano Ronaldo’s Instagram earns $2M per post.

4. Metaverse Land

Virtual plots in 3D worlds for events or ads.

- Pros: Immersive; rising with VR tech.

- Cons: Volatile prices.

- Example: The Sandbox land rents for $1K/month.

5. NFTs and Tokenized Assets

Digital deeds for art or real property shares.

- Pros: Fractional ownership (buy 1% of a building).

- Cons: Crypto crashes can hurt.

- Example: Tokenized funds like Kin Capital’s $100M real estate debt fund.

6. E-commerce Stores and Apps

Ready shops or apps that sell goods. Want to grow one? Here’s how to scale an online store with a low budget.

- Pros: Scalable sales.

- Cons: Competition high.

- Example: A Shopify store flipped for 20x revenue on Empire Flippers.

Pick based on your skills domains for quick flips, websites for long-term holds. In 2025, AI helps optimize all types.

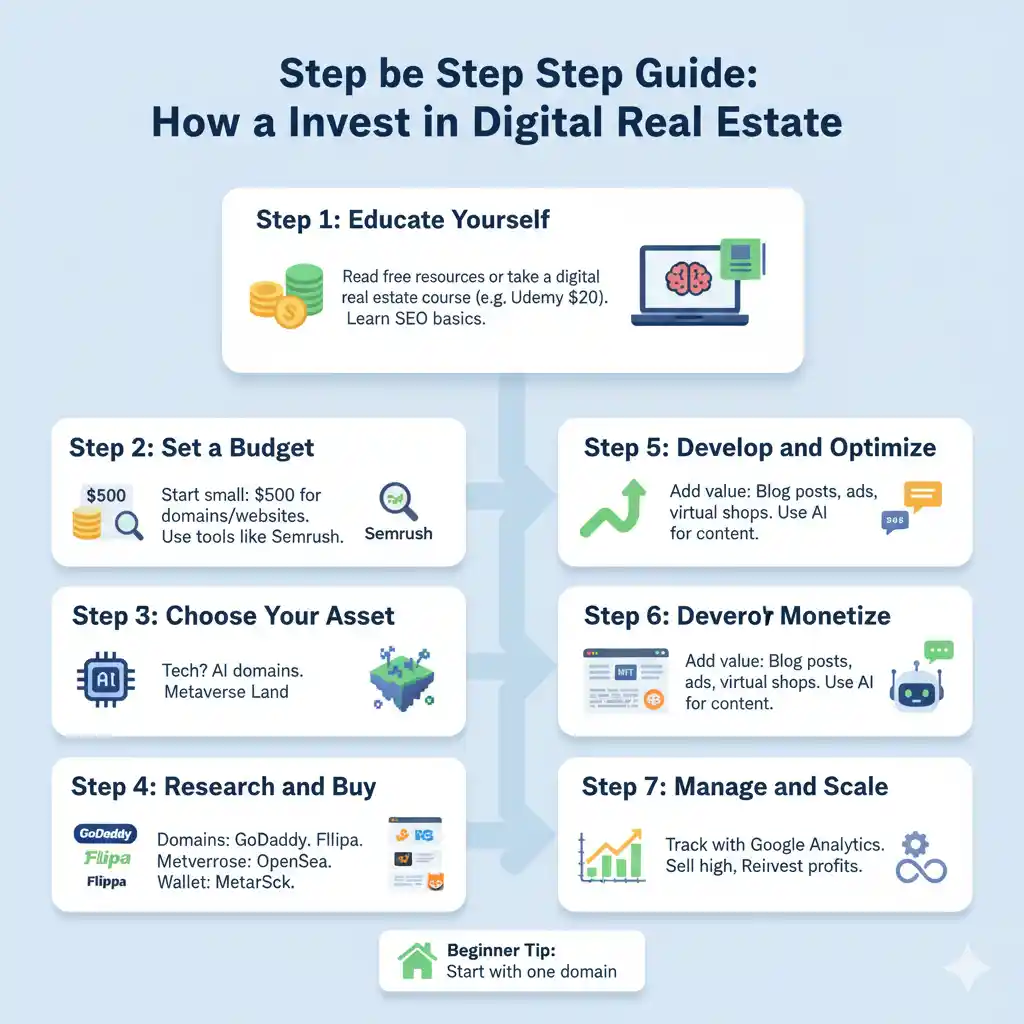

Step by Step Guide: How to Invest in Digital Real Estate

Wondering how to invest in real estate using digital assets? Follow this beginner-friendly plan:

Step 1: Educate Yourself

Read free resources or take a digital real estate course (e.g., on Udemy for $20). Learn SEO basics it’s key for traffic.

Step 2: Set a Budget

Start small: $500 for domains/websites. Use tools like Semrush (free trial) for research.

Step 3: Choose Your Asset

Based on interest in tech? Buy AI domains. Love gaming? Metaverse land.

Step 4: Research and Buy

- Domains: GoDaddy Auctions.

- Websites: Flippa or Empire Flippers.

- Metaverse: OpenSea for NFTs, Decentraland marketplace.

- Create a wallet like MetaMask for crypto buys.

Step 5: Develop and Optimize

Add value: Write blog posts, run ads, or build virtual shops. Use AI for content e.g., ChatGPT.

Step 6: Monetize

See next section!

Step 7: Manage and Scale

Track with Google Analytics. Sell when value peaks. How to start a digital real estate business? Reinvest profits into more assets. Discover how to scale an online store with a low budget for practical growth tips.

Digital real estate for beginners tip: Start with one domain to test waters.

Best Platforms for Digital Real Estate Investing in 2025

Top picks for safe, easy investing:

- Flippa: Best for websites/e-commerce. Buy/sell with verified revenue. Fees: 5–10%.

- GoDaddy: Domains galore. Auctions for deals under $50.

- OpenSea: NFTs and metaverse. User-friendly for newbies.

- Decentraland/The Sandbox: Virtual land marketplaces. Start at $100/parcel.

- Shopify/Empire Flippers: E-stores. Flippers has vetted listings.

- RealtyMogul/Yieldstreet: For tokenized real estate. Accredited investors get 8–12% returns.

- EquityMultiple: Crowdfunded properties. Min $5K, but fractional options.

These digital real estate platforms are legit—check reviews on Trustpilot (e.g., Flippa at 4.5/5).

(Word count so far: 1,812)

How to Make Money from Digital Real Estate

Marketing digital real estate is key to profits. Here’s how to make money from digital real estate with real examples. Want more strategies? Learn about building passive income through online entrepreneurship to boost your earnings.

- Advertising: Place Google Ads on your site. Example: A travel blog earns $10K/month from 100K visitors.

- Affiliate Marketing: Promote products for commissions. Amazon Associates pays 1–10%.

- Rentals: Lease metaverse land for events. One Sandbox plot rents for $500/month.

- Flipping: Buy low, sell high. Example: Voice.com flip netted $30M.

- Subscriptions/Sponsorships: Charge for premium content. Influencer pages get $2M/post.

- E-commerce Sales: Sell via your store. Dropshipping needs zero inventory.

Digital real estate reviews show averages: 20–50% ROI yearly if managed well. Digital real estate signage? Use virtual billboards in metaverse for ad revenue.

Pro tip: Digital real estate asset management tools like Ahrefs track earning

Risks and How to Avoid Scams

Is digital real estate legit? Mostly yes, but scams lurk. Digital real estate reviews on Reddit warn of fake courses promising riches.

Risks:

- Volatility: Crypto dips crash NFT values.

- Scams: Fake listings on shady sites.

- Maintenance: Sites need updates.

Avoid: Verify sellers, use escrow on Flippa, skip “guaranteed” schemes. Regulations in 2025 will help e.g., tokenized assets under SEC watch. Derek and Dakota digital real estate? Legit cousins teaching basics but DYOR.

FAQs

What is digital real estate investing for beginners?

It’s buying online assets like domains to earn income starting with $100 on Flippa.

How to buy digital real estate?

Pick a platform, research value, pay via wallet or card.

Digital real estate companies to watch?

Republic Realm, Kin Capital pioneers in metaverse and tokens.

Champion digital real estate strategies?

SEO for traffic, AI for automation.

The digital real estate cousins?

Derek and Dakota are popular educators on YouTube.

How to start a digital real estate business?

Learn SEO, buy one asset, scale with profits.

Conclusion

Digital real estate investing in 2025 offers endless opportunities for beginners. From what is digital real estate to flipping domains for millions, it’s accessible, profitable and future-proof. With markets growing 48% yearly and tools like AI simplifying everything, now’s the time to act. Start small, learn continuously and watch your portfolio grow. Ready to become a digital entrepreneur? Start here.

Remember: Research beats hype. Is digital real estate legit? Absolutely if you’re smart. Dive in, build your first asset and join the digital landlords shaping tomorrow. Your online empire awaits what’s your first move?