Saudi Arabia’s economy continues to blend traditional oil strength with ambitious diversification. By 2024, GDP reached $1.24 trillion, with non-oil sectors growing faster than the energy base. Exports remain dominated by crude oil and petrochemicals, while investments in tourism, technology, and mining reshape the economic landscape. As 2025 unfolds, projections indicate 3.2–4% growth, driven by Vision 2030 initiatives and strategic trade expansion. This article highlights essential facts, market trends, and what lies ahead for Saudi Arabia’s economy.

Understanding the Saudi Arabia Economy Type

People often ask, what type of economy does Saudi Arabia have? It’s a mixed economy, folks. That means the government guides the big plays, like oil, while private folks handle shops and startups. No pure command setup here—it’s flexible. What economy does Saudi Arabia have? One rooted in resources but blooming into tech and tourism. Is Saudi Arabia a mixed economy? You bet. It mixes state control with market freedom, helping it adapt fast. What is the economy of Saudi Arabia? Strong on exports, keen on growth. What is Saudi Arabia’s economy based on? Oil still leads, but Vision 2030 spreads the bets. Is Saudi Arabia economy good? Signs point yes, with smart tweaks.

This setup lets the Saudi Arabia economy juggle old strengths and new dreams. What kind of economy is Saudi Arabia? Resource-rich and reforming. What economy type is Saudi Arabia? Mixed, with a push away from oil alone. Is Saudi Arabia a command economy? Nope—it’s got room for ideas from all. What is Saudi Arabia economy? A dynamic force, evolving daily.

Table of Facts and Figures

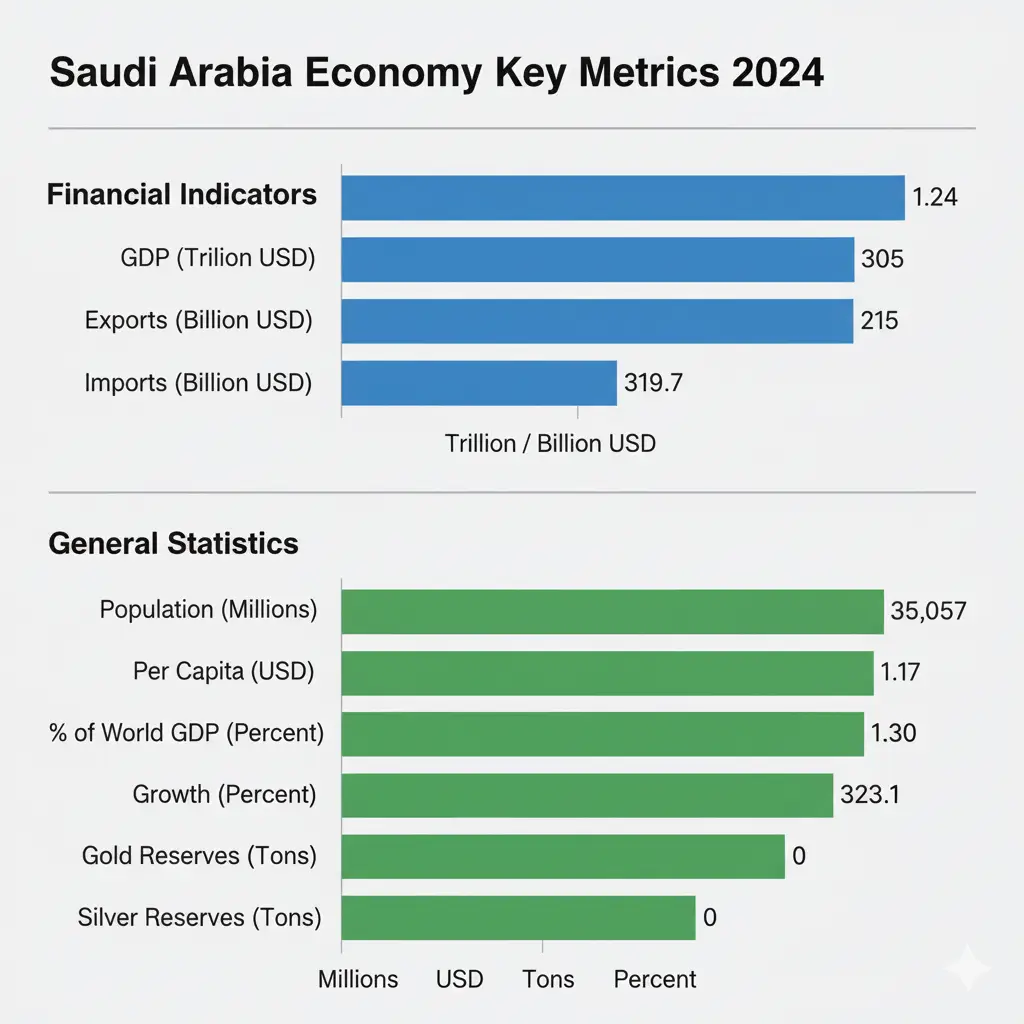

Let’s break down the numbers that tell the real story. Here’s a quick table with key stats for the Saudi Arabia economy 2024. These figures come from trusted sources like the World Bank1 and IMF2, painting a clear picture.

| Metric | Value (2024) | Remarks |

| Country | Saudi Arabia | The Kingdom of Saudi Arabia, a leading oil producer and member of OPEC and G20. |

| GDP 24 | $1.24 T | Total economic output in 2024; places Saudi Arabia in the top 20 global economies. Oil contributes ~40%, non-oil ~60%. |

| Growth 24 | 1.30% | Real GDP growth slowed due to OPEC+ oil cuts; the non-oil sector grew 4.4%, showing diversification progress. |

| Population – 24 | 35.3 M | Includes ~13M expatriates; over 60% under age 30, creating a young, dynamic workforce. |

| Per Capita 24 | $35,057 | High per-person income; above global average, supports strong domestic consumption and savings. |

| % of World GDP 24 | 1.17% | Contributes over 1% of global GDP; ranks 19th worldwide, ahead of many developed nations. |

| Imports 24 | $215 B | Mainly machinery, vehicles, electronics, and food; diverse import base reduces supply risk. |

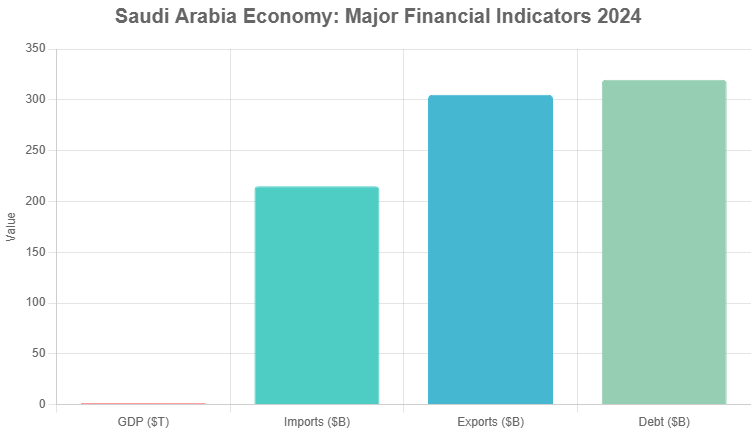

| Exports 24 | $305 B | $90B trade surplus; 70%+ oil & petrochemicals, rest from plastics, metals, and fertilizers. |

| Debt 24 | $319.7 B | Public debt at ~25% of GDP; low and manageable, gives room for investment in Vision 2030. |

| Gold Reserves 24 | 323.1 Tons | Held by SAMA (central bank); worth ~$27B; used as a safe-haven asset and global trust signal. |

| Silver Reserves 24 | Minimal (N/A) | Silver not a strategic reserve; focus remains on gold and oil; mining silver is emerging but minor. |

These bits help you grasp the Saudi Arabia economy overview. They spotlight strengths and spots to watch.

This chart highlights the Saudi Arabia economy ranking among globals. Exports outpace imports, signaling health.

Major Imports and Exports: Fueling the Saudi Arabia Economy

Trade3 keeps the wheels turning. In 2024, the Saudi Arabia economy exported $305 billion, mostly oil and chemicals. Imports hit $215 billion, filling daily gaps. Here’s the top lineup:

Top Exports (2024):

- Crude oil and refined petroleum: Over 70% of total, shipped to China (21.5%), India (11.6%), and Japan (11.6%).

- Ethylene polymers and fertilizers: Key for industry, adding $20+ billion.

- Aluminum and plastics: Growing fast, tied to manufacturing pushes.

Top Imports (2024):

- Cars and vehicles: $15 billion, from Japan and South Korea.

- Machinery and electrical equipment: $40 billion, powering factories.

- Processed petroleum oils and phone devices: $25 billion combined, for energy and tech.

- Chemicals and food: Essentials like wheat and meds, $30 billion.

These flows create a surplus, strengthening the riyal. Link this to economic globalization for bigger context. How is the economy of Saudi Arabia? Balanced by smart trade.

Saudi Arabia Economy Diversification: Why and How It’s Happening

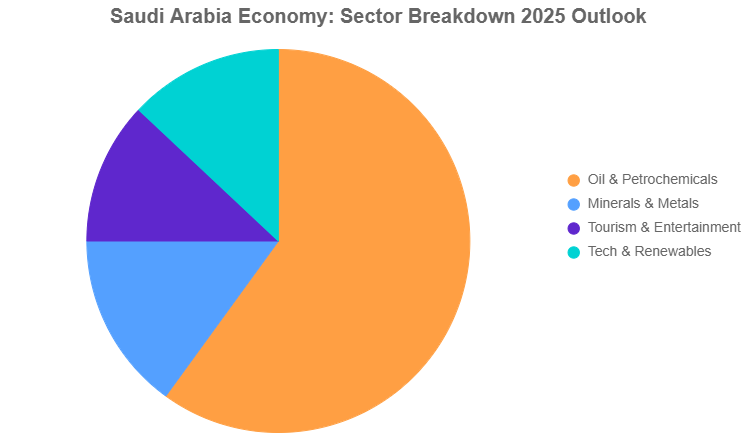

Why must Saudi Arabia diversify its economy? Oil prices swing wild, like desert winds. Relying on one source risks sandstorms. How can Saudi Arabia diversify its economy? Through Vision 20304—big plans for tourism, tech, and green energy. How is Saudi Arabia diversifying its economy? By pouring cash into NEOM city and entertainment hubs. Jobs in renewables hit 100,000 last year.

What is the economy like in Saudi Arabia? Shifting from black gold to bright ideas. Non-oil GDP grew 4.4% in 2024, outpacing oil. Saudi Arabia economy diversification shines in mining too—a 500% exploration surge in gold and silver spots. This builds new pillars.

This pie shows the spread. Oil dips to 60%, others rise. Reassuring? Absolutely—steps like these secure tomorrow.

Saudi Arabia Economy 2025 Outlook: Bright Signals from Recent News

Saudi Arabia economy 2025 looks up. The IMF bumped growth to 4%, from 3%. The World Bank says 3.2% for the year, with first-half GDP at 3.9%. Saudi Arabia economy news today October 2025 buzzes with Vision 2030 at 85% done. Minister Khalid Al-Falih calls 2025 a “pivotal moment” for supply chains.

Saudi Arabia economy news today highlights mining booms—spending up fivefold to $280 million5. Pensions upgraded to B-grade by global ranks. US Treasury holdings steady at $120-140 billion. Saudi Arabia economy overview 2025? Resilient, with oil output rising.

Compared to peers: Unlike the US economy or China economy, Saudi Arabia focuses on green shifts. India economy shares diversification vibes.

Saudi Arabia economy news today September 2025 echoed these, but October amps it up. Saudi Arabia economy news August 2025? Similar optimism. Saudi Arabia economy news updates flow steadily.

Saudi Arabia Economy News Today Recency 3: Quick Hits

- IMF nods to 4% growth—oil rebounds help.

- Vision 2030: 85% on track, per minister.

- Mining investments soar, eyeing silver plays.

These keep the Saudi Arabia economy system humming.

FAQs

What type of economy does Saudi Arabia have?

Saudi Arabia runs a mixed economy. The government steers oil and big projects, while markets drive retail and services. This blend aids quick changes.

How is Saudi Arabia diversifying its economy?

Via Vision 2030, it invests in tourism, tech, and renewables. Non-oil sectors now grow faster than oil, creating jobs and stability.

Saudi Arabia economy 2025 outlook?

Experts forecast 4% GDP growth, per IMF. Diversification and oil recovery fuel this upbeat view for steady progress.

Is Saudi Arabia economy good?

Yes, with a trade surplus and low debt. Per capita income tops $35,000, and reforms promise more gains ahead.

What is Saudi Arabia’s economy based on?

Primarily oil exports, but shifting to mining, entertainment, and green energy. This mix cuts risks from price swings.

How can Saudi Arabia diversify its economy?

Boost non-oil trades like tech hubs and events. Partnerships with globals, like in Germany economy, speed this up.

What economy is Saudi Arabia?

A resource-led mixed system, ranking high in world economy ranking 2025. It’s adapting well to new eras.

Conclusion

In wrapping up, the Saudi Arabia Economy thrives on smart trades, diversification drives, and positive 2025 vibes. From $1.24 trillion GDP to Vision 2030 wins, it’s set for solid steps. These updates reassure—change brings chances. What’s your take on Saudi’s next big move in global trades?

References

- World Bank: Saudi Arabia Growth Forecast – Details 3.2% projection for 2025, based on H1 data. ↩︎

- IMF: World Economic Outlook – Upgraded to 4% growth, October 2025 update for policymakers. ↩︎

- World’s Top Exports: Trade Data – 2024 import/export breakdowns, for trade analysts. ↩︎

- Al Arabiya: Vision 2030 Progress – 85% completion stats, aimed at economic diversifiers. ↩︎

- Kitco: Mining Surge – Fivefold exploration rise, for investors eyeing resources. ↩︎