Before you dip into your emergency fund, it’s important to pause and think twice. Your emergency savings are designed to protect you from unexpected financial shocks—not to cover everyday wants or impulsive purchases. Knowing when it’s truly necessary to use those funds can make the difference between financial stability and future stress. By asking yourself three key questions before spending your emergency fund, you can make confident, responsible decisions that safeguard your long-term financial security.

Why What Are Three Questions to Ask Yourself Before You Spend Your Emergency Fund Matters

Bad things come. Car stop. Job go. Sick bill. You save an emergency fund for this. But I want to hit. New phone? Trip? Stop. What are three questions to ask yourself before you spend your emergency fund? This keeps a safe net.Most want 3-6 months to save. But 60% live pay to pay. Take the wrong empty fast. When should you use your emergency fund? Only big bad. This is a list. Story. Help. Good for young work, family, save man. Keep the fund strong.Reasons to use your emergency savings must pass a check. Or sad big.

What Are Three Questions to Ask Yourself Before You Spend Your Emergency Fund? The Core Three

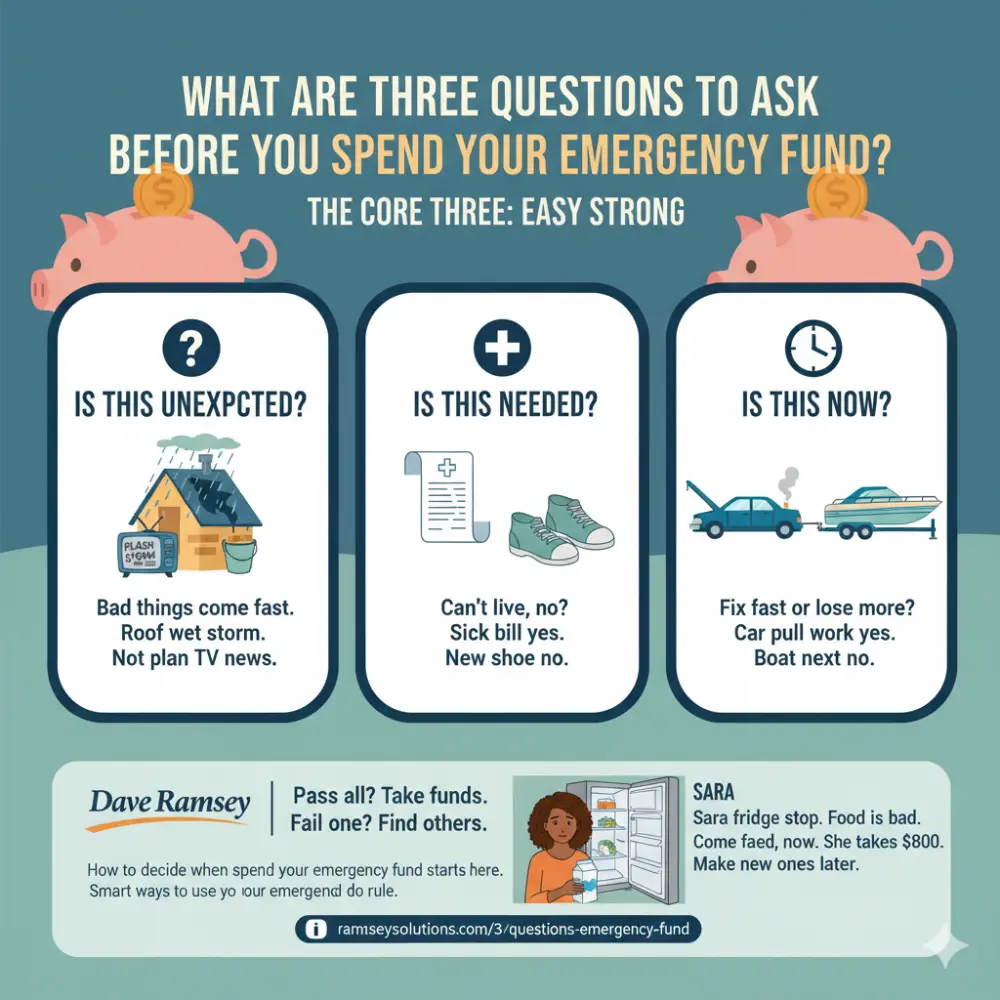

What are three questions to ask yourself before you spend your emergency fund? Easy strong:

- Is this unexpected? Bad things come fast. Roof wet storm. Not plan TV news.

- Is this needed? Can’t live, no? Sick bill yes. New shoe no.

- Is this now? Fix fast or lose more? Car pull work yes. Boat next no.

This from good man Dave Ramsey. Pass all? Take funds. Fail one? Find others.How to decide when to spend your emergency fund starts here. Smart ways to use your emergency fund do rule.Story: Sara fridge stop. Food is bad. Come fast, need, now. She takes $800. Make new ones later.Out: [Ramsey 3 Question Help1].

Emergency Fund Withdrawal Guidelines: Deep Look

Emergency fund withdrawal guidelines keep you safe.

Question 1: Is It Unexpected?

- Financial planning tips say the plan covers no cost.

- Unexpected expenses and savings check: You plan?

- Car fix hole? Yes. Oil change? No, plan that.

Question 2: Is It Necessary?

- Difference between wants and needs in spending big.

- Financial emergencies that justify using savings: Sick, home, job no.

- When not to use emergency funds: Things to eat, toys.

Question 3: Is It Urgent?

- Money management strategies see time.

- Wait ok? Pay check. Must now? Take funds.

- Rules for using an emergency fund: Do fast bad things.

Emergency savings do’s and don’ts:

- Do: Sick, home out.

- No: Fast buy.

Protecting Your Emergency Fund: Why Big

Protecting your emergency fund makes it safe. Empty wrong, face card 20% bad.Building financial security takes hard work. Mean fund $5,000. Make many new months.Budgeting and saving advice: Make other pots know about a big buy trip.Personal finance decision-making uses question stops.In: Do flow how to manage cash small work.

Real Story: Good Bad Use

Examples of true emergencies for emergency funds:

- Good: Job no. Pay home 3 months.

- Bad: New phone. I want to.

Lisa: Water bad home. Take $3,000. Need. Make a new cut.Tom: TV kid break. Not now. Fix work more.How to know if it’s okay to use your emergency fund? Do question.Out: Finder When Taking Fund2.

Questions to Ask Before Withdrawing from Your Emergency Fund: More Check

Past three, ask:

- Make new fast?

- Other way? Family, work side?

- Is this a real emergency to use my savings?

Steps to take before using your emergency savings:

- Write.

- Mark question 1-3.

- Low all? Think new.

Bad Do: When Not to Use Emergency Funds

Common mistakes people make when using emergency savings:

- Take a small amount. Kill fund.

- Not now “need” cloth.

- No plan.

60% are not bad. Go zero safe.How to tell if it’s an emergency or not financially? Question clean.Story: Family trip fund. Then the car was really bad. No money. Debt bad go.

How to Rebuild Your Emergency Fund After Using It

Take it right? Make new smart.

Help:

- Cut fun: Coffee go, see stop.

- Work side: Drive car man.

- Auto put: 10% pay.

How to rebuild your emergency fund after using it takes 3-6 months.Saving for emergencies starts day one after take.

When Should I Tap Into My Emergency Fund for Bills?

- Bill: Come fast big yes. Same no.

- When should you use your emergency fund light? Stop light only.

- Financial discipline and preparedness mean planning first.

Sink Pot vs Emergency Fund

- Sinking funds plan: Holy day, car paper.

- Emergency: Fast bad.

- How to decide if spending your emergency fund is a smart move? Other pots.

Number on Emergency Fund

- 58% less $1,000.

- 3+ month: Half no broke.

- After getting sick up 25%.

From a big bank.

Help from Good Man

- Dave Ramsey: “Step 3 baby: 3-6 months spent.”

- Suze Orman: Question stop, want big.

- Financial planning tips: See every three months.

- In: Plan like check save same.

For Family Young Work

- Family: Kids need first.

- Young: Make rent time.

- Entrepreneurship skills keep fund. Link: work skill new man.

Wrong Think Stop

Think: Fund all big. True: Only bad real.

Think: One time ok. True: Bad way to start.

Help Thing Decide

- App: Mint see part.

- Paper: List question.

- Money management strategies make checks fast.

- Out: Quora Talk Fund Question3.

Long Time: Protecting Your Emergency Fund Way

See plan month. Make more make. Building financial security grows big.

Top 3 financial questions to ask yourself before any major expense work all.

What Are Three Questions to Ask Yourself Before You Spend Your Emergency Fund? Fast Tell

- Come fast?

- Need?

- Now?

FAQs

What are three questions to ask yourself before you spend your emergency fund?

Come fast, need, now.

When should you use your emergency fund?

Bad real only.

Reasons to use your emergency savings?

Job no, sick, fix.

How to decide when to spend your emergency fund?

Do three questions.

Protecting your emergency fund help?

Plan, make fast.

conclusion

What are three questions to ask yourself before you spend your emergency fund? Come fast, need, now. This keeps a safe net. Emergency fund withdrawal guidelines make you safe. Stop bad. Make new smart. Money peace comes from hard work.

What do you want to fund? Tell me!

References

- Ramsey: 3 Question Emergency Fund – List help save man 25-45 make safe, say now check. ↩︎

- Finder: When Take Emergency Fund – Help make new for plan man not sure take not now. ↩︎

- Quora: Question Take Emergency Fund – Talk man worry money look friend ok take. ↩︎