Owning a car comes with both convenience and responsibility, and one of the most important responsibilities is having the right auto insurance. The main purpose of having auto insurance is to provide financial protection against unexpected losses caused by accidents, theft, or damage to your vehicle. It ensures that you are not burdened with high repair costs or legal liabilities after an unfortunate event. In addition, car insurance promotes safe driving habits, compliance with traffic laws, and peace of mind for drivers. Understanding why auto insurance is essential helps vehicle owners make smarter, more secure decisions on the road.

Why What is the Main Purpose of Having Auto Insurance Matters to Drivers

What is the main purpose of having auto insurance1? It protects your wallet from big costs after crashes, theft, or harm to others. Without it, one bad day on the road could wipe out savings. In Pakistan, roads get busy. Accidents happen fast. The importance of car insurance grows as cars cost more.Think of Ahmed in Lahore. He hit a pothole. The car was damaged badly. No insurance? He paid a Rs. 200,000 fix. With policy? The insurer covered most. Benefits of having auto insurance include peace. It meets law too. Many places require it.This guide explains it all. You learn types, claims, tips. Good for new buyers, families, drivers. Stats show need. Pakistan has 5 million cars. Road deaths top 10,000 yearly. Insurance claims rise 15% in 2024.

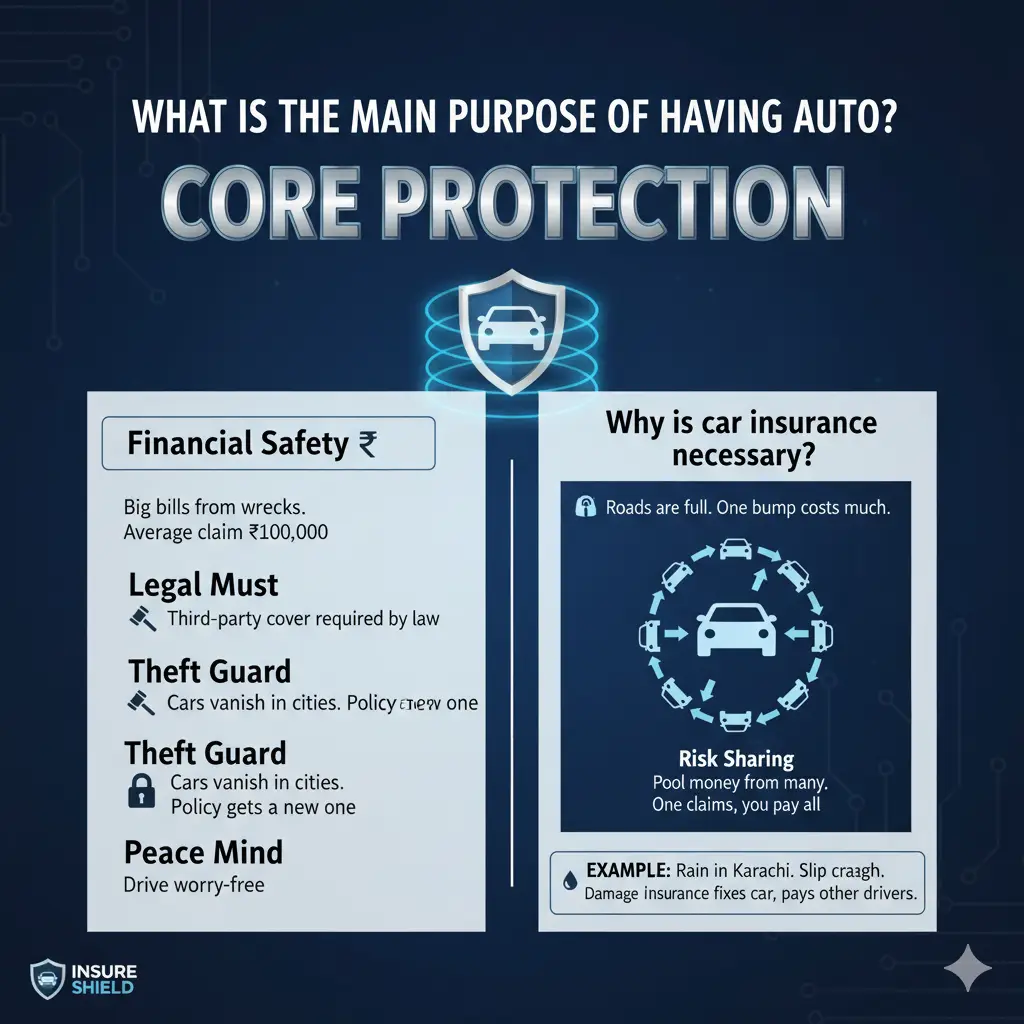

What is the Main Purpose of Having Auto Insurance? Core Protection

What is the main purpose of having auto insurance? To shield you from money loss in risks. Cars face hits, fires, steals. Insurance pays repair or replace. It hurts others too.

Key goals:

- Financial safety: Big bills from wrecks. Average claim Rs. 100,000.

- Legal must: Third-party cover required by law.

- Theft guard: Cars vanish in cities. Policy gets a new one.

- Peace mind: Drive worry-free.

Why is car insurance necessary? Roads are full. One bump costs much. Without, you pay all. The purpose of vehicle insurance is risk sharing. Pool money from many. One claims, all help.

Example: Rain in Karachi. Slip crash. Damage Rs. 300,000. Insurance fixes car, pays other drivers.

External link: PakWheels on car insurance importance2.

Benefits of Having Auto Insurance: Money and More

Benefits of having auto insurance go far. Not just cash. It saves time, stress.

List:

- Accident cover: Collision damage. Own fault or not.

- Third-party liability: Hurt person or car? Pays medical, fix.

- Theft protection: Steal? Get market value back.

- Natural woes: Flood, quake hit Pakistan hard. Policy aids.

Advantages of car insurance include roadside help. Flat tire? Two free. Legal fights? The lawyer paid.

Stats: IGI Insurance says claims up 20% post-floods. Comprehensive plans save most.

The role of insurance in vehicle protection is key. It keeps the car running. No big out-of-pocket.

Types of Auto Insurance: Pick Right One

Auto insurance coverage explained starts with types.

- Third-party only: Law must. Covers others only. Cheap, Rs. 5,000 a year.

- Comprehensive: All risks. Own damage too. Rs. 20,000+.

- TPPD: Third-party plus own damage. Middle ground.

In Pakistan, third-party mandatory. ID card, reg needed.

Car insurance requirements vary. New car? Buy before plate. Banks loan cars need full cover.

Comprehensive insurance policy best for new rides. Covers collision, non-collision.

Tip: Compare quotes. PakWheels tools help.

Internal link: Manage costs with how to manage cash flow in a small business.

Why You Need Car Insurance: Real Risks in Pakistan

Why do you need car insurance? Roads are rough. Traffic is wild. Theft high.

Facts:

- Karachi thefts: 1,000 cars yearly.

- Accidents: 27 daily deaths.

- Repair costs up 10% inflation.

No insurance? Fines Rs. 50,000. Jail too. Financial protection from accidents is the key purpose.

Story: Family in Islamabad. My son crashed. Hurt another kid. Court Rs. 500,000. Policy paid. They are safe.

Vehicle damage and theft protection stops ruin.

IGI on why essential3.

How Auto Insurance Works: Step by Step

How does auto insurance work after an accident?

- Report fast: Call insurer in 24 hours. Police FIR.

- Survey: Agent checks damage.

- Claim file: Papers: FIR, bills, ID.

- Pay: Approve? Cash or repair shop.

- Settle: Done in weeks.

The auto insurance claim process is smooth if docs are right. Delays from late report.Personal injury protection in some plans. Covers hospital.What is covered under a comprehensive car insurance plan? Most, minus war, drunk driving.

Car Insurance Premium Factors: What Sets Price

Premiums based on:

- Car model: Toyota big, high rate.

- Driver age: Young risk more.

- Location: City high theft.

- No-claim bonus: Good record, discount 30%.

- Add-ons: Engine guard extra.

Shop smart. Why is auto insurance important for car owners? The right plan saves cash.

Legal Side: Is Car Insurance Mandatory in Pakistan and Why

Is car insurance mandatory in Pakistan and why? Yes, third-party. The Motor Vehicle Act says. Protects the public. No cover? Fine, seize the car.

Gov push full insurance. Banks require loans.

Legal compliance for drivers avoids jail. What happens if you don’t have car insurance? Pay all damages. Court too.

Road Safety and Risk Management: Insurance Role

Road safety and risk management ties to insurance. It makes for careful driving. Know cover, less reckless.

Tips:

- Seat belts on.

- No phone.

- Service car regular.

Collision and non-collision coverage handles hits, floods.

Stats: Insured drivers claim less repeat.

For New Car Owners: Why Do I Need Car Insurance for My New Car

Why do I need car insurance for my new car? Value high. Theft target. The loan needs it.

What is the main purpose of car insurance in Pakistan? Same: Protect investment. Local risks are high.

Buy before driving. Dealers help.

Internal: Start biz with a car? See how to start a small business.

Family Angle: Protect Loved Ones

Families need to be comprehensive. Kids drive? High cover.

How does car insurance protect you financially? No medical bills eat savings.

Example: Theft at night. The next day, I got a new car value.

Choosing Policy: How to Choose the Right Auto Insurance Policy

How to choose the right auto insurance policy?

- Assess needs: City? Theft add-on.

- Compare: EFU, IGI, Pak Qatar.

- Read terms: Exclusions clear.

- Agent talk: Custom fit.

- Renew early: Bonus keep.

Top benefits of having vehicle insurance: Custom peace.

Common Myths Busted

Myth: Insurance waste. Fact: One crash pays many times.

Myth: Third-party enough. Fact: Own damage hurts more.

Stats and Trends in Pakistan

- Market: Rs. 50 billion 2024.

- Growth: 12% yearly.

- Claims: 70% accident.

Floods spike natural claims.

Tips to Save on Premiums

- No-claim keep.

- Safe driver discount.

- Higher deduct.

- Bundle home car.

Vehicle insurance benefits include these saves.

Claim Success Stories

Sara in Lahore: Rear-end. Rs. 150,000 repair. Paid fast.

Avoid: Fake docs. Insurers check.

Future of Auto Insurance

Tech: Telematics track drive. Lower rates are safe.

Pakistan: Digital claims grow.

What is the Main Purpose of Having Auto Insurance in Daily Life

Back to core. What is the main purpose of having auto insurance? Safety net. Drive free.

It covers third-party liability coverage, own fixes, and steals.

FAQs

What is the main purpose of having auto insurance?

Financial shield from risks.

Importance of car insurance?

Protects assets, meets law.

Benefits of having auto insurance?

Covers damage, liability, theft.

Why is car insurance necessary?

Accidents cost a lot.

Purpose of vehicle insurance?

Risk transfer to insurer.

Conclusion:

What is the main purpose of having auto insurance is clear: Guard money and life from road woes. Why do you need car insurance boils for protection? In Pakistan, get a third-party at least. Go comprehensive for full peace. Compare, claim smart. Save on premiums. Drive safe.What auto insurance questions do you have? Share below!

References

- Gauthmath: Quiz on Auto Insurance Purpose – Educational quiz targeting new drivers and students explaining core purpose simply. ↩︎

- PakWheels: Importance of Car Insurance – 8 Key Benefits – Blog with benefits and stats for car owners in Karachi/Lahore, focusing on theft and accident protection. ↩︎

- IGI Insurance: 4 Reasons Why Car Insurance is Essential – Lists financial protection and liability for urban drivers 25-55 in Pakistan seeking affordable coverage. ↩︎