Singapore’s economy in 2025 continues to prove its strength through agility and smart policy. Even as global demand cools and new tariffs test trade flows, the nation’s diverse base in technology, finance, and logistics keeps growth on track. GDP expanded 2.9% in Q3, reflecting how Singapore balances openness with resilience.1 Supported by strong reserves, a skilled workforce, and regional trade partnerships, its 2025 outlook remains positive — steady growth, innovation momentum, and fiscal discipline all point toward sustained economic stability.

For deeper context on global ties, check our pillar on the world economy.

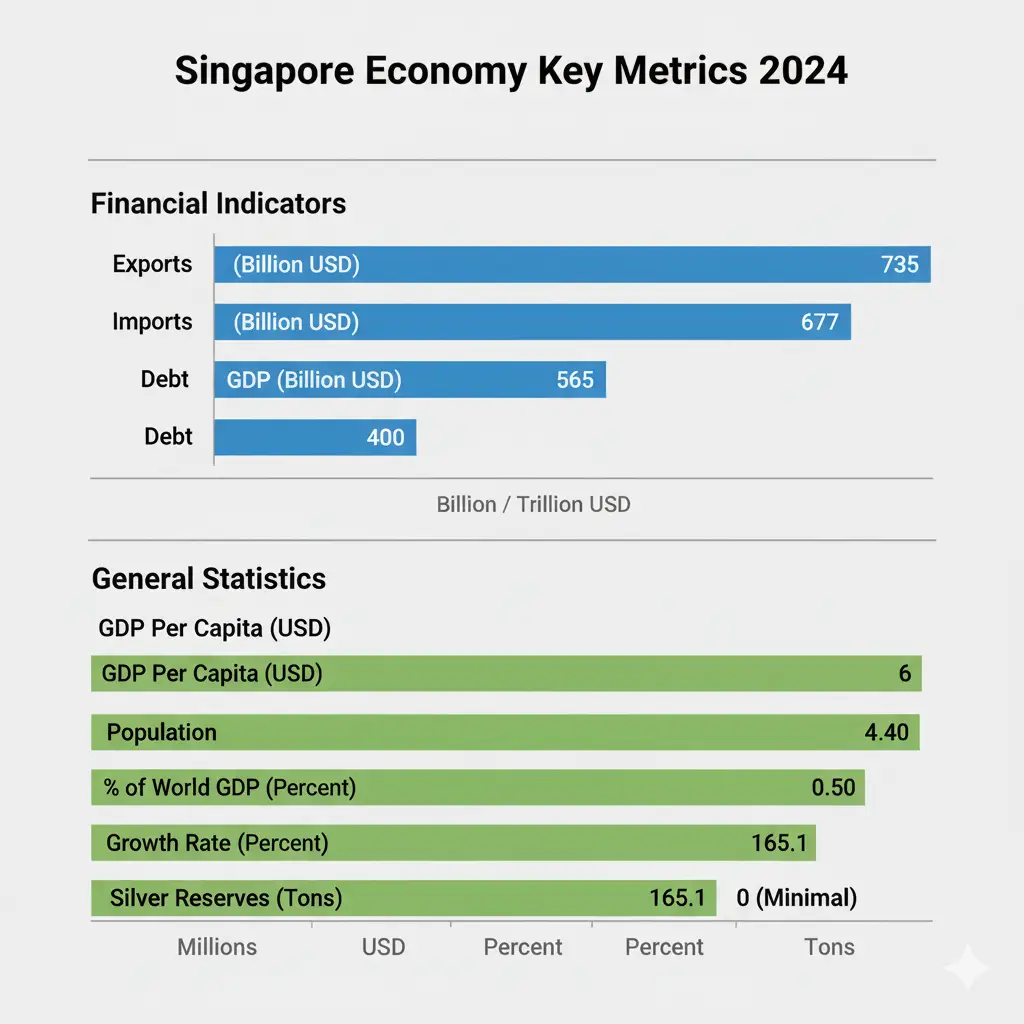

Table of Facts and Figures

To grasp the Singapore economy‘s strength, let’s review core 2024 metrics. This table breaks down vital stats, showing how Singapore punches above its weight.2

| Metric | Value (2024) | Remarks |

| GDP | $565 Billion | A powerhouse figure, reflecting high-value sectors like finance and manufacturing. This positions Singapore as a top Asian hub. |

| Growth Rate | 4.40% | Robust expansion, outpacing many peers amid recovery. It signals investor confidence and export rebound. |

| Population | 6 Million | Compact yet dynamic workforce drives efficiency. Low numbers mean high productivity per person. |

| GDP Per Capita | $81,697 | Among the world’s highest, highlighting wealth creation and living standards. It beats many developed nations. |

| % of World GDP | 0.50% | Small slice but outsized influence via trade routes and innovation. Ties to global GDP trends. |

| Imports | $677 Billion | Heavy reliance on inputs for re-exports, showing trade’s engine role. Vulnerable to supply shocks. |

| Exports | $735 Billion | Surplus driver, with electronics leading. Boosts current account strength. |

| Debt | $400 Billion | Manageable at ~70% of GDP, thanks to fiscal prudence. Low risk for stability. |

| Gold Reserves | 165.1 Tons | Solid buffer against volatility, held by MAS for diversification. |

| Silver Reserves | 0 Tons | Minimal official holdings; focus on gold and forex instead. Private vaults like The Reserve store investor silver. |

These remarks tie directly to performance. For instance, the GDP per capita reveals why is Singapore economy good—it delivers real prosperity. High imports and exports underline trade’s double-edged sword: opportunity and exposure.3

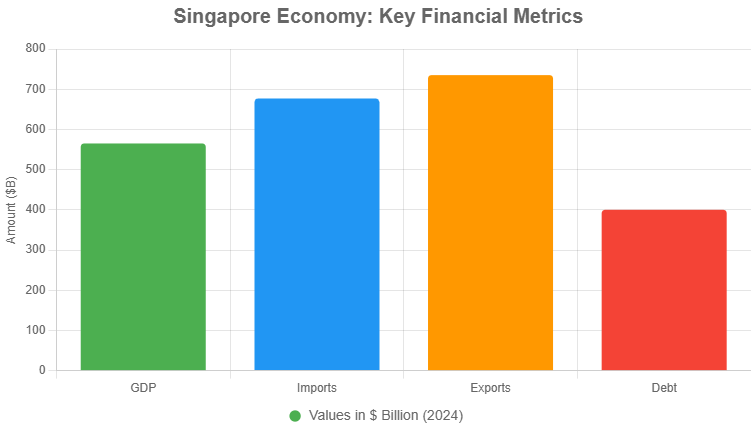

This chart visualizes the balance: Exports edge out imports, fueling growth, while debt stays controlled.

Major Imports and Exports: Trade Engines of the Singapore Economy

Trade defines the Singapore economy type—a highly open, export-led model. In 2024, exports hit $735 billion, imports $677 billion, creating a surplus. What powers this?

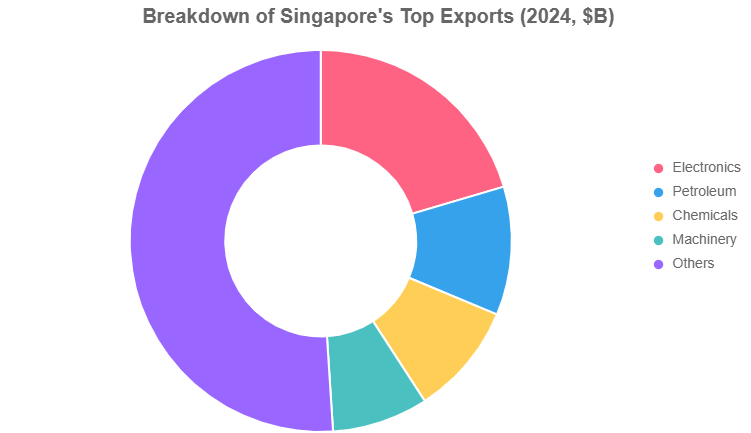

Top Exports

- Electronics and Integrated Circuits: $150+ billion, key to tech dominance.

- Refined Petroleum: $80 billion, from processing hubs.

- Chemicals and Pharmaceuticals: $70 billion, serving global pharma needs.

- Machinery and Precision Instruments: $60 billion, for manufacturing.

- Services (Finance, Logistics): Indirect boost, adding $200+ billion in value.

These flows link to partners like China and the US. For US ties, see US economy.

Top Imports

- Integrated Circuits and Electronics: $120 billion, for assembly and re-export.

- Crude Petroleum: $90 billion, feeding refineries.

- Machinery and Equipment: $85 billion, upgrading industries.

- Chemicals: $70 billion, for production.

- Mineral Fuels: $50 billion, ensuring energy security.

This mix shows what the Singapore economy based on: Re-exports and value-add. Yet, Singapore economy updates today warn of risks, like supply chain snags.

The chart spotlights electronics’ lead—vital for Singapore economy ranking among exporters.

Singapore Economy News Today: October 2025 Highlights

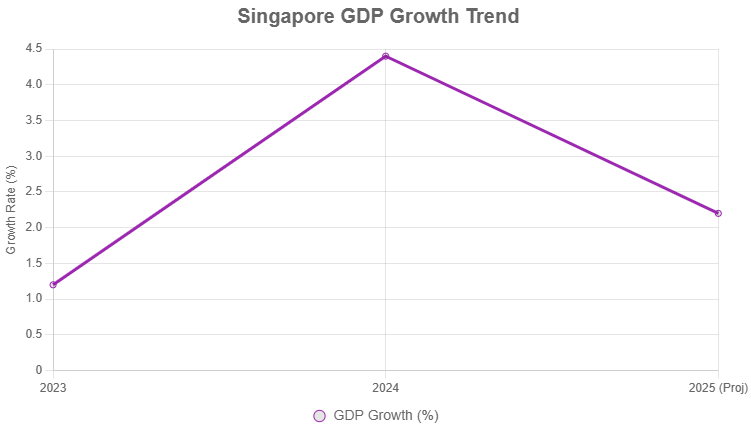

Singapore economy news today October 2025 buzzes with mixed signals. Q3 GDP hit 2.9%, down from 4.5% in Q2 but above 1.9% expected. The Monetary Authority of Singapore (MAS) held policy steady, citing firm growth. Earlier, Singapore economy news today September 2025 noted upgraded forecasts to 1.5-2.5% for full-year 2025.

Experts praise resilience: “Singapore’s output gap stays positive,” per MAS. Yet, Singapore economy 2025 faces tests. IMF4 projects 2.2% growth, with inflation at 0.9%. Long-term? DBS sees GDP doubling to $1.5 trillion by 2040.

Impact of US Tariffs on Singapore Economy 2025

Global shifts loom large. Impact of US tariffs on Singapore economy 2025 could sting, as trade is 300% of GDP. Trump’s policies eye 10-25% rates on imports, hitting electronics and chemicals. MAS warns of “demand shock,” with multiplier effects on income.5

Trump tariffs impact Singapore economy? SMEs face higher costs, potential job dips in export firms. Analysts cut growth views by 0.5-1% if tariffs bite. Singapore counters via diversification—RCEP ties help. For broader effects, explore economic globalization.

- Short-term hit: Export dip of 5-10% in affected sectors.

- Long-term pivot: Boost to ASEAN trade, up 15% potential.

- Investor tip: Watch forex; SGD may strengthen as a safe haven.

US tariffs impact on Singapore economy echoes in Singapore economy 2025 outlook: Resilient base, but agile needed.

Singapore Economy 2025 Outlook: Strengths and Strategies

The Singapore economy overview 2025 paints optimism. Growth at 2.0-2.8%, per MTI and DBS. Key drivers:

- Tech and Green Push: $5 billion in AI investments.

- Tourism Rebound: 19 million visitors, aviation key.

- Fiscal Buffers: Reserves top $400 billion.

But why is Singapore economy so strong? Pro-business laws, low taxes. How did Singapore develop its economy? From port to hub via education and FDI.

Aviation adds flavor—Singapore airlines economy class shines, drawing tourists. Many ponder, what is premium economy on Singapore airlines? Extra legroom, meals—worth it for long hauls. Is Singapore airlines premium economy worth it? Yes, for comfort boosting sector’s $10 billion GDP slice. Does Singapore airlines have premium economy? Absolutely, on key routes. How is Singapore airlines premium economy? Spacious, service-led. What is Singapore airlines premium economy like? Lounge access, fine dining. How is Singapore airlines economy class? Reliable, with KrisFlyer perks. What economy does Singapore have in skies? Efficient, global.

This ties to what type of economy does Singapore have: Mixed-market, service-heavy. What kind of economy is Singapore? Open, innovative. Singapore economy class? Top-tier in air travel.

For rankings, see world economy ranking 2025.

Decoding the Singapore Economy Type and Class

The Singapore Economy blends free-market vigor with state guidance. Singapore economy type? Export-oriented, high-tech. What type of economy is Singapore? Capitalist with social nets. What is the economy in Singapore? Thriving on ports, finance.

Singapore economy vs premium economy? Wait—aviation’s “economy” seats fuel tourism GDP. Singapore economy seats? Comfortable on SQ flights. What is premium economy Singapore airlines? Upgraded travel aiding recovery.

Singapore economy overview? Compact, competitive. Is Singapore economy good? Metrics say yes.

This line chart tracks progress—steady climb.

FAQs on the Singapore Economy

What is the Singapore Economy based on?

It relies on trade, finance, and tech. Exports like electronics drive 20% of GDP, with services adding 70%. Resilient amid shocks.

Singapore Economy Ranking?

Ranks 27th globally by nominal GDP (2025 est.), top in Asia for per capita wealth. Outshines peers in ease of business.

How is the Economy in Singapore?

Strong, with 2.9% Q3 2025 growth. Low unemployment at 2%, high innovation scores keep it vibrant.

Singapore Economy 2023?

Grew 1.2%, rebounding post-COVID. Exports surged 10%, setting the stage for the 2024 boom.

Impact of US Tariffs on Singapore Economy?

Could shave 0.5% off growth via export hits. Diversification to ASEAN mitigates; watch for SGD moves.

Singapore Economy 2025?

Forecast: 2.0-2.5% growth. Tech investments and trade pacts cushion tariff risks.

What Kind of Economy is Singapore?

Mixed: Free-market with government steers. High openness (trade >300% GDP) defines it.

Conclusion: The Road Ahead for the Singapore Economy

In summary, the Singapore economy proves its mettle—$565 billion GDP, trade surplus, and 2025 outlook at 2%+ growth. Tariffs pose challenges, but strategies like green tech ensure bounce-back. Singapore economy news today reassures: It’s built to endure.

What aspect of the Singapore economy intrigues you most—trade shifts or aviation’s role? Share below!

References

- Monetary Authority of Singapore: MAS Policy Statement Oct 2025 – Growth and outlook details. ↩︎

- Singapore Department of Statistics: SingStat Trade Data – For import/export figures. ↩︎

- OEC World: Trade Partners – Export/import breakdowns. ↩︎

- IMF Country Report: Singapore 2025 Projections – GDP forecasts. ↩︎

- Reuters: US Tariffs Impact – Analysis on demand shocks. ↩︎