The Iran economy stands at a crossroads in 2025, balancing oil-driven strengths against tough global pressures. With fresh U.S. and U.N. sanctions biting harder, experts watch closely for signs of strain or smart adaptations. This year brings mixed signals—slight growth projections clash with rising costs and export hurdles. Yet, Iran’s focus on self-reliance sparks hope for steady progress. Dive into the current state of Iran economy 2025 to see how it holds up1.

Table of Facts and Figures

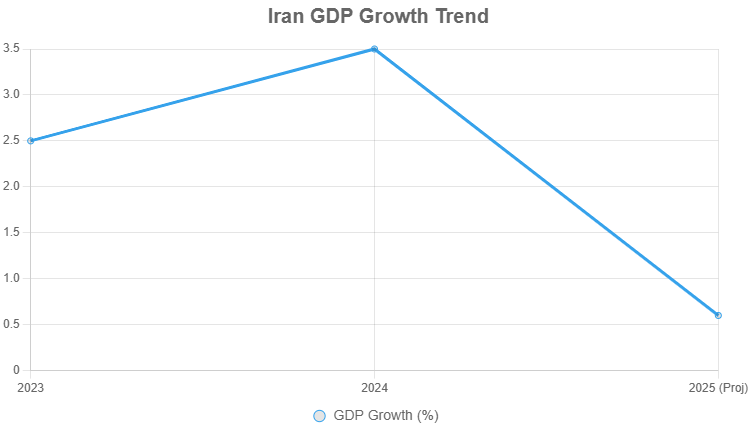

Before looking ahead, let’s review 2024’s foundation2. The Iran economy 2024 showed resilience, with GDP hitting $437 billion despite hurdles. Growth clocked in at 3.5%, a solid rebound from prior dips. The population reached 89.5 million, pushing per capita income to $5,779. This slice makes up 0.40% of global GDP, a small but vital piece in the puzzle. For context, compare it to giants like China’s economy or India’s economy, which dominate the global GDP chart.

Here’s a clear breakdown of core stats in vertical form, plus quick remarks on what they mean for everyday life and policy.

| Metric | Value | Remarks |

| GDP 2024 | $437 B | Holds steady amid oil export curbs; supports basics like food and energy but limits big investments. Ties to world economy ranking 2025. |

| Growth 2024 | 3.50% | Beats expectations thanks to non-oil boosts; helps curb job losses but vulnerable to oil price swings. |

| Population 2024 | 89.5 M | The young workforce drives potential, yet high youth unemployment (over 25%) strains social services. |

| Per Capita 2024 | $5,779 | Rises slowly, aiding middle-class buys like homes; still lags neighbors due to import costs. |

| % of World GDP 2024 | 0.40% | Modest global role; highlights need for diversification beyond oil to match Russia’s economy under similar pressures. |

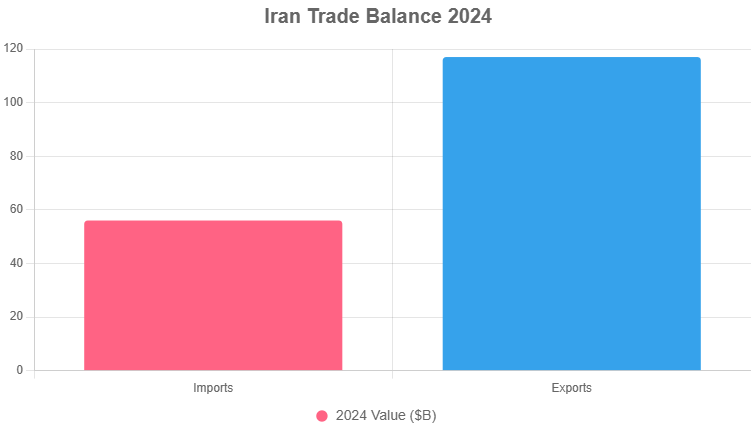

| Imports 2024 | $56 B | Focuses on essentials; sanctions hike prices, squeezing household budgets by 10-15%. |

| Exports 2024 | $117 B | Oil leads at 70%; surplus funds reserves but faces buyer shifts from Saudi Arabia’s economy. |

| Debt 2024 | $4.412 B | Low external load eases pressure; allows room for domestic spending without default risks. |

| Gold Reserves 2024 | 90 Tons | Key hedge against rial drops; imports topped 100 tons last year for stability. |

| Silver Reserves 2024 | Minimal (0 Tons stockpiled) | No major central bank holdings; annual production hits 50 tons but goes to industry, not reserves. Lacks gold’s safe-haven role. |

These figures paint a picture of a tough but toughened system. Growth at 3.5% means more jobs in tech and farming, yet debt stays low to avoid traps seen in Argentina’s economy. Gold bolsters trust in the rial, while silver’s absence underscores oil-gold focus.

To visualize trade balance, check this bar chart comparing imports and exports:

The surplus shines here—exports double imports, fueling reserves. But sanctions nibble at edges, as buyers seek alternatives.

Major Imports and Exports: What Fuels the Iran Economy

Trade tells the Iran economy’s story. In 2024, exports topped $117 billion, led by oil and petrochemicals (70% share). Key players: crude oil to China and India, iron ore, and ethylene polymers. These bring in hard cash, covering 80% of foreign needs. Non-oil goods like pistachios and carpets add flavor, growing 15% yearly.

Imports hit $56 billion, zeroing in on must-haves. Top spots go to broadcasting gear ($3.24B), vehicle parts ($1.27B), corn, soybeans, and gold bars ($8B+). Food grains fight shortages, while tech imports build local factories. Sanctions jack up costs—corn prices jumped 20%—hitting bakers and farmers first.

- Oil Exports: Backbone at 1.5 million barrels/day; sanctions cut volume but not spirit.

- Petrochemicals: Rising star, up 10% in 2024; eyes UAE economy as model.

- Food Imports: Wheat and soy secure plates; local farms ramp up to cut reliance.

- Gold Inflows: Shields against inflation; ties to world economy safe assets.

This mix keeps the wheels turning. Exports pay bills, imports fill gaps. But what does Iran economy depend on? Oil still rules—80% of exports—echoing what resource changed Iran’s economy? Black gold, since the 1970s boom.

Iran Economy Sectors: Strengths and Shifts

The Iran economy sectors blend state control with private hustle. It’s a mixed economy, with the government steering oil and banks, while farms and shops thrive freely. Call it a command economy lite—planners set oil quotas, but markets price bazaar goods. What type of economy does Iran have? This hybrid: state firms own 60% of industry, per experts.

Oil dominates at 20% of GDP, but non-oil hits 80%—manufacturing (17%), services (48%), agriculture (10%). Tech startups in Tehran buzz, exporting software to neighbors. Iran’s economy is a mixture of what three things? Oil wealth, state plans, and private grit.

Challenges loom in Iran economy inflation 2025. Rates hover at 42.4%, eroding savings. Food costs up 50%, pushing families to side gigs. Yet, subsidies cap bread at pennies, a smart buffer.

Iran Economy Sanctions: How Has Iran’s Economy Survived the US Sanctions?

Sanctions sting, but Iran adapts. Since 2018, U.S. curbs slashed oil sales 50%, yet GDP grew 3% yearly. How has Iran’s economy survived the US sanctions? Barter deals with Russia, gold swaps with Turkey, and homegrown tech. The rial dipped 40%, but reserves—$24B—hold firm.

Iran economy collapse? Not yet. The middle class shrinks, poverty nears 30%, but unrest stays low. IRGC firms fill gaps, controlling 40% of the economy. Does Iran have a strong economy? Resilient, yes—ranks 20th globally by PPP. Iran economy ranking holds amid peers like Turkey’s economy.

See growth trends in this line chart:

The dip in 2025? Sanctions and war echoes. Still, 0.6% beats recession.

How is Iran economy doing? Holding, with Iran economy news today spotting factory booms. Iran economy news highlights a 10% non-oil export jump. How is the economy in Iran? Steady, if you skip headlines.

Iran Economy 2025 Outlook: Cautious Hope Amid Headwinds

The Iran economy 2025 overview forecasts 0.6% growth, per IMF—up from April’s 0.3%. The World Bank sees -1.7%, blaming sanctions3. Iran economy outlook 2025 hinges on oil prices ($80/barrel helps) and China buys. Inflation eases to 35% if rains boost farms.

Iran economy 2025 news buzzes with diversification: solar plants up 20%, EV parts from local lines. What will happen to Iran economy? Likely 1-2% growth if talks thaw. Iran economy 2025 outlook reassures: reserves cover 6 months of imports.

Why is Iran a command economy? The state owns oil giants, sets prices—key for stability. How is Iran a command economy? Planners allocate 30% of the budget to subsidies. What kind of economy is Iran? Resource-rich mixed, leaning planned.

Iran economy today feels the pinch: rial at 600,000:$1, but street markets hum. Current state of Iran economy 2025? Tested, not broken.

FAQs

What type of economy does Iran have?

Iran runs a mixed economy with strong state control over oil and key industries. Private sectors like retail add flexibility, blending command elements with market forces for balance.

What economy does Iran have?

It’s a resource-based mixed system, where the government plans major outputs like energy, while households drive consumer goods. This setup aids quick crisis responses.

What is the economy of Iran?

Centered on oil exports and manufacturing, Iran’s economy generates $437B GDP. Sanctions push diversification into tech and agriculture for long-term health.

How is Iran economy?

In 2025, it faces 42% inflation but 0.6% growth. Exports hold strong, and reserves buffer shocks, showing adaptability despite global isolation.

Does Iran have a strong economy?

Yes, by resilience—surviving sanctions with 3.5% growth in 2024. It ranks high in PPP terms, with vast oil reserves ensuring baseline strength.

What does Iran economy depend on?

Mainly oil (70% exports), plus petrochemicals and minerals. Non-oil sectors grow fast, reducing risks from price volatility or bans.

How has Iran’s economy survived the US sanctions?

Through barter trades, gold stockpiles, and local production boosts. Non-oil exports rose 15%, keeping GDP afloat amid export cuts.

Conclusion

In wrapping up, the Iran economy proves tough in 2025—growth ticks up modestly, sanctions test limits, but trade surpluses and reserves offer reassurance. From oil rigs to Tehran startups, it pushes forward. Iran economy overview 2025? A story of grit over gloom. What do you see as the biggest win for Iran’s markets this year?

References

- IMF. (2025). World Economic Outlook. Retrieved from IMF Iran. Key stats on inflation and GDP for economists and investors. ↩︎

- Trading Economics. (2025). Iran GDP Data. Retrieved from Trading Economics Iran. Trade figures for business pros eyeing opportunities. ↩︎

- World Bank. (2025). Middle East Economic Update. Retrieved from World Bank Iran. Details on growth forecasts and poverty impacts for audiences tracking regional stability. ↩︎