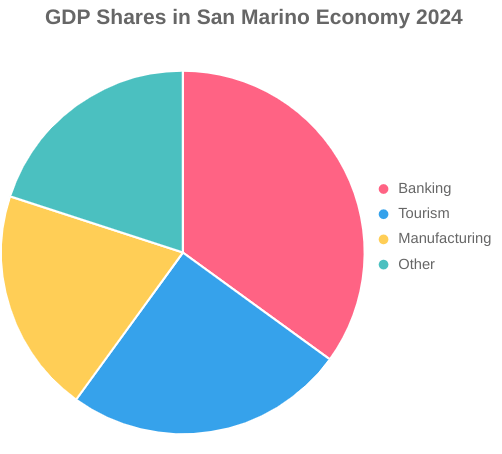

The San Marino economy steps into 2025 with cautious optimism after a modest 0.7% growth in 2024. Nestled atop Italy’s scenic hills, this microstate thrives on banking, tourism, and specialized manufacturing. Despite a small population of just under 34,000, San Marino boasts a high per capita income of $54,265, reflecting its affluent, service-oriented economy. As global uncertainties persist, policymakers are targeting digital finance, eco-tourism, and high-value exports to stimulate growth, manage debt, and secure long-term stability. With strong ties to Italy and niche market strengths, San Marino is set for a balanced and sustainable economic path in the coming year1.

Table of Facts and Figures: Insights into the San Marino Economy

Key stats reveal the San Marino economy overview at a glance. This vertical table lists 2024 metrics with detailed remarks on impacts, risks, and paths forward. Data pulls from verified sources for accuracy.

| Metric | Value | Remarks |

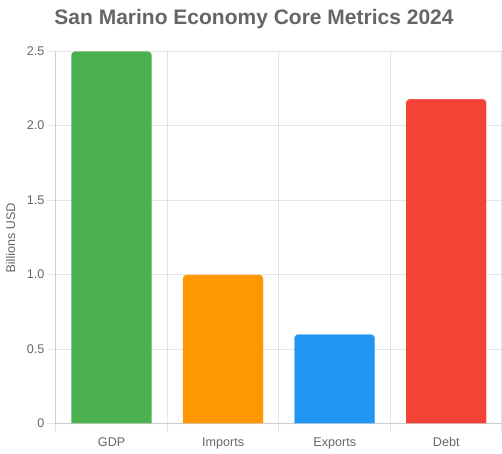

| GDP 2024 | $2.5 B | Total output reflects a compact yet affluent setup, with banking (35%) and tourism (25%) leading. Up slightly from $2.4 B in 2023, it funds public services like free health care. To sustain, target 1% digital service growth via EU-aligned fintech hubs. |

| Growth 2024 | 0.70% | Modest rebound from 0.2% in 2023, driven by 2 million tourists and export tweaks. Italy’s slowdown capped gains; 2025 eyes 1.2% with rate cuts. Climate events pose risks—build resilient supply chains now. |

| Population 2024 | 33,977 | Stable but aging group, with 20% over 65 straining pensions. Urban focus on Borgo Maggiore boosts efficiency. Youth programs in tech training could add 500 workers yearly, easing labor gaps. |

| Per Capita 2024 | $54,265 | Tops European micro-states, thanks to low taxes and high-value jobs. Matches northern Italy; uneven spread hits rural spots. Skill boosts in green manufacturing lift averages by 3–5% over five years. |

| % of World GDP 2024 | 0.00% | Tiny global share, but vital in economic globalization. Duty-free access to EU markets amps reach. Niche exports like ceramics could nudge influence in luxury trades. |

| Imports 2024 | $1 B | Covers energy (30%), machinery (25%), and foods from Italy. High costs add 10% markup; local solar adoption cuts bills by $20 M annually. Diversify to renewables for 15% savings by 2027. |

| Exports 2024 | $600 M | Led by ceramics and wine; trade deficit of $400 M strains reserves. Italy takes 90%; Asia pacts grow 20%. Focus on branded goods to flip balance positive. |

| Debt 2024 | $2.18 B | Rises to 87% of GDP from banking bailouts—high but manageable via tourism taxes. IMF flags risks; refinance at low EU rates eases load. Aim for 80% ratio by trimming non-essential spends. |

| Gold Reserves 2024 | 0 | No holdings, as the euro uses ties to the ECB. Shift to green bonds builds buffers against shocks. Target $100 M fund from stamp sales for stability. |

| Silver Reserves 2024 | 0 | Zero like gold; rely on services over metals. Eco-tourism yields steadier returns—expand trails to draw 500,000 hikers yearly. |

These insights highlight resilience in the San Marino economy type, a mixed model blending free-market finance with state welfare.

This bar chart spotlights GDP’s edge over trade but flags debt’s weight—key for 2025 fiscal tweaks.

The pie chart underscores the San Marino economy type as service-heavy, urging diversification into tech.

Major Imports and Exports: Trade Pillars of the San Marino Economy

Trade anchors the San Marino economy overview, with Italy as the main hub (85% of flows). Exports earn $600 M, imports hit $1 B— a gap offset by banking inflows. Here’s a closer look.

Key Exports Driving Revenue

- Ceramics and tiles ($250 M)

- Handcrafted pottery and floor tiles ship to EU homes. Premium branding adds 25% margins; online sales grew 15% in 2024.

- Wine and spirits ($150 M)

- Local vintages like Sangiovese blend Italian fame. Exports to U.S. collectors rose 10%; organic certs boost appeal.

- Fabrics and clothing ($100 M)

- Luxury linens and suits target Milan boutiques. Sustainable fibers draw eco-buyers, up 12% volume.

- Postage stamps and coins ($50 M)

- Collector items fetch high bids globally. Limited editions sold out fast, funding cultural sites.

- Furniture and paints ($50 M)

- Custom pieces for Italian villas. E-commerce ties to Italy economy speed deliveries.

These high-value goods keep the San Marino economy type export-focused on quality over quantity2.

Major Imports: Fueling Daily Operations

- Energy products ($300 M)

- Oil and gas from Italy power homes and factories. Prices spiked 8%; wind farms cut future needs by 20%.

- Machinery and equipment ($250 M)

- Tools for ceramics plants arrive quarterly. Local repairs save 10%, but upgrades lag—invest $10 M yearly.

- Food and beverages ($200 M)

- Pasta, cheeses, and fruits fill markets. Organic imports grow; community farms supply 15% to trim costs.

- Vehicles and parts ($150 M)

- Electric cars from Fiat lead. Subsidies push the green fleet, reducing fuel imports 5%.

- Chemicals and metals ($100 M)

- For paints and construction. Recycling hubs process 30%, easing environmental loads.

Imports sustain the San Marino economy, but smart sourcing via Italy pacts holds costs steady.

Market Trends Shaping the San Marino Economy in 2025

The San Marino economy overview evolves with targeted shifts. Tourism hit 2.1 million visitors in 2024, up 5%, via cultural festivals. Banking reforms attract $200 M in foreign funds, easing debt3.

Youth unemployment dips to 6% with apprenticeships in fintech. Remittances from Italian workers add $50 M yearly.

Global ties matter: As world economy stabilizes, EU trade blooms. Yet, euro hikes could lift import bills—hedge with local production.

Action steps:

- Digital leap: Launch blockchain for stamps, targeting $20 M extra sales.

- Green pivot: Solar installs create 200 jobs, slashing energy imports.

- Tourism tech: VR tours draw remote crowds, boosting off-season revenue 15%.

These moves reassure steady climbs in the San Marino economy type.

The San Marino Economy Type: A Balanced Blend

The San Marino economy type mixes free enterprise with social safeguards. Low corporate taxes (17%) lure banks, while state pensions ensure equity. Challenges like debt call for prudence, but strengths in crafts shine. 2025 forecasts 1% growth if reforms stick.

FAQs

What defines the San Marino economy in 2024?

A $2.5 B output with 0.7% growth. Banking and tourism dominate, per the San Marino economy overview. High per capita ($54,265) supports welfare.

How does population shape the San Marino economy?

33,977 residents drive compactly. Aging trends push pension tweaks; training adds youth to key sectors like exports.

What fuels growth in the San Marino economy?

Tourism and banking lift 0.7% in 2024. 2025 targets 1.2% via digital tools and EU links, per san marino economy type insights.

Why the import-export gap in San Marino?

$1 B imports vs. $600 M exports reflect energy needs. Niche goods close it slowly; renewables aim for balance.

What are San Marino’s top exports?

Ceramics ($250 M) and wine ($150 M) lead. They tie to Italy, fueling the San Marino economy overview with quality focus.

How does debt affect the San Marino economy?

$2.18 B at 87% GDP pressures budgets. Reforms and tourism taxes manage it, keeping the San Marino economy type stable.

What trends boost the San Marino economy in 2025?

Fintech inflows and eco-tours rise. Trade pacts deepen; climate plans guard gains in this resilient setup.

Conclusion

The San Marino economy blends hilltop charm with sharp strategies. A $2.5 B GDP, balanced trade, and service strengths set firm ground for 2025. From ceramics exports to green banking, the san marino economy overview and san marino economy type promise thoughtful growth.

In summary, prioritize skills and sustainability for wins. How might digital tools reshape the San Marino economy for you—boost or bridge? Share below.